HDB Financial Services IPO – Review, Update

Update:

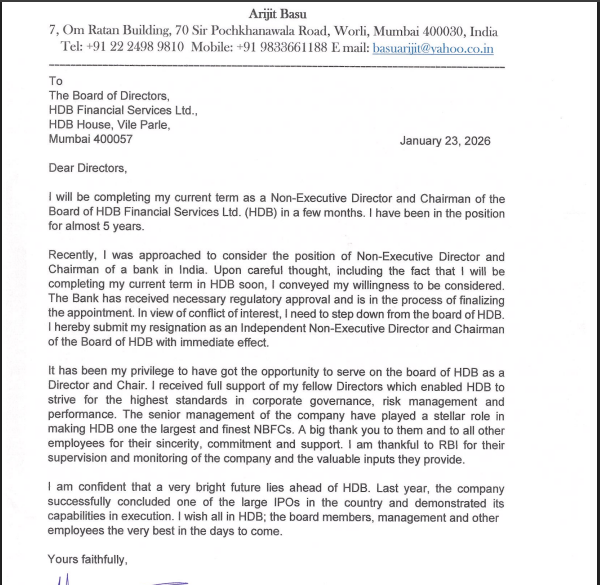

Resignation of Independent Director

HDB Financial Services Ltd (HDFC Bank’s subsidiary) on January 23, 2026, said that Mr. Arijit Basu (DIN: 06907779) has tendered his resignation as the Non-Executive Independent Director & Chairman of the Company with immediate effect, for reasons as mentioned in the resignation letter.

Refer to Hdb financial services latest news today for more details.

In the second half of the day, private lender IndusInd Bank Ltd said that its part-time Chairman and director Sunil Mehta will step down effective, January 30, 2026, post the completion of his tenure and Arijit Basu will take over as an Additional Director and part-time Chairman of the Bank for a period of three years, effective from January 31 this year, till January 30, 2029.

IndusInd Bank also stated that the appointment of Mr. Basu was approved by its board of directors, based on the nod from the Reserve Bank of India (RBI) and recommendations made by the Compensation and Nomination & Remuneration Committee.

Arijit Basu currently serves as the Chairman of HDB Financial Services. He was also the managing director (MD) of the State Bank of India (SBI), prior to which he served as the MD and CEO of SBI Life Insurance Company.

The Stock made an intraday high of ₹718 and a low of ₹694 before ending at ₹695.40 (down 2.60%) on the NSE.

LAST ARTICLE – Amagi Media Labs IPO Review

15 July 2025

Update

Q1 FY 2026 Results

HDB Financial Services Limited (HDBFS), a non-deposit taking non-banking finance company (NBFC) has presented its Q1 FY 2026 numbers today during market hours.

Asset Under Management (AUM) of the company was at INR 1,09,690 crore as on June 30, 2025 compared to INR 95,643 crore as on June 30, 2024, a growth of 14.7% Y-o-Y basis.

Net total income was at INR 2,726 crore as on June 30, 2025 compared to INR 2,387 crore as on June 30, 2024, a growth of 14.2% Y-o-Y basis.

Profit After Tax was INR 568 crore as on June 30, 2025 compared to INR 582 crore as on June 30, 2024, de-growth of 2.41%.

Branch count stood at 1,771, spread across 1,166 cities and towns in India.

The Company came up with an IPO in June 2025 and raised INR 12,500 crore via offering.

25 June, 2025

HDB Financial Services Limited, a leading Non-Banking Financial Company (NBFC) in India, is planning to raise INR 12,500 crore via IPO.

[Fresh Issue 2500 crore + OFS 10,000 crore]

Hdb financial services ipo price is INR 700 – 740 per share

HDB Financial Services: History

The Company was incorporated as HDB Financial Services Limited under the Companies Act, 1956 under a certificate of incorporation issued by the RoC, Gujarat, Dadra & Nagar Haveli in Ahmedabad on June 4, 2007.

The Reserve Bank of India (RBI) granted a certificate of registration on December 31, 2007, to the Company to carry on the business of a non-banking financial institution without accepting public deposits.

Also Read – Kalpataru IPO review

HDB Financial Services: Business

According to the CRISIL Report, HDB Financial Services Ltd is one of the leading, diversified retail-focused NBFCs in India in terms of Total Gross Loan book size.

The Company began its journey in 2007 as a subsidiary of HDFC Bank Limited (the largest private sector bank in India, in terms of total assets).

HDB Financial offers a large portfolio of lending products that cater to a growing and diverse client base through a wide omni-channel distribution network.

The Company’s lending products are offered through 3 business verticals –

- Enterprise Lending,

- Asset Finance, and

- Consumer Finance

The Company also offers business process outsourcing (BPO) services such as back-office support services, collection, and sales support services to the Promoter company as well as fee-based products such as the distribution of insurance products primarily to the lending clients.

Loan Book

The Company’s total Gross Loans stood at 986.2 billion as of September 30, 2024, reflecting a CAGR of 20.93 percent between March 31, 2022 to September 30, 2024.

Assets Under Management

Assets Under Management (AUM) of the Company stood at 902.3 billion as of March 31, 2024, reflecting a CAGR of 21.18 percent between Fiscal Year 2022 and Fiscal Year 2024.

Network

With a strong branch network of 1,771 branches across 1,170 towns and partnerships with over 1,40,000 retailers, HDB Financials serves 19.2 million clients, growing at a 25.45 percent CAGR.

Strategies Ahead

- Diversify and expand addressable client segments by widening and enhancing product offerings.

- Expand pan-India omnichannel distribution network

- Invest in technology, data analytics, and artificial intelligence to further improve client experience, increase organisational productivity, and decrease costs

- Diversify borrowing profile to optimise borrowing costs

- Strengthen and improve risk management framework as well as underwriting and collections capabilities to minimize the risk of credit losses

- Attract, upskill, and retain talented employees by strengthening organizational culture

Company Promoter

HDFC Bank Limited

IPO Details

IPO date = 25 June to 27 June 2025

Minimum Amount = INR 14,800

Minimum Bid = 20 Shares

Face Value (FV) = INR 10

Listing On = NSE, BSE

Book Running Lead Managers

BNP Paribas,

JM Financial Limited,

Bofa Securities India Limited,

Goldman Sachs (India) Securities Private Limited,

HSBC Securities & Capital Markets Pvt Ltd,

IIFL Capital Services Limited,

Jefferies India Private Limited,

Morgan Stanley India Company Pvt Ltd,

Motilal Oswal Investment Advisors Limited,

Nomura Financial Advisory & Securities (India) Pvt Ltd,

Nuvama Wealth Management Limited,

UBS Securities India Private Limited

Financials

Last Article – Sambhv Steel Tubes IPO review

CONCLUSION

FinBlab recommends ‘SUBSCRIBE‘ ratings on HDB Financial Service IPO (keeping a long-term view in mind)

Disclaimer: The contents and data presented here are just for your information & personal use only. While much effort is made to provide the information, I ( Vishal Dalwadi ) or “FinBlab” do not guarantee the accuracy, correctness, completeness or reliability of any information or data displayed herein and shall not be held responsible.