Shreeji Shipping Global IPO – Review, Update

Update

Shreeji Shipping Global Ltd – Listing

Shreeji Shipping Global Limited (NSE: SHREEJISPG) made its debut today at ₹270, a premium of nearly 8% over the IPO price of ₹252 a piece. While the opening on the Bombay Stock Exchange (BSE) was at ₹270.85

The market capitalisation of the stock stands at around ₹4,148 Crore.

The stock erode its early gain in the afternoon session and fell more than 6% to close at ₹254.60 per share, marking only 1.25% rise from the IPO price.

LAST ARTICLE – Anlon healthcare ipo review

15 August 2025

Shreeji Shipping Global Limited, the flagship company of Jamnagar-based “Shreeji Group”, is planning to raise ₹411 Crore via an IPO.

[Fresh Issue ₹411 Cr + OFS NIL]

Shreeji shipping ipo price is ₹240 – ₹252 per share

Shreeji Shipping Global – History

The Company was constituted as a partnership firm under the name of M/s Shreeji Shipping through a deed of partnership dated June 14, 1995.

The Company was converted into a public limited company under a special resolution passed in the extraordinary general meeting by the shareholders on October 17, 2024, and its name was changed to Shreeji Shipping Global Limited under a fresh certificate of incorporation issued by the RoC on November 18, 2024.

LAST ARTICLE – Regaal resources ipo review

Shreeji Shipping Global – Business

Shreeji Shipping Global Ltd provides logistics and shipping solutions for dry bulk cargo at various Jetties and Ports in India and Sri Lanka.

As of September 30, 2024, the company has provided services at more than twenty ports and jetties, including major Indian ports at Kandla, non-major ports at Bhavnagar, Bedi, Magdalla, Navlakhi, and Dharmatar and overseas port at Puttalam Port (Sri Lanka). (Source: Dun & Bradstreet Report)

The Company has a legacy of more than 25 years in the logistics and shipping industry with prominent experience in –

- Cargo Handling,

- Transportation,

- Fleet Chartering,

- Equipment Rentals, and

- Other Ancillary Services

As of September 30, 2024, the company has fleet of more than 75 vessels (consisting of barges, floating cranes, mini bulk carriers & tug boats) and more than 380 earth-moving equipment (consisting of excavators, material handling machines, pay loaders, tippers including tankers, trailers, and other vehicles) in services of its clients.

The Company primarily caters to clients in the sectors including –

- Coal,

- Energy and Power,

- Fast-Moving Consumer Goods (FMCG),

- Oil & Gas,

- Metal Industry

Major Clients

Reliance Industries Limited, Adani Enterprise Limited, Ultratech Cement Limited, ArcelorMittal Nippon Steel India Limited, Sanghi Industries Limited, Torrent Power Limited, Saurashtra Cement Limited, Shree Digvijay Cement Company Limited, and Tata International Limited.

Strategies Ahead

- Continued focus on cost optimization and improving operational efficiency

- Continue to invest in fleet and earth-moving equipment

- Focus on expansion of business operations from land to port to capitalize on industry opportunities

- Acquire new customers and expand into new sectors

Company Promoters

- Ashok Kumar Haridas Lal

- Jitendra Haridas Lal

Refer to Shreeji Shipping IPO DRHP for detailed information.

IPO Details

ipo date = 19 to 21 August 2025

Minimum Amount = INR 14,616

Minimum Bid = 58 Shares

Face Value (FV) = INR 10

Listing On = NSE, BSE

Book Running Lead Manager

Beeline Capital Advisors

Elara Capital (India)

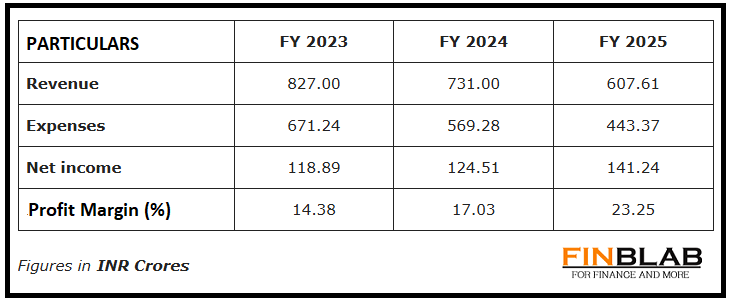

Financials

CONCLUSION

FinBlab recommends ‘SUBSCRIBE‘ ratings on Shreeji Shipping IPO

Disclaimer: The contents and data presented here are just for your information & personal use only. While much effort is made to provide the information, I ( Vishal Dalwadi ) or “FinBlab” do not guarantee the accuracy, correctness, completeness or reliability of any information or data displayed herein and shall not be held responsible.