All Time Plastics IPO – Review

All Time Plastics Limited, a company producing plastic consumer ware products in India, is planning to raise ₹ 400 crores through an IPO.

[Fresh Issue ₹ 280 Cr + OFS ₹ 120 Cr]

All time plastics ipo price is ₹ 260 – ₹ 275 per share

All Time Plastics: History

The Company was incorporated as All Time Plastics Private Limited, a private limited company under the Companies Act, 1956, on March 8, 2001.

The Company was converted into a public limited company under a special resolution passed in the EGM by the shareholders on May 21, 2024, and its name was changed to All Time Plastics Limited under a fresh certificate of incorporation issued by the RoC on August 5, 2024.

All Time Plastics: Business

All Time Plastics Ltd is the second largest manufacturer of plastic consumer ware products (primarily a business-to-business player in India in terms of revenue from operations) for FY 2023 (source: Technopak Report).

It is a manufacturing company with more than 13 years of experience of producing plastic consumer ware products for everyday household needs.

Product Categories

As of March 31, 2024, the Company had 1,608 SKUs (stock-keeping units) across eight product categories –

- Prep Time (kitchen tools for preparing cooking ingredients);

- Containers (food storage containers);

- Organization (miscellaneous storage containers);

- Hangers (various types of hangers);

- Meal Time (kitchenware);

- Cleaning Time (cleaning equipment);

- Bath Time (bathroom products); and

- Junior (child-friendly tableware, cutlery, and other items)

Export Footprint

The company’s export footprint spans 29 countries, including major markets like the European Union (EU), the United Kingdom (UK), and the United States.

Domestically, All Time Plastic caters to modern trade retailers, super distributors, and general trade stores, forging long-standing relationships with industry leaders like Asda, IKEA, Michaels, and Tesco.

Employee Strength

As of March 31, 2024, the Company had 610 employees and 1,061 persons working as contract labour.

Strategies Ahead

- Increase production capacity by opening a new Manekpur Facility and expanding the existing capacity

- Propel manufacturing processes through digital innovation and enhancement of our automation and mould development capabilities

- Continue to expand plastic homeware product offerings

- Diversify revenue stream through the manufacturing of bamboo products

- Acquire new customers and sell more products to existing customers

- Selective Expansion into Overseas Markets

LAST ARTICLE – JSW cement ipo review

Company Promoters

- Kailesh Punamchand Shah,

- Bhupesh Punamchand Shah,

- Nilesh Punamchand Shah

IPO Details

All time plastics ipo date = 07 August to 11 August 2025

Minimum Amount = INR 14,850

Minimum Bid = 54 Shares

Face Value (FV) = INR 2

Listing On = NSE, BSE

Book Running Lead Manager

Intensive Fiscal Services Private Ltd

DAM Capital Advisors Ltd

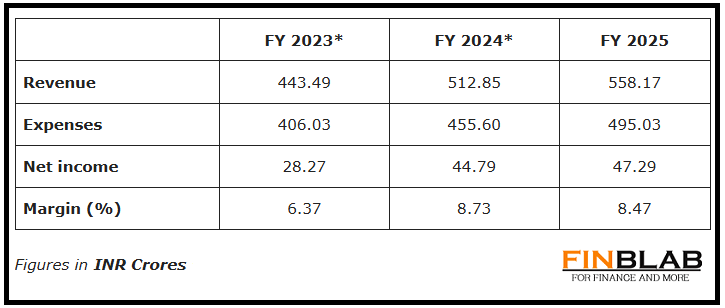

Financials

CONCLUSION

FinBlab recommends ‘SUBSCRIBE‘ ratings All Time Plastic IPO

Disclaimer: The contents and data presented here are just for your information & personal use only. While much effort is made to provide the information, I ( Vishal Dalwadi ) or “FinBlab” do not guarantee the accuracy, correctness, completeness or reliability of any information or data displayed herein and shall not be held responsible.