GK Energy IPO – Review

GK Energy Limited, a provider of EPC for solar-powered pump systems in India, is planning to raise ₹464 Crore through an IPO.

[Fresh Issue ₹400 Cr + OFS ₹64 Cr]

Gk energy ipo price is ₹145 – ₹153 per share

GK Energy: History

The Company was originally incorporated as GK Energy Marketers Private Limited, a private limited company under the Companies Act, 1956, at Pune, Maharashtra, on October 14, 2008.

The Company was converted into a public limited company under a special resolution passed by the shareholders on October 19, 2024, and its name was changed to GK Energy Limited under a fresh certificate of incorporation issued by the RoC on December 2, 2024.

LAST ARTICLE – Saatvik green energy ipo review

GK Energy: Business

GK Energy Ltd. is India’s biggest pure play provider of engineering, procurement, and commissioning services for solar-powered agricultural water pump systems under Component B of the “PM-KUSUM Scheme”.

The Company offers farmers an end-to-end single-source solution for the survey, design, supply, assembly & installation, testing, commissioning, and maintenance of solar-powered pump systems.

The Company’s EPC services comprise –

- Erection and installation of water storage and distribution facilities (under Jal Jeevan Mission (JJM) – a Central Government scheme),

- Supply and installation of various solar products for government organizations, and

- Rooftop solar solutions (together with other EPC Services).

- Sell solar modules and photovoltaic cells (PV cells) manufactured by third parties and other miscellaneous items.

The Company operates an asset-light business model and sources solar panels, pumps, and various other components of solar-powered pump systems under the GK_Energy_brand from different specialized vendors.

Installed Pump System

As of 31 July 2025, G.K Energy had installed over 62,559 solar pump systems, accounting for 7.37 percent of the scheme’s completed installations.

ALSO READ – Ivalue Infosolutions IPO Review

Order Book

The company’s order book stood at ₹1,028.96 crore, demonstrating strong market traction and future revenue visibility.

Strategies Ahead

- Replicate success in Maharashtra, Haryana, Rajasthan, UP, and MP.

- Diversify means of revenue by installing rooftop solar systems.

- Backward integrate by manufacturing solar panels.

- Development of a dedicated vendor ecosystem through organic and inorganic means

- Exploring other solar market opportunities

Company Promoters

- Gopal Rajaram Kabra

- Mehul Ajit Shah

Refer to GK Energy DRHP for detailed information.

IPO Details

Gk energy ipo date = 19 to 23 September 2025

Minimum Amount = ₹14,994

Minimum Bid = 98 Shares

Face Value (FV) = ₹2

Listing On = NSE, BSE

Book Running Lead Managers

IIFL Capital Services

HDFC Bank Limited

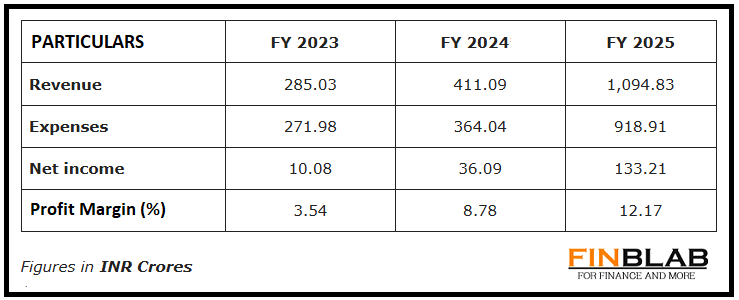

Financials

CONCLUSION

FinBlab recommends ‘SUBSCRIBE‘ ratings on GK Energy IPO (keeping a long-term view in mind)

Do come back to know more about “upcoming ipos“

Disclaimer: The contents and data presented here are just for your information & personal use only. While much effort is made to provide the information, I ( Vishal Dalwadi ) or “FinBlab” do not guarantee the accuracy, correctness, completeness or reliability of any information or data displayed herein and shall not be held responsible.