Aditya Infotech IPO – Review

Aditya Infotech Limited, India’s leading surveillance brand (CCTV & Security Products), is planning to raise INR 1300 via an IPO.

[Fresh Issue 500 Cr + OFS 800 Cr]

Aditya infotech ipo price is INR 640 – 675 per share

Aditya Infotech: History

The Company was incorporated as Perfect Lucky Goldstar International Limited in New Delhi (India), as a public limited company under the Companies Act, 1956,

The Company was converted into a public limited company under a special resolution passed in the AGM by the shareholders on August 6, 1997, and its name was changed to Aditya Infotech Ltd under a fresh certificate of incorporation issued by the RoC on September 11, 1997.

LAST ARTICLE – Laxmi india finance ipo review

Aditya Infotech: Business

Aditya Infotech Ltd is the largest India-based company offering video security & surveillance products, solutions, and services, with a market share of 20.2 percent of the video surveillance industry in the country (in terms of revenues in FY 2024, according to F&S Report).

The Company offers a comprehensive range of advanced video security and surveillance products, technologies, and solutions for enterprise and consumer segments under the ‘CP PLUS’ brand.

It also offers solutions and services such as fully integrated security systems and Security-as-a-Service (SAAS) directly and through its distribution network in a broad range of sectors, such as –

- Banking,

- Defense,

- Education,

- Healthcare,

- Hospitality,

- Insurance,

- Industrial,

- Manufacturing,

- Real Estate,

- Retail, and

- Law Enforcement.

‘CP PLUS’ is recognized as one of the top video security and surveillance brands in Asia and a leading security brand in India.

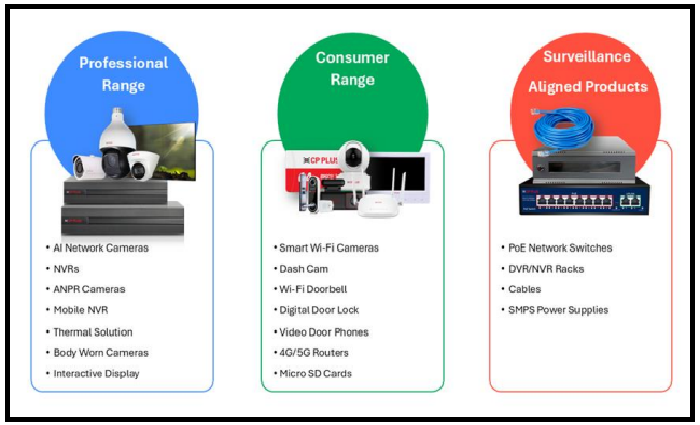

Product Portfolio

In FY 2024, the Company offered 2,937 stock keeping units (SKUs) and classified its products under the following categories,

Largest Manufacturer

- According to the F&S Report, Aditya Infotech is the third-largest manufacturer of surveillance products globally in terms of units manufactured in FY 2024.

- It is also the largest manufacturer (outside China) of surveillance products in terms of units manufactured in FY 2024, according to the F&S Report.

Joint Venture

In 2017, the Company entered into a joint venture agreement with Dixon Technologies (I) Limited to expand its manufacturing operations by creating a captive manufacturing plant and leveraging Dixon’s expertise in manufacturing processes.

Manufacturing Facility

As of March 31, 2024, the company’s manufacturing facility in Kadapa (Andhra Pradesh, India) has an installed capacity of 15.59 million units per annum.

Network

Aditya Infotech sold its surveillance products through a network of over 800 distributors in tier I, tier II, and tier III cities, and over 2,200 system integrators in FY 2024.

Strategies Ahead

- Continue to innovate and introduce new products and the next generation of existing products,

- Developing an ecosystem for commercial and consumer use

- Expand retail presence through additional experience centres and stores

- Focus on the service-led model and the enterprise customer

- Increase production at the Kadapa facility

Company Promoters

- Hari Shanker Khemka,

- Aditya Khemka,

- Ananmay Khemka,

- Rishi Khemka,

- Hari Khemka Business Family Trust

Refer to Aditya infotech ipo DRHP for detailed information.

IPO Details

IPO date = 29 July to 31 July 2025

Minimum Amount = INR 14,850

Minimum Bid = 22 Shares

Face Value (FV) = INR 1

Listing On = NSE, BSE

Book Running Lead Manager

ICICI Securities Limited

IIFL Securities Limited

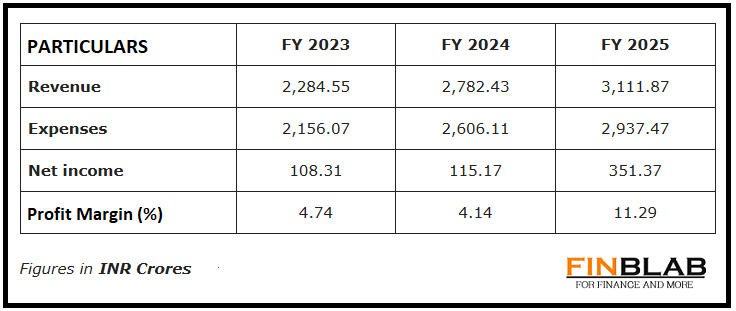

Financials

CONCLUSION

FinBlab recommends ‘SUBSCRIBE‘ ratings Aditya Infotech IPO

Disclaimer: The contents and data presented here are just for your information & personal use only. While much effort is made to provide the information, I ( Vishal Dalwadi ) or “FinBlab” do not guarantee the accuracy, correctness, completeness or reliability of any information or data displayed herein and shall not be held responsible.