Pace Digitek IPO – Review, Update

Pace Digitek Update

“Secures Order from RIL”

Pace Digitek Limited, a company that provides solutions for telecom infra and solar industries, today, in its exchange filing, said that

Lineage Power Pvt Ltd, the material subsidiary of the company (Pace Digitek Ltd), has secured a major order from Reliance Industries Limited (RIL) for the supply of high-capacity lithium-ion battery packs. Source – BSE

Order Details

The management stated that, under the agreement, Lineage Power will manufacture and supply 50,000 units of 48V 15S1P 314AH Lithium-Ion battery packs.

These industrial-grade power systems are specifically designed for backup support for telecom loads.

LAST CONTENT – Omnitech Engineering IPO Review

Order Size

The total value of the purchase order is ₹158.71 crore (One hundred fifty-eight crore seventy-one lakh rupees only) (inclusive of GST).

Duration

The delivery of the newly received order is expected to be completed by August 31, 2026, the company spokesperson added.

ALSO READ – PNGS Reva Diamond Jewellery IPO Review

Total Order Book

With this order, the consolidated order book of Pace Digitek Limited stands at ₹10,490 Cr, comprising Telecom, ICT infrastructure, and Energy segments.

Management Speech –

Commenting on the development, Chairman & MD, Mr. Venugopal Rao Maddisetty said,

This order from Reliance Industries Limited reinforces our position as a trusted provider of critical energy infrastructure in India and supports our strategy of increasing product-led revenues alongside EPC and annuity-linked infrastructure projects.

As large-scale deployments gain momentum, we remain focused on disciplined execution, maintaining high-quality standards, and scaling manufacturing capacity in line with order visibility.

Refer to Pace digitek news today for further details.

- The company’s market capitalization is ₹3,935 Cr.

- The stock is currently trading above its 20-day Simple Moving Average (SMA).

Also Read –

Clean Max Enviro Energy IPO Review

27 September 2025

Pace Digitek Limited, a multi-disciplinary solutions provider for the telecom passive infrastructure industry in India, is planning to raise ₹819 Crore through an IPO.

[Fresh Issue ₹819 Cr + OFS NIL]

Pace digitek ipo price is ₹208 – ₹219 per share

Pace Digitek: History

The Company was originally incorporated as Pace Power Systems Private Limited, a private limited company under the Companies Act, 1956, at Bengaluru, India, on March 1, 2007.

The Company was then converted into a public limited company under a special resolution passed by the shareholders on October 16, 2024, and its name was changed to Pace Digitek Limited under a fresh certificate of incorporation issued by the RoC on November 19, 2024.

LAST ARTICLE – TruAlt Bioenergy IPO review

Pace Digitek: Business

Pace Digitek Ltd. is an experienced, multidisciplinary solutions provider with a strong presence in –

- Telecom Passive Infrastructure (Passive Infra) sector,

- ICT Services (Information and Communications Technology), and

- Energy Solutions.

The Company has commenced operations as a passive electrical equipment product manufacturer and, over the years, has expanded its scope to include passive infrastructure operations, products, projects, operations & maintenance (O&M), and integrated solutions.

The Company has also forayed (through its subsidiary company – Lineage), into manufacturing battery energy storage systems (BESS), which are systems that utilize batteries to capture, store, and distribute electrical energy.

It also undertakes turnkey projects for the renewable energy sector (through a subsidiary company – Pace Renewable Energies Private Limited).

Manufacturing Facilities

The company operates three manufacturing facilities in Bengaluru, Karnataka, India – Collectively, these facilities span 200,000 sq. ft.

Order Book

As of September 30, 2024, the Company maintains a robust order book of ₹6,342 crore, with 100% public sector contracts.

ALSO READ – Jinkushal Industries IPO Review

Employee Strength

As of February 28, 2025, the company had 1,296 permanent employees, out of which 18 were part of the core research and development (R&D) team.

Strategies Ahead

- Foray into manufacturing battery energy storage system (BESS)

- Deepen existing products and services offerings.

- Expand geographical reach

Company Promoters

- Maddisetty Venugopal Rao,

- Padma Venugopal Maddisetty,

- Rajiv Maddisetty,

- Lahari Maddisetty

Refer to Pace Digitek DRHP for detailed information.

IPO Details

Pace Digitek IPO date = 26 to 30 September 2025

Minimum Amount = ₹14,892

Minimum Bid = 68 Shares

Face Value (FV) = ₹2

Listing On = NSE, BSE

Book Running Lead Manager

Unistone Capital

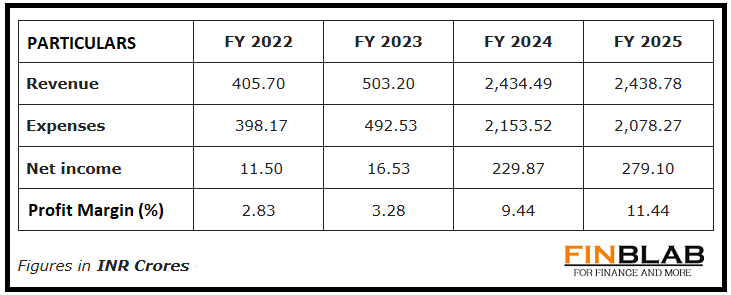

Financials

CONCLUSION

FinBlab recommends ‘SUBSCRIBE‘ ratings on Pace Digitek IPO (keeping a long-term view in mind)

Do come back to know more about “upcoming ipos“

Disclaimer: The contents and data presented here are just for your information & personal use only. While much effort is made to provide the information, I ( Vishal Dalwadi ) or “FinBlab” do not guarantee the accuracy, correctness, completeness or reliability of any information or data displayed herein and shall not be held responsible.