Jinkushal Industries IPO – Review

Jinkushal Industries Limited, the largest exporter of non-OEM construction machinery and a trusted provider of mining services & logistics solutions in India, is planning to raise ₹116 Crore through an IPO.

[Fresh Issue ₹104 Cr + OFS ₹12 Cr]

Jinkushal industries ipo price is ₹115 – ₹121 per share

Jinkushal Industries: History

The Company was originally incorporated as Zenith Tie-Up Private Limited, a private limited company under the Companies Act, 1956, on November 27, 2007.

The Company was converted into a public limited company under a special resolution passed by the shareholders in the extraordinary general meeting held on September 25, 2024, and its name was changed to Jinkushal Industries Limited under a fresh certificate of incorporation issued by the RoC on October 30, 2024.

LAST ARTICLE – Jain resource recycling ipo review

Jinkushal Industries: Business

Jinkushal Industries Ltd. (JKIPL) is engaged in the export trading of new (customized) and used (refurbished) construction machines in global markets.

The Company specializes in the export trading of construction machines, including asphalt pavers, backhoe loaders, bulldozers, cranes, hydraulic excavators, motor graders, soil compactors, and wheel loaders.

The Company primarily operates across three business verticals –

- Export trading of customized, modified, and accessorized new construction machines,

- Export trading of used (refurbished) construction machines, and

- Export trading of the own brand ‘HexL’ construction machines.

In addition to the afore-listed business verticals, the company also derives a small portion of revenue from (1) renting of construction machines, (2) logistics warehouses leasing, and (3) Merchant Trade Transactions (MTT).

According to the Care Edge Report, JKIPL is the largest non-OEM construction machine exporter, holding a 6.9% market share.

The Company is recognized as a Three-Star Export House by the Directorate General of Foreign Trade (DGFT), Government of India (GoI).

As of the date of this Red Herring Prospectus, the company has successfully supplied over 1,500 construction machines, comprising 900 new and more than 600 used (refurbished) machines.

Export Business

As of the date of this Red Herring Prospectus (RHP), the company has exported over 1,500 construction machines to more than 30 countries, including Australia, Mexico, the Netherlands, South Africa, the UAE, and the UK.

Employee Strength

With 21 interns and 90 permanent employees, the company continues to strengthen its global footprint and operational efficiency.

ALRO READ – New GST Rates

Strategies Ahead

- Further Integration and Diversification

- Sales Volume Growth

- Efficiency Enhancement and Cost Optimization

- Expansion of Product portfolio

- Create and strengthen our brand recognition.

- Working Capital Optimization

Company Promoters

- Anil Kumar Jain,

- Abhinav Jain,

- Sandhya Jain,

- Tithi Jain,

- Yashasvi Jain.

IPO Details

IPO date = 25 to 29 September 2025

Minimum Amount = ₹14,520

Minimum Bid = 120 Shares

Face Value (FV) = ₹10

Listing On = NSE, BSE

Book Running Lead Manager

GYR Capital Advisors

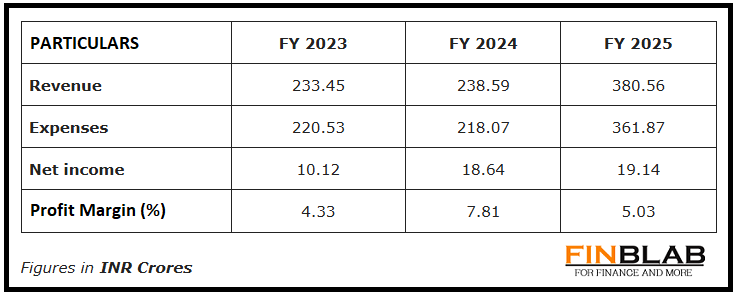

Financials

CONCLUSION

FinBlab recommends ‘SUBSCRIBE‘ ratings on Jinkushal Industries IPO (keeping a long-term view in mind)

Do come back to know more about “upcoming ipos“

Disclaimer: The contents and data presented here are just for your information & personal use only. While much effort is made to provide the information, I ( Vishal Dalwadi ) or “FinBlab” do not guarantee the accuracy, correctness, completeness or reliability of any information or data displayed herein and shall not be held responsible.