Atlanta Electricals IPO – Review

Atlanta Electricals Limited, engaged in manufacturing Power, Distribution, and Special application-type of transformers in India, is planning to raise ₹687 Crore through an IPO.

[Fresh Issue ₹400 Cr + OFS ₹287 Cr]

Atlanta electricals ipo price is ₹718 – ₹754 per share

Atlanta Electricals: History

The Company was originally incorporated as Atlanta Electricals Private Limited, a private limited company under the Companies Act, 1956, on December 15, 1988.

The Company was converted into a public limited company under a special resolution passed by the shareholders on November 14, 2024, and its name was changed to Atlanta Electricals Limited under a fresh certificate of incorporation issued by the RoC on December 20, 2024.

LAST ARTICLE – Ganesh consumer ipo review

Atlanta Electricals: Business

Atlanta Electricals Ltd. is one of the leading manufacturers of power, auto, and inverter duty transformers in India (in terms of production volume, as of FY 24).

It is also one of the few companies in India that manufactures transformers with a capacity of up to 200 Mega Volt-Amp (MVA) and a 220 kilovolts (kV) voltage.

With a pan-India presence and operations spanning over 30 years in the transformer manufacturing industry in India, the company supplies a wide range of transformers starting from 5 MVA/11 kV up to 200 MVA/220 kV.

Manufacturing Facilities

- The company operates with three manufacturing facilities, two located in Anand, Gujarat, and one in Bengaluru, Karnataka.

- Additionally, it is also in the process of setting up a manufacturing facility at Vadod, Gujarat, which is under construction as of the date of this DRHP.

Customer Base

- As of September 30, 2024, the company has a customer base (208 customers) in three union territories and 19 states, across India, with a supply of 4,000 transformers, aggregating to 78,000 MVA to various national and state electricity grids, private sector players, and prominent renewable energy generation projects.

- Some of the renowned customers of the company include Adani Green Energy Ltd, Gujarat Energy Transmission Corporation Ltd, SMS India, and TATA Power Ltd.

ALSO READ – Gk energy ipo review

Order Book

As of September 30, 2024, the company’s order book stood at ₹1,283.32 crore (projects awarded by public and private sector players contributed to 73.39 percent and 26.61 percent, respectively).

Strategies Ahead

- Capital expenditure to achieve capacity expansion

- Focus on being a backward-integrated player.

- Expand customer base beyond India and increase wallet share.

- Increase market share with improved utilisation levels.

- Enhance brand through innovation.

- Focus on marketing initiatives.

ALSO READ – GST 2.0 News

Company Promoters

- Niral Krupeshbhai Patel,

- Amish Krupeshbhai Patel,

- Tanmay Surendrabhai Patel,

- Narharibhai S. Patel Family Trust,

- Atlanta UHV Transformers LLP.

Refer to Atlanta Electricals drhp for detailed information.

IPO Details

Atlanta Electricals IPO date = 22 to 24 September 2025

Minimum Amount = ₹14,326

Minimum Bid = 19 Shares

Face Value (FV) = ₹2

Listing On = NSE, BSE

Book Running Lead Managers

Motilal Oswal Investment Advisors,

Axis Capital

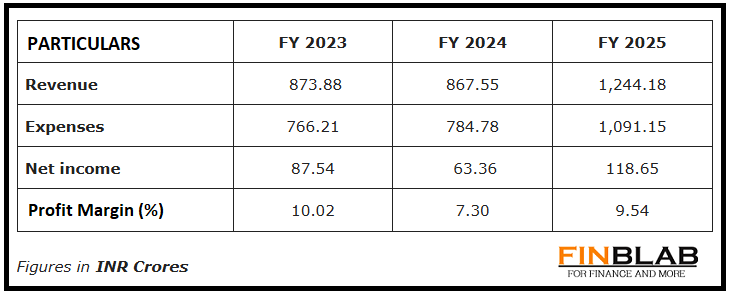

Financials

CONCLUSION

FinBlab recommends ‘SUBSCRIBE‘ ratings on Atlanta electricals ipo (keeping a long-term view in mind)

Do come back to know more about “upcoming ipos“

Disclaimer: The contents and data presented here are just for your information & personal use only. While much effort is made to provide the information, I ( Vishal Dalwadi ) or “FinBlab” do not guarantee the accuracy, correctness, completeness or reliability of any information or data displayed herein and shall not be held responsible.