Kalpataru IPO – Review

Kalpataru Limited – an integrated real estate development company (with over 50 years of experience) is planning to raise INR 1590 crore via IPO.

[Fresh Issue 1590 crore + OFS NIL]

Kalpataru ipo price is INR 387 – 414 per share

Kalpataru: History

The Company was originally incorporated as Kalpataru Homes Private Limited as a private limited company under the Companies Act, 1956, under a certificate of incorporation dated December 22, 1988.

The Company was converted into a public limited company by the BOD (and a special resolution passed by Shareholders at the EGM) on January 28, 2008. The name of the Company was changed to Kalpataru Limited, and a fresh certificate of incorporation was issued by the RoC on February 1, 2008.

Also Read – Globe civil projects ipo review

Kalpataru: Business

Kalpataru is an integrated real estate development company (backed by the 55-year-old Kalpataru Group) involved in all key activities associated with real estate development, starting from the identification and acquisition of land, planning, designing, execution, sales, and marketing of the projects.

The Company focuses on developing luxury, premium, and mid-income residential, commercial, and retail projects, integrated townships, lifestyle gated communities, and redevelopments.

Kalpataru is a prominent integrated real estate development company with a strong footprint in the MMR – Mumbai Metropolitan Region (Maharashtra, India).

The Company is the 5th largest developer in the MCGM area in Maharashtra and the 4th largest developer in Thane (Maharashtra, India) in terms of units supplied from the calendar years 2019 to 2023, according to Anarock Report.

Completed Projects

As of March 31, 2024, the company had 113 completed projects aggregating more than 24.10 MSF (million square feet) of Developable Area in Mumbai, Thane, Panvel, and Pune in Maharashtra, and Bengaluru, Indore, Hyderabad, and Jodhpur in the states of Telangana, Madhya Pradesh, Karnataka, and Rajasthan, respectively.

Strong Brand Equity

The Company operates in 75 countries with over 29,000 employees, Kalpataru leverages strong brand equity, in-house execution capabilities, and deep regional insight to drive sustained growth.

Last Article – Ellenbarrie industrial gases ipo review

Strategies Ahead

- Maintain focus on the MMR and Pune (Maharashtra) as well as pursuing opportunities in other high-growth cities.

- Completing and selling Ongoing Projects, Forthcoming Projects, and Planned Projects promptly

- Unlocking potential value in existing land reserves

- Growing real estate development business by entering into redevelopment,

- Joint venture and joint development projects with other landowners to develop their land

- Focus on all segments of residential projects while selectively developing retail, commercial, and other projects as part of mixed-use developments

- Create innovative, quality, green, and sustainable real estate developments

Company Promoters

- Mofatraj P. Munot,

- Parag M. Munot

IPO Details

Kalpataru Limited IPO date = 24 June to 26 June 2025

Minimum Amount = INR 14,904

Minimum Bid = 36 Shares

Face Value (FV) = INR 10

Listing On = NSE, BSE

Book Running Lead Managers

ICICI Securities Limited,

JM Financial Limited,

Nomura Financial Advisory and Securities (India) Pvt Ltd

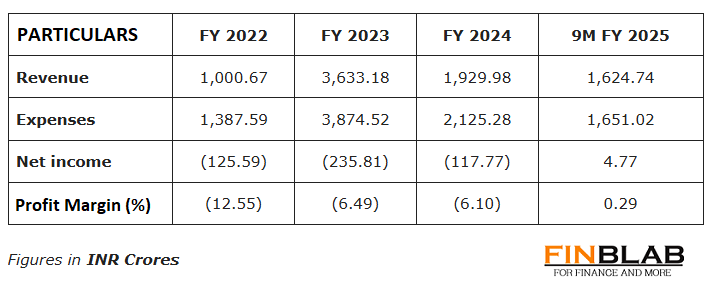

Financials

CONCLUSION

FinBlab recommends ‘SUBSCRIBE‘ ratings on Kalpataru Limited IPO (keeping a long-term view in mind)

Disclaimer: The contents and data presented here are just for your information & personal use only. While much effort is made to provide the information, I ( Vishal Dalwadi ) or “FinBlab” do not guarantee the accuracy, correctness, completeness or reliability of any information or data displayed herein and shall not be held responsible.