Anlon Healthcare IPO – Review

Anlon Healthcare Limited, a research-intensive manufacturer of Pharmaceutical Intermediates and Active Pharmaceutical Ingredients, plans to raise ₹121 Crore through an IPO.

[Fresh Issue ₹ 121 Cr + OFS NIL]

Anlon healthcare ipo price is ₹ 86 – ₹ 91 per share

Anlon Healthcare: History

The Company was originally incorporated as Anlon Ventures Private Limited, a private limited company under the Companies Act, 1956, on November 19, 2013.

The Company was converted into a public limited company under a special resolution approved by the shareholders on August 3, 2024, and its name was changed to Anlon Healthcare Limited under a fresh certificate of incorporation issued by the RoC on September 2, 2024.

LAST ARTICLE – Vikran Engineering IPO

Anlon Healthcare: Business

Anlon Healthcare Limited is a chemical manufacturing company engaged in the manufacturing of –

- High Purity Advanced Pharmaceutical Intermediates serve as raw material in the manufacturing of active pharmaceutical ingredients; and

- Active Pharmaceutical Ingredients (APIs) serve as a raw material for pharmaceutical formulations in preparation of various types of Finished Dosage Formulas such as capsules, ointments, tablets, and syrups.

The Company’s products span across the family of –

- Pharmaceutical Intermediates,

- Active Pharmaceutical Ingredients,

- Nutraceutical APIs,

- Ingredients For Personal Care, and

- Veterinary API

According to the D&B Report, Anlon Healthcare is one of the few manufacturers of Loxoprofen Sodium Dihydrate in India, a notable API widely used in the treatment of pain/inflammation associated with conditions including –

- Rheumatoid Arthritis,

- Osteoarthritis,

- Lower Back Pain,

- Frozen Shoulder,

- Neck-Shoulder-Arm Syndrome,

- Tooth Pain Or After Surgery, and

- Injury Or Tooth Extraction

The Company undertakes API development, preparation and filing of Drug Master File (DMF) in the Indian and global markets as per the requirements of clients and regulatory agencies.

The Company’s API products are manufactured in accordance with Indian and international pharmacopeia standards such as BP, EP, IP, JP, the USP.

Product Portfolio

As of the date of this Red Herring Prospectus, the company’s product portfolio consists of sixty-five (65) commercialised products, twenty-eight (28) products which are at the pilot stage and forty-nine (49) products which are at the laboratory testing stage/laboratory scale stage.

Manufacturing Facility

The Company’s operations are supported by a 5,059 sq. mtrs. manufacturing facility in Rajkot (Gujarat, India) with a 400 MTPA capacity, 2 production blocks, 4 in-house laboratories, and advanced reactors up to 4 KL.

Global Footprint

In addition to domestic market sales in India, the company has clients in countries like Argentina, Brazil, Chile, Columbia, China, Egypt, Germany, Italy, Japan, Mexico, South Korea, Turkey, the United Kingdom, and the United Arab Emirates.

Strategies Ahead

- Increase manufacturing capacity to focus on the growing demand for core products

- Increase wallet share with existing customers and continue to focus on expanding the customer base

- Improve cost management and operational efficiencies, along with a focus on rationalizing indebtedness

- Expand existing product portfolio

Company Promoters

- Punitkumar R. Rasadia,

- Meet Atulkumar Vachhani,

- Mamata Punitkumar Rasadia

IPO Details

Anlon healthcare ipo date = 26 to 29 August 2025

Minimum Amount = INR 14,924

Minimum Bid = 164 Shares

Face Value (FV) = INR 10

Listing On = NSE, BSE

Book Running Lead Manager

Interactive Financial Services Ltd

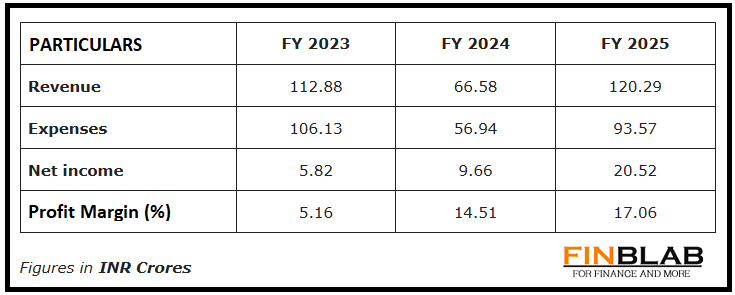

Financials

CONCLUSION

FinBlab recommends ‘SUBSCRIBE‘ ratings on Anlon Healthcare IPO (keeping a long-term view in mind)

Disclaimer: The contents and data presented here are just for your information & personal use only. While much effort is made to provide the information, I ( Vishal Dalwadi ) or “FinBlab” do not guarantee the accuracy, correctness, completeness or reliability of any information or data displayed herein and shall not be held responsible.