Anthem Biosciences IPO – Review

Anthem Biosciences Limited, a Contract Research and Innovation Service Provider in India is planning to raise INR 3395 Crore via IPO.

[Fresh Issue NIL + OFS 3395 crore]

Anthem biosciences ipo price INR 540 – 570 per share

Anthem Biosciences: History

The Company was originally incorporated as Anthem Biosciences Private Limited under the provisions of the Companies Act, 1956.

The Company was converted into a public limited company under a special resolution passed in the EGM by the shareholders on October 18, 2024, and its name was changed to Anthem Biosciences Ltd under a fresh certificate of incorporation issued by the RoC on December 10, 2024.

Anthem Biosciences: Business

Anthem Biosciences is a technology-focused and innovation-driven Contract Research, Development, and Manufacturing Organization (CRDMO) with fully integrated operations spanning –

(1) Drug Discovery,

(2) Development, and

(3) Commercial Manufacturing.

As a one-stop service provider, Anthem serves a range of clients, encompassing innovator-focused emerging biotech and large pharma companies globally.

According to the F&S Report, Anthem Biosciences is one of the few companies in India with integrated New Biological Entity (NBE) and New Chemical Entity (NCE) capabilities across drug discovery, development & manufacturing.

Anthem is one of the youngest Indian CRDMO companies and the fastest Indian CRDMO to achieve a milestone of INR 10,000 Crore of revenue within 14 years of operations, as per the F&S Report.

In addition to product research and development, Anthem helps test drugs for –

- Safety,

- Efficacy (In Vitro and In Vivo),

- Pre-Clinical Animal Studies in a Glp Facility,

- Clone Development,

- Antibody Drug Conjugates,

- R&D and Manufacture of Highly Potent Compounds,

- Flow Chemistry Based Production, and

- Large Scale Commercial Product Manufacture

Completed Programs

Over the last 15 years, Anthem has completed more than 8,000 unique programs commissioned by its clients (Projects) and worked on molecules with more than 675 customers at various stages of the drug development lifecycle under the CRDMO business.

Client List

Anthem serves over 550 clients across 44+ countries, including the United States, European countries, and Japan (many of whom the Company has a long-standing relationship with).

LAST ARTICLE – Smartworks Coworking Spaces ipo review

Strategies Ahead

- Expand technological capabilities to gain wallet share and win new clients in the discovery and development phase

- Leverage on manufacturing capacity to cater to the expected increase in commercialized and late-stage molecules

- Focus on growing complex specialty ingredients business with large market opportunity

- Improving cost management and operational efficiencies (supply chain resilience)

- Complement overall growth by identifying opportunities for inorganic expansion

- Continue to implement sustainable manufacturing practices and green chemistry

Company Promoters

- Ajay Bhardwaj,

- Ganesh Sambasivam,

- K Ravindra Chandrappa,

- Ishaan Bhardwaj

IPO Details

IPO date = 14 July to 16 July 2025

Minimum Amount = INR 14,820

Minimum Bid = 26 Shares

Face Value (FV) = INR 2

Listing On = NSE, BSE

Book Running Lead Manager

JM Financial Limited

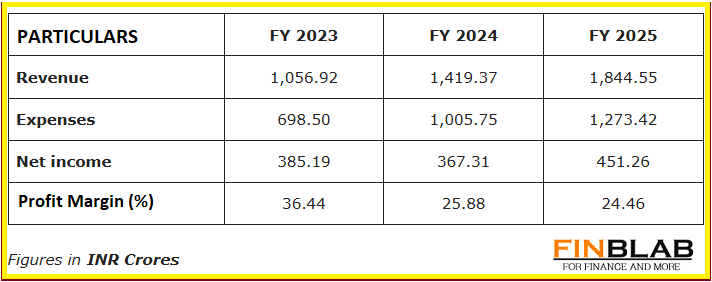

Financials

CONCLUSION

FinBlab recommends ‘SUBSCRIBE‘ ratings on Anthem Biosciences IPO

Disclaimer: The contents and data presented here are just for your information & personal use only. While much effort is made to provide the information, I ( Vishal Dalwadi ) or “FinBlab” do not guarantee the accuracy, correctness, completeness or reliability of any information or data displayed herein and shall not be held responsible.