Ivalue Infosolutions IPO – Review

Ivalue Infosolutions Limited, one of the fastest-growing Strategic Technology Advisors in India, is planning to raise ₹560 Crore through an IPO.

[Fresh Issue NIL + OFS ₹560 Cr]

Ivalue infosolutions ipo price is ₹284 – ₹299 per share

Ivalue Infosolutions: History

The Company was originally incorporated as iValue Infosolutions Private Limited, a private limited company under the Companies Act, 1956, at Bengaluru, India, on April 9, 2008.

The Company was converted into a public limited company under a special resolution passed by the shareholders in the extraordinary general meeting held on June 12, 2024, and its name was changed to Ivalue Infosolutions Limited under a fresh certificate of incorporation issued by the RoC on July 8, 2024.

LAST ARTICLE – VMS TMT IPO Review

Ivalue Infosolutions: Business

Ivalue Infosolutions Ltd. is an enterprise technology solutions specialist, providing comprehensive, custom-designed solutions for protecting and managing data and digital applications.

The Company primarily serves large enterprises in their digital transformation journey by understanding their needs and working with System Integrators and OEMs to identify, recommend, and deploy solutions that meet their requirements, aimed at ensuring the scalability, performance, availability, and security of digital applications and data.

Over the past 16 years, the company has built expertise in the dynamic, knowledge-based technology solutions and services sector, adapting to an ever-evolving landscape that demands expertise and close collaboration with multiple stakeholders, including System Integrators, OEMs, and end-customers.

- Transactions: In FY 2022, 2023, and 2024, the company enabled 3,841, 4,410, and 4,758 transactions, respectively, with average transaction size of 3.38 million, 4.11 million, and 4.44 million, respectively.

- OEM Partners: The Company’s network of OEM partners has grown from 84 as of March 31, 2022, to 93 as of March 31, 2023, and subsequently to 101 as of March 31, 2024.

- System Integrators: In the same period, the number of System Integrators of the company grew from 528 in FY 2022 to 567 in FY 2023, and subsequently to 648 in FY 2024.

- Enterprise Customers: The number of enterprise customers served by the company grew from 1,619 in FY 2022 to 1,804 in FY 2023 to 2,014 in FY 2024.

Industry Presence

- The Company has offices across 8 locations in India, including the Corporate and Registered Office in Bangalore, India.

- It is also present in six international locations: Bangladesh, Cambodia, Kenya, Singapore, Sri Lanka, and the UAE.

ALSO READ – Euro Pratik Sales IPO Review

Strategies Ahead

- Capitalize on the growth in the enterprise technology solutions market in India and the SAARC region.

- Expand OEM, System Integrator, and end-customer portfolio,

- Leverage existing client relationships to generate cross-sell and up-sell opportunities.

- Growing ALM offerings,

- Growing hybrid cloud offerings,

Company Promoters

- Sunil Kumar Pillai,

- Krishna Raj Sharma,

- Srinivasan Sriram.

Refer to iValue Infosolutions DRHP for detailed information.

IPO Details

Ivalue infosolutions ipo date = 18 to 20 September 2025

Minimum Amount = ₹14,950

Minimum Bid = 50 Shares

Face Value (FV) = ₹2

Listing On = NSE, BSE

Book Running Lead Manager

IIFL Securities

Motilal Oswal Investment Advisors

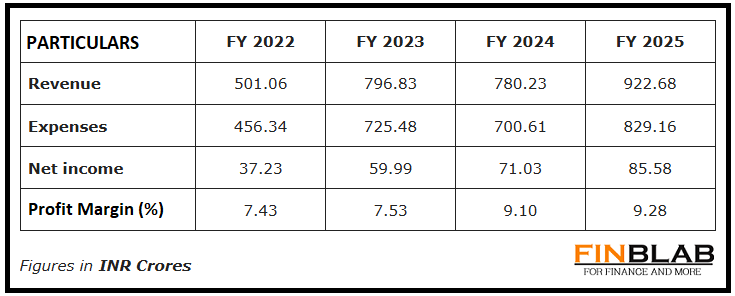

Financials

CONCLUSION

FinBlab recommends ‘SUBSCRIBE‘ ratings on Ivalue infosolutions IPO (keeping a long-term view in mind)

Do come back to know more about “upcoming ipos“

Disclaimer: The contents and data presented here are just for your information & personal use only. While much effort is made to provide the information, I ( Vishal Dalwadi ) or “FinBlab” do not guarantee the accuracy, correctness, completeness or reliability of any information or data displayed herein and shall not be held responsible.