WeWork India IPO – Review

WeWork India Management Limited, a provider of flexible and high-quality workspaces to clients in India, is planning to raise ₹3000 Crore through an IPO.

[Fresh Issue NIL + OFS ₹3000 Cr]

Wework india ipo price is ₹615 – ₹648 per share

WeWork India: History

The Company was originally incorporated as Halosaur Bengaluru Private Limited, a private limited company under the Companies Act 2013, at Bengaluru, Karnataka, India, on May 13, 2016.

The Company was then converted into a public limited company under a special resolution passed by the shareholders on October 18, 2024, and its name was changed to WeWork India Management Limited under a fresh certificate of incorporation issued by the RoC on November 19, 2024.

LAST ARTICLE – Om freight forwarders ipo review

WeWork India: Business

WeWork India Management Ltd. is a leading premium flexible workspace operator in India and has been the largest operator by total revenue in the past three fiscal years, (according to the CBRE Report).

The Company caters to a diverse client base, including a marquee roster of Fortune 500 companies, large enterprises, international and domestic companies, MSMEs, GCCs, startups, and individuals.

The Company leases primarily Grade A office space from such developers and designs, builds, and operates them as flexible workspaces according to global standards.

The Company’s technologically integrated workspaces come with shared amenities including meeting rooms, event spaces, printing, mail and packaging, wellness rooms, and recreational spaces.

The Company primarily operates in India’s key office markets – Bengaluru, Chennai, Delhi, Gurgaon, Hyderabad, Mumbai, Noida, and Pune.

The Company is owned and promoted by Embassy Group, a leading real estate developer in India, which has a portfolio of more than 85 million square feet of commercial real estate and is the sponsor of Embassy REIT, India’s first REIT and Asia’s largest office REIT by leasable area (according to the CBRE Report).

Strategies Ahead

- Continue to deepen presence in existing cities.

- Expand in key micro-markets with strong demand for flexible workspace solutions.

- Focus on unit economics.

- Invest in new products and technology to diversify revenues through product innovation and inorganic expansion.

- Tech and data-based approach to improve margins.

Company Promoters

- Jitendra Mohandas Virwani,

- Karan Virwani,

- Embassy Buildcon LLP

IPO Details

ipo date = 03 Oct – 07 Oct 2025

Minimum Amount = ₹14,904

Minimum Bid = 23 Shares

Face Value (FV) = ₹10

Listing On = NSE, BSE

Book Running Lead Manager

JM Financial

ICICI Securities

Jefferies India

Kotak Mahindra Capital

360 ONE WAM

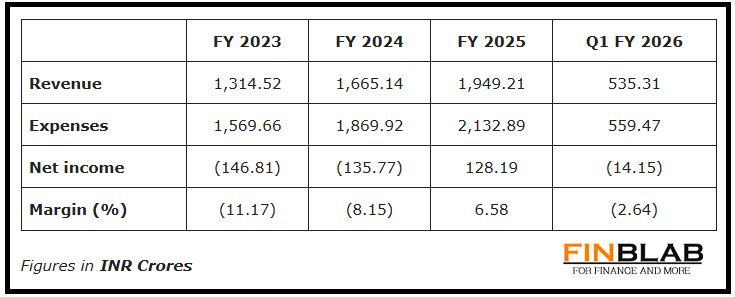

Financials

CONCLUSION

FinBlab recommends ‘NEUTRAL‘ ratings on WeWork India IPO (for the time-being)

Do come back to know more about “upcoming ipos“

Disclaimer: The contents and data presented here are just for your information & personal use only. While much effort is made to provide the information, I ( Vishal Dalwadi ) or “FinBlab” do not guarantee the accuracy, correctness, completeness or reliability of any information or data displayed herein and shall not be held responsible.