JSW Cement IPO – Review

JSW Cement Limited, a leading green cement manufacturer company in India, is planning to raise ₹ 3600 crores through an IPO.

[Fresh Issue 1600 Cr + OFS 2000 Cr]

Jsw cement ipo price is INR 139 – 147 per share

JSW Cement: History

The Company was incorporated as a public limited company under the Companies Act, 1956, under a certificate of incorporation issued by the Registrar of Companies (Maharashtra, Mumbai, India) on March 29, 2006.

JSW Cement: Business

According to the CRISIL Report, JSW Cement Ltd is the fastest-growing cement manufacturing company in India (in terms of increase in installed grinding capacity and sales volume from FY 2014 to FY 2024).

As of March 31, 2024, the Company had installed a Grinding Capacity of 20.60 MMTPA, consisting of 11.00 MMTPA in the southern regions, 4.50 MMTPA in the western areas, and 5.10 MMTPA in the eastern regions of India.

According to the CRISIL Report, JSW Cement is India’s largest manufacturer of Ground Granulated Blast Furnace Slag (GGBS), with a market share in terms of GGBS sales of 82.70% in FY 2024.

Product Portfolio

JSW Cement’s product portfolio includes blended cement products, such as –

- Portland Slag Cement (PSC),

- Portland Composite Cement (PCC),

- Ground Granulated Blast Furnace Slag (GGBS),

- Ordinary Portland Cement (OPC),

- Allied Cementitious Products (ready-mix concrete – RMC),

- Clinker,

- Screened Slag,

- Construction Chemicals, and

- Waterproofing Compounds

Manufacturing Plants

As of March 31, 2024, JSW Cements operated seven plants in India, which comprise one integrated unit, one clinker unit, and five grinding units.

Strategies Ahead

- Create a pan-India footprint by setting up new plants in north and central India, supplemented by expansions in current regions of operation.

- Continue to deepen presence in existing markets and grow market share

- Continue to improve operational efficiency and implement cost reduction measures

- Continue to focus on sustainable development

Company Promoters

- Sajjan Jindal,

- Parth Jindal,

- Sangita Jindal,

- Adarsh Advisory Services Private Ltd,

- Sajjan Jindal Family Trust

Refer to JSW Cement IPO DRHP for detailed information.

IPO Details

IPO date = 07 August to 11 August 2025

Minimum Amount = INR 14,994

Minimum Bid = 102 Shares

Face Value (FV) = INR 10

Listing On = NSE, BSE

Book Running Lead Manager

JM Financial Limited

Axis Capital Limited

Citigroup Global Markets India Pvt Ltd

DAM Capital Advisors Limited

Goldman Sachs (India) Securities Pvt Ltd

Jefferies India Private Limited

Kotak Mahindra Capital Company Limited

SBI Capital Markets Limited

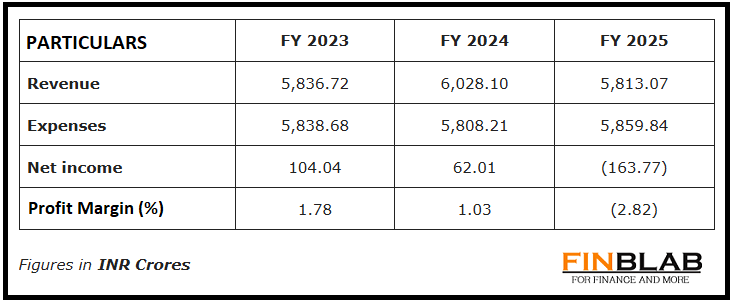

Financials

LAST ARTICLE – Highway infrastructure ipo review

CONCLUSION

FinBlab recommends ‘MAY SUBSCRIBE‘ ratings JSW Cement IPO

Disclaimer: The contents and data presented here are just for your information & personal use only. While much effort is made to provide the information, I ( Vishal Dalwadi ) or “FinBlab” do not guarantee the accuracy, correctness, completeness or reliability of any information or data displayed herein and shall not be held responsible.