Glottis IPO – Review

Glottis Limited, a leader in contract logistics and freight management services in India, is planning to raise ₹307 Crore through an IPO.

[Fresh Issue ₹160 Cr + OFS ₹147 Cr]

Glottis ipo price is ₹120 – ₹129 per share

Glottis: History

The Company was originally formed as a partnership firm under the name M/s Glottis, pursuant to a deed of partnership dated June 24, 2004.

The Company was then converted into a public limited company under a special resolution passed by the shareholders at an Extraordinary General Meeting held on February 16, 2024, and its name was changed to Glottis Limited under a fresh certificate of incorporation issued by the RoC on May 14, 2024.

LAST ARTICLE – pace digitek ipo review

Glottis: Business

Glottis Ltd. is a leading multi-modal, integrated logistics service provider with a focus on energy supply chain solutions.

The Company delivers end-to-end logistics (transport) solutions with multimodal capabilities across verticals to optimize the movement of goods across sectors, including –

- Ocean Freight Forwarding (full container load and project cargo load – import as well as export),

- Air Freight Forwarding (import as well as export),

- Road Transportation,

- Other Ancillary Services (including cargo handling, custom clearance, storage, warehousing, and third-party logistics (3PL) services, among others.

With a global footprint and expertise in handling complex supply chains, the company serves clients across multiple industries, with particular emphasis on (1) energy infrastructure and (2) renewable energy projects.

Over the years the company had built a track record of offering freight forwarding services to varied industries including engineering products, granite and minerals, home appliances, timber, and other industries including agro, automobile chemicals, textiles, machineries among others and have been increasing our share of wallet from existing clients by offering freight forwarding services for products forming part of their supply chain.

Network

- As of the date of this DRHP, the company operates pan-India through a network of 8 branch offices and a registered and corporate office in Chennai, India, to cover major transportation hubs.

- Over the years, the company has spread operations across countries, including Africa, Europe, North America, South America, the Middle East, and Asian countries through local freight forwarding agents.

Agent Network

As of March 31, 2024, the company had a network of one hundred and sixty (160) overseas agents, ninety (90) shipping lines & agencies, forty-one (41) transporters, thirty (30) customs house agents, twenty (20) airlines, eleven (11) consol agents, and container freight stations, among others.

ALSO READ – TruAlt Bioenergy IPO review

Strategies Ahead

- Increase market and revenue share by foraying into new revenue streams.

- Expand to provide end-to-end solutions to clients by becoming a total logistics provider.

- Increase global footprint and augment growth in current geographies.

- Capitalize on governmental reforms in the renewable energy industry to expand and increase business operations.

- Invest in infrastructure capabilities.

- Focus on enhancements in technology.

Company Promoters

- Ramkumar Senthilvel

- Kuttappan Manikandan

Refer to Glottis Limited DRHP for detailed information.

IPO Details

Glottis ipo date = 29 Sept to 01 Oct 2025

Minimum Amount = ₹14,706

Minimum Bid = 114 Shares

Face Value (FV) = ₹2

Listing On = NSE, BSE

Book Running Lead Manager

Pantomath Capital Advisors

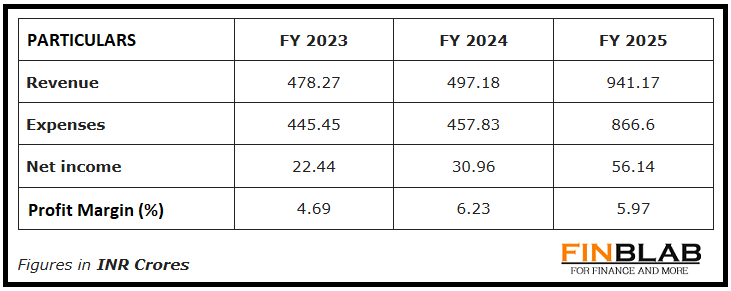

Financials

CONCLUSION

FinBlab recommends ‘SUBSCRIBE‘ ratings on Glottis Limited IPO (keeping a long-term view in mind)

Do come back to know more about “upcoming ipos“

Disclaimer: The contents and data presented here are just for your information & personal use only. While much effort is made to provide the information, I ( Vishal Dalwadi ) or “FinBlab” do not guarantee the accuracy, correctness, completeness or reliability of any information or data displayed herein and shall not be held responsible.