Dev Accelerator IPO – Review

Dev Accelerator Limited, a platform that offers office space and boosts the startup ecosystem in India, plans to raise ₹143 crore through an IPO.

[OFS NIL + Fresh Issue ₹143 Cr]

Dev accelerator ipo price is ₹56 – ₹61 per share

Dev Accelerator: History

The Company was originally incorporated as a limited liability partnership (LLP) under the name Dev Accelerator LLP on September 14, 2017, pursuant to the Limited Liability Partnership Act, 2008.

The Company was converted into a public limited company under a special resolution passed by the shareholders at the extraordinary general meeting held on July 12, 2024, and its name was changed to Dev Accelerator Limited under a fresh certificate of incorporation issued by the RoC on September 03, 2024.

LAST ARTICLE – Urban Company IPO Review

Dev Accelerator: Business & Service

Dev Accelerator Ltd. is one of the largest flex space operators in India (in terms of operational flex stock in Tier 2 markets), specializing in complete Built to Suit Managed Office Solutions for enterprises.

The Company’s service offerings can be classified into three categories –

- Managed Office Solutions

- Co-Working Space Solutions

- Design And Build Solutions

The Company provides integrated services from sourcing office spaces, customizing designs, developing spaces, and providing technology solutions to complete asset management.

The Company’s clientele comprises SMEs, MNCs, and large corporates to whom it offers a variety of flexible office space solutions such as managed office spaces and co-working spaces, as well as design and execution services.

Market Presence

As per the JLL Report, the Company has established a market presence across 15 sub-markets in India, including Tier 1 markets of Pune, Mumbai, Hyderabad, and Delhi NCR, and Tier 2 markets of Ahmedabad, Jaipur, Udaipur, Indore, and Vadodara.

Area Under Management

As of August 31, 2024, the company has provided its service to more than 230 clients and has 25 Centers across 11 cities in India, with 12,691 seats covering a total area under management of 806,635 square feet.

ALSO READ – Shringar House of Mangalsutra IPO Review

Strategies Ahead

- Expansion into new and existing markets

- Enhance client offerings

- Enhancing asset procurement strategy

- Leveraging the potential of Global Capability Centres

Company Promoters

- Parth Naimeshbhai Shah,

- Umesh Satishkumar Uttamchandani,

- Rushit Shardulkumar Shah,

- Jaimin Jagdishbhai Shah,

- Pranav Niranjan Pandya,

- Amisha Jaimin Shah,

- Kruti Pranav Pandya,

- Dev Information Technology Limited

Refer to Dev Accelerator IPO DRHP for detailed information.

IPO Details

IPO date = 10 to 12 September 2025

Minimum Amount = ₹14,335

Minimum Bid = 235 Shares

Face Value (FV) = ₹10

Listing On = NSE, BSE

Book Running Lead Manager

Pantomath Capital Advisors

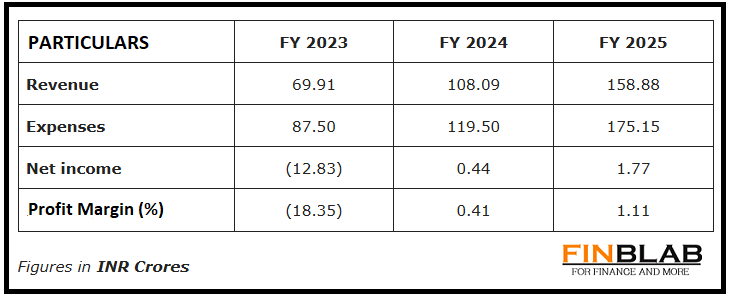

Financials

CONCLUSION

FinBlab recommends ‘MAY SUBSCRIBE‘ ratings on Dev Accelerator IPO

Do come back to know more about “upcoming ipos“

Disclaimer: The contents and data presented here are just for your information & personal use only. While much effort is made to provide the information, I ( Vishal Dalwadi ) or “FinBlab” do not guarantee the accuracy, correctness, completeness or reliability of any information or data displayed herein and shall not be held responsible.