GNG Electronics IPO – Review

GNG Electronics Limited, a company specializing in the sale of high-quality refurbished laptops and desktops in India and abroad, plans to raise INR 460 Crore via an IPO.

[Fresh Issue 400 Cr + OFS 60 Cr]

Gng electronics ipo price is INR 225 – 237 per share

GNG Electronics: History

The Company was originally incorporated as GNG Electronics Private Limited under the provisions of the Companies Act, 1956,

The Company was converted into a public limited company under a special resolution passed in the Extraordinary General Meeting by the shareholders on October 23, 2024, and its name was changed to GNG Electronics Ltd under a fresh certificate of incorporation issued by the RoC on November 20, 2024.

GNG Electronics: Business

GNG Electronics is India’s largest refurbisher of desktops and laptops, and among the largest refurbishers of ICT Devices (both globally and in India) with significant presence across –

- India,

- Africa,

- USA,

- Europe, and

- UAE

The Company follows a repair-over-replacement approach, which provides cost advantages and helps achieve true sustainability by reducing the carbon footprint.

GNG Electronics operates under the brand “Electronics Bazaar”, with a presence across the full refurbishment value chain, from sourcing to refurbishment to sales, to after-sales services, and warranty provision.

LAST ARTICLE – Rossari Biotech Q1 Results

The Company meets customers’ requirements for affordable, reliable, and premium ICT Devices (such as laptops, desktops, tablets, servers, premium smartphones, mobile workstations, and accessories) that are as good as new devices, both functionally and aesthetically.

According to the 1Lattice Report, GNG is one of the few companies that pioneered the concept of warranty for the refurbished ICT Devices to provide comfort and trust to its clients, and is still offering industry-leading warranty terms.

Authorized Partner

- India’s largest Microsoft Authorized Refurbisher, in terms of refurbishing capability, as of FY 2024 (Source: 1Lattice Report)

- IT asset disposal partner for India’s second–largest software company, in terms of market capitalization as of CY 2024, procuring their used IT assets (Source: 1Lattice Report)

- Certified refurbishment partner with HP and Lenovo, which are the top two global brands, in terms of market share of 21% and 24%, respectively, as of CY 2023 (Source: 1Lattice Report).

Network

- The Company’s sales network includes its refurbished ICT Devices being sold in 35 countries (as of September 30, 2024).

- Its sales network comprises 3,265 touchpoints in India and globally (as of September 30, 2024).

- Multi-channel global procurement network of 447 suppliers supported by an extensive procurement network in India and across the globe.

- A Company with domestic and international operations, with 5 refurbishing facilities located across India, the USA, and the UAE.

Quality Standard

The Company’s facility in India adheres to internationally recognized quality management standards, including –

- ISO 9001:2015 for quality management,

- ISO 27001:2013 for information security,

- ISO 14001:2015 for environmental management, and

- ISO 45001:2018 for occupational health and safety.

Strategies Ahead

- Expand footprint and increase market presence in India and other countries to capitalize on the industry tailwinds.

- Enhancing procurement in India & other countries and strengthening brand relationships

- Focus on environmental, social, and governance (ESG) standards and expanding opportunities with OEMs

Company Promoters

- Sharad Khandelwal,

- Vidhi Sharad Khandelwal,

- Kay Kay Overseas Corporation,

- Amiable Electronics Private Limited

IPO Details

Gng electronics ipo date = 23 July to 25 July 2025

Minimum Amount = INR 14,931

Minimum Bid = 63 Shares

Face Value (FV) = INR 2

Listing On = NSE, BSE

Book Running Lead Manager

Motilal Oswal Investment Advisors Limited

IIFL Capital Services Limited

JM Financial Limited

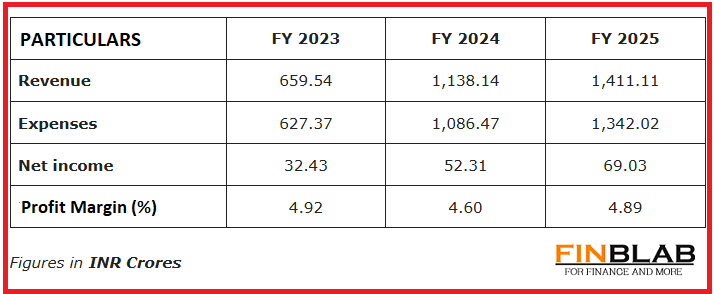

Financials

CONCLUSION

FinBlab recommends ‘SUBSCRIBE‘ ratings on GNG Electronics IPO

Disclaimer: The contents and data presented here are just for your information & personal use only. While much effort is made to provide the information, I ( Vishal Dalwadi ) or “FinBlab” do not guarantee the accuracy, correctness, completeness or reliability of any information or data displayed herein and shall not be held responsible.