Euro Pratik Sales IPO – Review

Euro Pratik Sales Limited, one of the largest organized wall panel brands in India, plans to raise ₹451 Crore through an IPO.

[OFS ₹451 Cr + Fresh Issue NIL]

Euro pratik sales ipo price is ₹235 – ₹247 per share

Euro Pratik Sales: History

The Company was originally incorporated as Better Life Mission Multitrade Private Limited, a private limited company under the Companies Act 1956, at Mumbai, India, on January 19, 2010.

The Company was converted into a public limited company under a special resolution adopted by the shareholders in the EGM held on August 22, 2024, and its name was changed to Euro Pratik Sales Limited under a fresh certificate of incorporation issued by the Registrar of Companies on October 11, 2024.

LAST ARTICLE – Dev Accelerator IPO Review

Euro Pratik Sales: Business

Euro Pratik Sales Ltd. operates in the decorative laminates and decorative wall panel industry as a prominent seller (and marketer) of Decorative Laminates and Decorative Wall Panels.

According to the Technopak Report, the company’s products are anti-bacterial, antifungal, and free from certain heavy metals such as mercury & lead.

These products are made from eco-friendly and recycled materials, offering greater environmental consciousness than the substitutes in the Indian wood, wallpaper, and paint market.

The Company develops various design templates for its Decorative Laminates and Decorative Wall Panels, which are tailored to meet contemporary interior design and architectural trends, resulting in product innovations for products like,

- Louvres,

- Chisel,

- Auris

According to the Technopak Report, Euro Pratik is one of the leading Decorative Wall Panel brands in India and has established itself as one of the largest organized Wall Panel brands in the country, with a market share of 15.87% (by revenue in the organized Decorative Wall Panels industry).

The Company operates on an asset-light business model by outsourcing manufacturing processes to contract manufacturing partners and has long-term agreements with select global manufacturers, which enables the offering of unique and trendy products.

ALSO READ – List Of Products With New GST Rates

Product Range

The company offered its clients a wide range of products in India, with over 30 product categories and 3,000 plus unique product designs, as per the Technopak Report.

Distribution Network

The Company has an extensive distribution network spread across 88 cities in India, which is distributed predominantly across Metros, Mini metros, Tier-I, II, and Tier-III cities in the country, enabling it to reach a broad spectrum of clients and markets.

As of September 30, 2024, the company managed a distribution network of 172 distributors across 25 states and 5 union territories in India.

Brand Ambassador

To strengthen the brand name in the industry, the Company has appointed Hrithik Roshan as the brand ambassador for the products under the “Euro Pratik” brand and Kareena Kapoor Khan as the brand ambassador for the products offered under the “Gloirio” brand.

Strategies Ahead

- Undertake measures to improve inventory management systems.

- Improve brand equity and consciousness.

- Expand distribution network

- Focus on product innovation.

- Expand product portfolio and new markets.

- Expand business through strategic inorganic growth opportunities.

- Leverage market share position to capitalize on favorable industry trends.

Company Promoters

- Pratik Gunvantraj Singhvi,

- Jai Gunvantraj Singhvi,

- Pratik Gunwantraj Singhvi HUF,

- Jai Gunwantraj Singhvi HUF.

Refer to Euro Pratik DRHP for detailed information.

IPO Details

Euro pratik sales ipo date = 16 to 18 September 2025

Minimum Amount = ₹14,820

Minimum Bid = 60 Shares

Face Value (FV) = ₹1

Listing On = NSE, BSE

Book Running Lead Manager

Axis Capital

DAM Capital Advisors

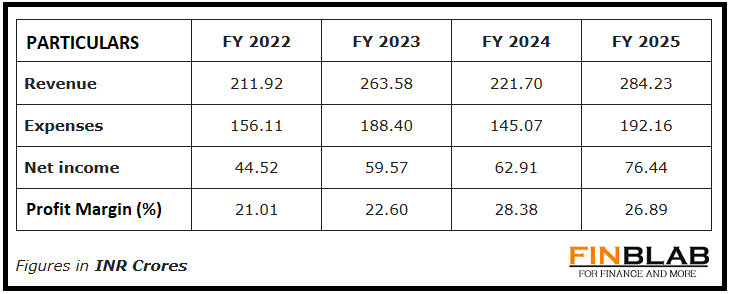

Financials

CONCLUSION

FinBlab recommends ‘SUBSCRIBE‘ ratings on Euro Pratik Sales IPO

Do come back to know more about “upcoming ipos“

Disclaimer: The contents and data presented here are just for your information & personal use only. While much effort is made to provide the information, I ( Vishal Dalwadi ) or “FinBlab” do not guarantee the accuracy, correctness, completeness or reliability of any information or data displayed herein and shall not be held responsible.