Laxmi India Finance IPO – Review

Laxmi India Finance Limited, a non-deposit-taking non-banking financial company (NBFC) in India, is planning to raise INR 254 Crore via an IPO.

[Fresh Issue 165 Cr + OFS 89 Cr]

Laxmi india finance ipo price is INR 150 – 158 per share

Laxmi India Finance: History

The Company was incorporated as Laxmi India Finleasecap Private Limited in New Delhi under the Companies Act, 1956,

The Company was converted into a public limited company and its name was changed to Laxmi India Finance Ltd under a fresh certificate of incorporation issued by the RoC on October 8, 2024.

Laxmi India Finance: Business

Laxmi India Finance is a tech-driven NBFC focused on serving the financial needs of underserved clients in India’s lending market.

The Company’s product portfolio includes (1) construction loans, (2) MSME loans, (3) vehicle loans, and other lending products (business and personal loans) catering to the diverse financial needs of its customers.

As of March 31, 2025, the company’s assets under management (AUM) stood at INR 1,277 Crore, with the MSME and vehicle loan segments contributing 76.34 percent and 16.12 percent, respectively.

Branch Network

As of March 31, 2025, the company operates with 158 branches in the states of Gujarat, Madhya Pradesh, Rajasthan, and Chhattisgarh.

Collections Team

As of September 30, 2024, Laxmi Finance has a dedicated collections team of 255 personnel who track repayment schedules, payments, and loan defaults, ensure timely collections, and review client accounts to maintain a healthy financial position.

LAST ARTICLE – Shanti Gold International IPO review

Strategies Ahead

- Expanding geographical footprint to deepen penetration in the target customer segment

- Leveraging existing branch and customer network to drive growth in other verticals

- Continuing to enhance information technology with a focus on customer service, operational efficiency, and cost optimization

- Diversify borrowing profile and optimize borrowing costs

Company Promoters

- Deepak Baid,

- Prem Devi Baid,

- Aneesha Baid,

- Hirak Vinimay Private Limited,

- Deepak Hitech Motors Private Limited,

- Prem Dealers Private Limited,

- Vivan Baid Family Trust

IPO Details

IPO date = 29 July to 31 July 2025

Minimum Amount = INR 14,852

Minimum Bid = 94 Shares

Face Value (FV) = INR 5

Listing On = NSE, BSE

Book Running Lead Manager

PL Capital Markets Private Limited

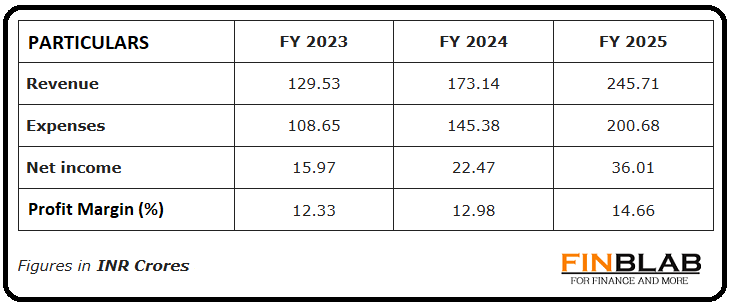

Financials

CONCLUSION

FinBlab recommends ‘May SUBSCRIBE‘ ratings Laxmi India Finance IPO

Disclaimer: The contents and data presented here are just for your information & personal use only. While much effort is made to provide the information, I ( Vishal Dalwadi ) or “FinBlab” do not guarantee the accuracy, correctness, completeness or reliability of any information or data displayed herein and shall not be held responsible.