Fabtech Technologies IPO – Review

Fabtech Technologies Limited, a company that provides engineering solutions to biotech, pharmaceutical, and healthcare companies worldwide, plans to raise ₹230 Crore through an IPO.

[Fresh Issue ₹230 Cr + OFS NIL]

Fabtech Technologies IPO Share Price is ₹181 – ₹191 per share

Fabtech Technologies: History

The Company was originally incorporated as Globeroute Ventures Private Limited, a private limited company under the Companies Act, 2013, on October 26, 2018.

The Company was then converted into a public limited company under a special resolution passed by the shareholders at the Extraordinary General Meeting held on April 3, 2024, and its name was changed to Fabtech Technologies Limited under a fresh certificate of incorporation issued by the RoC on July 24, 2024.

LAST ARTICLE – Glottis ipo review

Fabtech Technologies: Business

Fabtech Technologies Ltd. is a global company headquartered in India, specializing in turnkey engineering solutions for healthcare, biotech, and pharmaceutical companies.

The Company builds pharmaceutical, biotech, and healthcare capabilities by offering comprehensive start to finish solutions encompassing designing, engineering, procurement, installation, and testing of select pharmaceutical equipment for a wide range of clients.

Fabtech Technologies: Services

- The company helps people in the bio-pharma manufacturing life cycle from setting direction right through to taking products to market.

- The company offers a wide range of equipment for the production and distribution of purified water & pure steam generation, as well as water for injections with flow rates between 500 and 50,000 Litres Per Hour (LPH).

- The company supported life sciences, aeronautics, food and beverage, IT, and semiconductor industries with innovative solutions for clean air applications that drive their growth and progress.

Strategies Ahead

- Expansion in existing regions (through overseas subsidiaries or joint ventures)

- Increase government clients in the African region.

- Pursuing inorganic growth through acquisitions

- Diversify client base

Company Promoters

- Aasif Ahsan Khan,

- Hemant Mohan Anavkar,

- Aarif Ahsan Khan,

- Manisha Hemant Anavkar

Refer to Fabtech Technologies DRHP for detailed information.

IPO Details

ipo date = 29 Sept to 01 Oct 2025

Minimum Amount = ₹14,325

Minimum Bid = 75 Shares

Face Value (FV) = ₹10

Listing On = NSE, BSE

Book Running Lead Manager

Unistone Capital

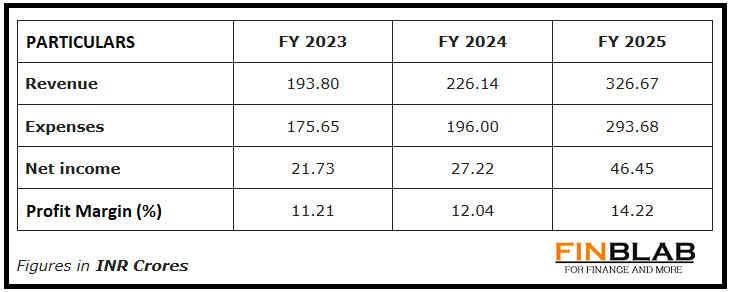

Financials

CONCLUSION

FinBlab recommends ‘SUBSCRIBE‘ ratings on Fabtech Technologies IPO (keeping a long-term view in mind)

Do come back to know more about “upcoming ipos“

Disclaimer: The contents and data presented here are just for your information & personal use only. While much effort is made to provide the information, I ( Vishal Dalwadi ) or “FinBlab” do not guarantee the accuracy, correctness, completeness or reliability of any information or data displayed herein and shall not be held responsible.