Shanti Gold International IPO – Review

Shanti Gold International Limited, the most prominent B2B CZ Gold Jewellery company in India, plans to raise INR 360 Crore via an IPO.

[Fresh Issue 360 Cr + OFS NIL]

Shanti gold ipo price is INR 189 – 199 per share

Shanti Gold International: History

The Company was originally formed as a partnership firm in the name and style of M/s Shanti Gold, as per a partnership deed dated August 05, 2003.

By the provisions of the Companies Act, 1956, the partnership firm was converted to a public limited company under the name of Shanti Gold International Ltd, and a fresh certificate of incorporation was issued by the RoC on November 01, 2013.

Shanti Gold International: Business

Shanti Gold International is one of the leading manufacturers of high-quality 22kt CZ casting gold jewellery in India (in terms of installed production capacity, specializing in the design and production of all types of gold jewellery.

The Company offers a wide range of high-quality, intricately designed pieces of bangles, necklaces, rings, and complete jewellery sets across various price points, ranging from jewellery for special occasions, such as –

- weddings,

- festive,

- daily-wear jewellery.

Manufacturing Facility

Shanti Gold International has a fully integrated in-house manufacturing setup, which enables the company to exercise control over the quality of products and meet the standards expected by its clients.

The Company’s manufacturing facility spans over 13,448.86 square feet in Andheri East (Mumbai, India), equipped to produce a variety of jewellery with precision and efficiency.

As of the date of this DRHP, the Company has an installed manufacturing capacity of 2,700 kg per annum.

Client Network

As of the date of filling this DRHP, Shanti Gold has a client network spaning across 13 states and one union territory in India, as well as four countries abroad.

The Company has a long-standing relationship with several jewellery businesses, including corporate jewellery brands such as –

- Joyalukkas India Limited,

- Lalithaa Jewellery Mart Limited,

- Alukkas Enterprises Private Limited,

- Vysyaraju Jewellers Private Limited,

- Shree Kalptaru Jewellers (I) Private Limited

Workforce

As of November 15, 2024, we had a team of 80 CAD designers on our payroll, who regularly develop over 400 designs per month.

Strategies Ahead

- Capturing market opportunities in the growing jewellery industry

- Geographical expansion in North India

- Penetrate new clients within the existing export countries

- Augmenting working capital for scalable business operations

Company Promoters

- Pankajkumar H Jagawat,

- Manojkumar N Jain,

- Shashank Bhawarlal Jagawat.

Last Article – Brigade Hotel Ventures IPO review

IPO Details

IPO date = 25 July to 29 July 2025

Minimum Amount = INR 14,925

Minimum Bid = 75 Shares

Face Value (FV) = INR 10

Listing On = NSE, BSE

Book Running Lead Manager

Choice Capital Advisors Private Limited

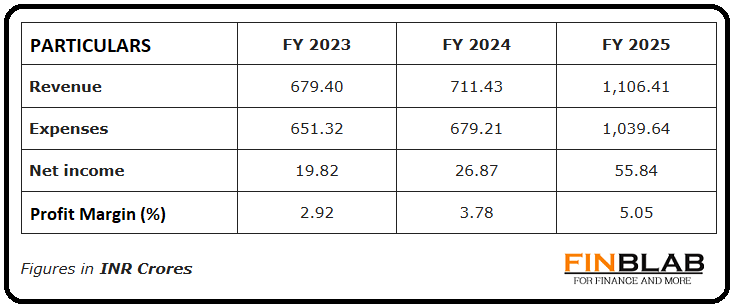

Financial

CONCLUSION

FinBlab recommends ‘SUBSCRIBE‘ ratings Shanti Gold IPO

Disclaimer: The contents and data presented here are just for your information & personal use only. While much effort is made to provide the information, I ( Vishal Dalwadi ) or “FinBlab” do not guarantee the accuracy, correctness, completeness or reliability of any information or data displayed herein and shall not be held responsible.