LG Electronics IPO – Review, Update

LG Electronics India Update:

Q3 FY26 Numbers, MD Speech, Future Outlook, and more

LG Electronics India Limited (LGE India), India’s leading consumer electronics brand, today announced the numbers for the third quarter of FY2026.

The company registered revenue from operations of ₹4,114 crores in Q3 FY26 compared to ₹4,396 crores in Q3 FY25, with an EBITDA margin of 4.8 percent in Q3 FY26. Source – BSE

Check list of upcoming ipos

Key Highlights: Q3 FY2026

- Revenue from operations stood at ₹4,114 Cr, down 6.4 percent on y-o-y basis

- EBITDA at ₹196 Cr with an EBITDA margin of 4.8 percent in Q3 FY26

- Profit after tax (PAT) stood at ₹90 Cr.

- LG Essential Series, affordable premium category products aimed at first-time

- Aspirational customers continue to witness growing traction across India.

- The Premium range, led by innovative new range products, continued to drive momentum.

- Reduction of US tariffs and EU FTA expected to drive new export-related opportunities.

- In the next financial year, the company aims to double exports, led by Make in India premium products, including the US & Europe.

New Launch

The Company further strengthened its premium portfolio during the quarter with the launch of advanced offerings, including French-door refrigerators and AI DD 2.0 powered washing machines, reinforcing its leadership position in the segment.

Refer to LG Electronics News for more information.

MD Speech –

Commenting on Q3 FY2026 performance, Mr. Hong Ju Jeon, MD and Chief Sales and Marketing Officer, LG Electronics India, said,

LGE India has maintained the No.1 position across key B2C segments, despite a subdued last quarter affected by external factors.

Anchored by strong fundamentals, focus on innovation, and long-term stability, we have entered Q4 with renewed strength, validated by the positive response to our new BEE-rated portfolio.

As summer approaches, we are poised to capture demand for compressor products through our two-track strategy – expanding both premium and ‘LG Essential’ lineups.

We remain committed to scaling our high-margin AMC business and leveraging B2B infrastructure opportunities.

Our third manufacturing plant, on track to be operational by the end of the year, will accelerate our ‘Make India Global’ plans.

Future Outlook

- Positive influence on consumer preferences with the introduction of the new 2026 BEE ratings portfolio

- Witnessing healthy demand across both affordable and premium categories with compressor-based products

- Ongoing focus on continuous product innovation and cost discipline to support sustainable, profitable growth.

The stock ended at ₹1518.15 9 (down 1.50%) on the Bombay Stock Exchange.

LAST ARTICLE – Quadrant Future Tek latest news

5 October 2025

LG Electronics India Limited, a market leader in India in major home appliances and consumer electronics markets, is planning to raise ₹11,607 Crore through an IPO.

[Fresh Issue NIL + OFS ₹11,607 Cr]

LG Electronics share price is ₹1,080 – ₹1,140 per share

LG Electronics: History

The Company was originally incorporated as LG Electronics India Private Limited, a private limited company under the Companies Act, 1956, at New Delhi, India, on January 20, 1997.

The Company was then converted into a public limited company under a special resolution passed by the shareholders on November 11, 2024, and its name was changed to LG Electronics India Limited under a fresh certificate of incorporation issued by the RoC on December 03, 2024.

LAST ARTICLE – Tata capital ipo review

LG Electronics: Business

LG Electronics India Ltd. is the market leader in India in consumer electronics (excluding mobile phones) and major home appliances.

It is also a market leader in India across multiple product categories, including inverter air conditioners, panel televisions, refrigerators, washing machines, and microwaves (based on value market share in the offline channel), according to the Redseer Report.

The company sells products to B2C and B2B consumers in India and outside India, and also offers installation, repair, and maintenance services for all of its products.

The Company was founded in the year 1997 as a wholly owned subsidiary of “LG Electronics”, which, according to the Redseer Report, is the leading single-brand global home appliances company in terms of market share by revenue in CY ‘23.

Manufacturing Units

As of June 30, 2025, the company has two manufacturing units in Noida and Pune with a combined capacity of 14.51 million products.

Distribution Network

- The company has a presence in 54 countries across Asia, Africa, and Europe.

- It has the largest distribution network among leading consumer electronics brands and home appliances, with 35,640 B2C touchpoints and a robust after-sales service network comprising 1,006 service centers and 13,368 engineers across the country.

Strategies Ahead

- Build a solid foundation to capitalize long-term growth story in India.

- Maintain position as the most preferred brand in both volume and premium market segments for every Indian household.

- Diversify business model to create new consumer value.

Company Promoters

- LG Electronics Inc.

Refer to LG Electronics IPO DRHP for detailed information.

IPO Details

ipo date = 07 Oct – 09 Oct 2025

Minimum Amount = ₹14,820

Minimum Bid = 13 Shares

Face Value (FV) = ₹10

Listing On = NSE, BSE

Book Running Lead Managers

Morgan Stanley India

J.P. Morgan India

Axis Capital

BofA Securities

Citigroup Global Markets India

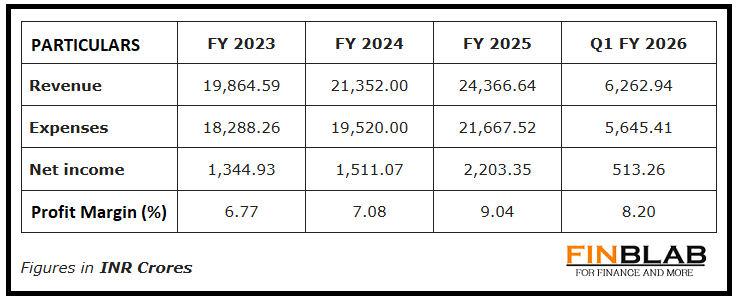

Financial

CONCLUSION

FinBlab recommends ‘SUBSCRIBE‘ ratings on LG Electronics IPO (keeping a long-term view in mind)

Do come back to know more about “upcoming ipos“

Disclaimer: The contents and data presented here are just for your information & personal use only. While much effort is made to provide the information, I ( Vishal Dalwadi ) or “FinBlab” do not guarantee the accuracy, correctness, completeness or reliability of any information or data displayed herein and shall not be held responsible.