Lenskart Solutions IPO – Review

Lenskart Solutions Limited, a technology-driven eyewear company in India, plans to raise ₹7,278 crore through an IPO.

[Fresh Issue ₹2,150 Cr + OFS ₹5,128 Cr]

Lenskart solutions ipo price is ₹382 – ₹402 per share

Lenskart Solutions: History

The Company was originally incorporated as Valyoo Technologies Private Limited, a private limited company under the Companies Act, 1956, on May 19, 2008.

The Company was then converted into a public limited company under a special resolution passed by the shareholders on May 30, 2025, and its name was changed to Lenskart Solutions Limited under a fresh certificate of incorporation issued by the RoC on June 16, 2025.

LAST ARTICLE – Studds Accessories IPO Review

Lenskart Solutions: Business

Lenskart Solutions Ltd. is a technology-driven eyewear company in India with integrated operations spanning designing, manufacturing, branding, and retailing of eyewear products.

The Company primarily sells prescription,

- Sunglasses,

- Eyeglasses,

- Other Products (eyewear accessories and contact lenses)

The Company offers products across a wide range of price points and age categories, catering to the requirements of an entire household.

By leveraging the latest technology, strong supply chain integration, and data-driven consumer engagement, Lenskart continues to dominate its market leadership and grow its global footprint in the eyewear industry.

According to the Redseer Report, Lenskart is the largest seller of prescription eyeglasses in terms of volumes sold in India in FY 2025.

Manufacturing Facilities

The company owns and operates eyeglasses manufacturing facilities at two locations in India: (1) Bhiwadi, Rajasthan, and (2) Gurugram, Haryana, supplemented by regional facilities in the United Arab Emirates and Singapore.

Network

As of March 31, 2025, the company operated 2,723 stores worldwide, comprising 2,067 stores in India and 656 stores in international markets (like Japan, the Middle East, and Southeast Asia).

Award

In FY 2025, the company was awarded “India’s Most Trusted Eyewear Brand of 2025” by TRA Research.

ALSO READ – Orkla India IPO Review

Strategies Ahead

- Enhance market penetration and broaden customer reach across multiple channels.

- Strengthen manufacturing and supply chain capabilities.

- Continue to innovate and expand the product portfolio.

- Invest in new technologies.

- Enhance customer experience

- Strengthen brand across markets.

Company Promoters

- Peyush Bansal

- Neha Bansal

- Amit Chaudhary

- Sumeet Kapahi

Refer to Lenskart solutions Limited DRHP for detailed information.

IPO Details

Lenskart solutions ipo date = 31 Oct – 04 Nov 2025

Minimum Amount = ₹14,874

Minimum Bid = 37 Shares

Face Value (FV) = ₹2

Listing On = NSE, BSE

Book Running Lead Managers

Kotak Mahindra Capital

Morgan Stanley India

Avendus Capital

Citigroup Global Markets

Axis Capital

Intensive Fiscal Services

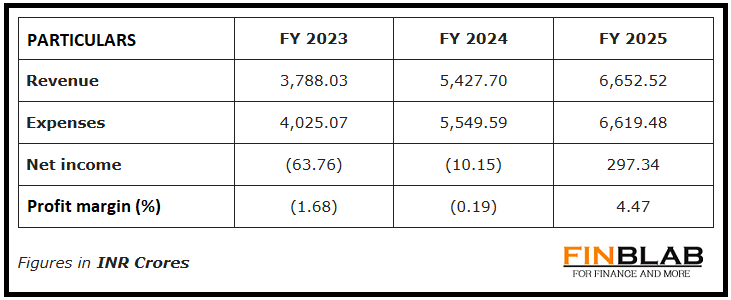

Financial

CONCLUSION

FinBlab recommends ‘NEUTRAL‘ ratings (for the time being) on Lenskart Solutions IPO

Do come back to know more about “upcoming ipos“

Disclaimer: The contents and data presented here are just for your information & personal use only. While much effort is made to provide the information, I (Vishal Dalwadi) or “FinBlab” do not guarantee the accuracy, correctness, completeness or reliability of any information or data displayed herein and shall not be held responsible.