Canara Robeco IPO – Review

Canara Robeco Asset Management Company Limited, one of India’s oldest asset management companies, plans to raise ₹1,326 Crore through an IPO.

[Fresh Issue NIL + OFS ₹1,326 Cr]

Canara robeco ipo share price is ₹253 – ₹266 per share

Canara Robeco: History

The Company was originally incorporated as Canbank Investment Management Services Limited, a public limited company under the provisions of the Companies Act, 1956, on March 2, 1993.

The name of the Company was then changed to Canara Robeco Asset Management Company Limited, as the promoter of the Company, Canara Bank, has entered into a Shareholders Agreement with ORIX Corporation Europe N.V., consequent to which a fresh certificate of incorporation was issued by the RoC on October 10, 2007, under the Companies Act, 1956.

LAST ARTICLE – Canara robeco ipo review

Canara Robeco: Business

Canara Robeco Asset Management Co. Ltd. is the 2nd-oldest asset management company (AMC) in India.

The Company was established in 1993 under the name of Canbank Investment Management Services Limited to manage the assets (funds) of Canbank Mutual Fund.

The primary activities of the company include (1) managing mutual funds, and (2) providing investment advice on Indian equities to Robeco Hong Kong Ltd (Robeco HK), a member of the Promoter Group.

As of December 31, 2024, the company manages 25 schemes, comprising 12 equity schemes, 10 debt schemes, and 3 hybrid schemes, with a quarterly average asset under management (QAAUM) of ₹1,083.66 billion as of December 31, 2024.

Pan-India Presence

As of June 30, 2025, the company has a pan-India presence with 23 branches across 14 states and 2 union territories (UTs), supported by 52,343 empaneled distribution partners, 548 national distributors, 44 other Indian banks, and over 51,750 mutual fund distributors.

Strategies Ahead

- Focus on providing consistent investment performance through a solid research-based process.

- Grow distribution and geographical presence.

- Focus on diversifying Assets Under Management across Asset-Classes and Product Offerings.

- Focus on leveraging technology to improve operational efficiency.

- Enhance the employee value proposition to attract and retain high-quality talent.

Company Promoters

- Canara Bank

- Orix Corporation Europe N.V.

Refer to Canara Robeco IPO DRHP for detailed information.

IPO Details

Canara robeco ipo date = 09 Oct – 13 Oct 2025

Minimum Amount = ₹14,896

Minimum Bid = 56 Shares

Face Value (FV) = ₹10

Listing On = NSE, BSE

Book Running Lead Managers

SBI Capital Markets

Axis Capital

JM Financial

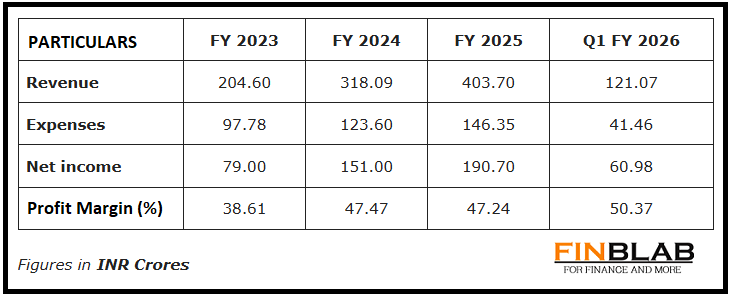

Financial

CONCLUSION

FinBlab recommends ‘SUBSCRIBE‘ ratings on Canara Robeco IPO (keeping a long-term view in mind)

Do come back to know more about “upcoming ipos“

Disclaimer: The contents and data presented here are just for your information & personal use only. While much effort is made to provide the information, I ( Vishal Dalwadi ) or “FinBlab” do not guarantee the accuracy, correctness, completeness or reliability of any information or data displayed herein and shall not be held responsible.