Tenneco Clean Air India Update

Q3 FY26 Numbers, CAPEX Plan, and more

Tenneco Clean Air India Limited, a global leader in designing and manufacturing clean air and powertrain products for automotive applications, today announced its financial results for the quarter ended on December 31, 2025. Source – BSE

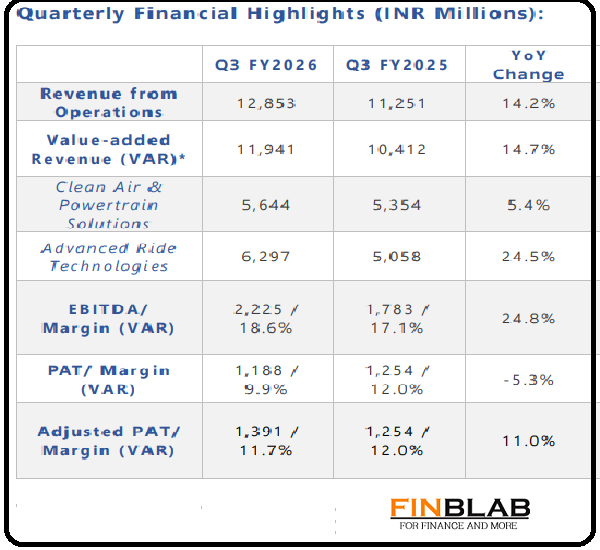

The Company delivers strong growth, with value-added revenue up 14.7% and EBITDA growing at 24.8% on a Year-over-Year basis.

Business Highlights: Q3 FY26

Q3 FY2026 was marked by a strategic technology leadership milestone:

- The DaVinci DCx advanced suspension system, developed by a leading Indian OEM, has been selected for a new-generation flagship SUV platform, recognized for its performance by India’s leading automotive reviewers.

- In addition to the DaVinci program, the company secured a high-value strategic Clean Air program with a leading global commercial vehicle OEM, with annual revenue potential of ₹115 crores.

Established A New Greenfield Plant

Tenneco Clean Air India plans to establish a new greenfield Clean Air plant in Haryana, India, strategically engancing proximity to key clients and supporting expansion across Light Vehicle, Tractor, and Off-Highway segments.

The project involves an investment of ₹71 crores, with production targeted to commence in Q3 FY27.

Refer to Tenneco Clean Air news for detailed information.

Management Remarks

Arvind Chandra, Whole-Time Director and CEO of the company, said –

The quarter demonstrated sustained execution across our business. We delivered strong business growth, resilient margins, and meaningful progress across Clean Air, Powertrain, and Advanced Ride Technologies.

The DaVinci DCx suspension system is our promise to India – bringing global suspension technology specifically tuned for Indian road conditions to provide superior comfort to drivers and passengers.

Our Clean Air strategic program won at a leading Commercial Truck OEM, demonstrated our ability to translate the voice of the client into high velocity execution, enabled by resident engineering support and a disciplined focus on first-time-right validation.

Supporting the company’s growth trajectory, the Board has approved the develop of a greenfield plant in North India to strengthen proximity to our northern client base.

In Exports, our order book remains very strong. Recent tariff and duty reductions announced by the U.S. and EU are expected to strengthen these tailwinds and accelerate export growth.

Notably, our current order book already covers 100 percent of projected FY2028 revenue, underpinning a double-digit CAGR growth over the next three years.

Currently the stock is trading above its 20-days and 50-days SMA.

LAST ARTICLE – Prostarm info systems news today

11 November 2025

Tenneco Clean Air Limited, a global automotive parts manufacturer specializing in clean air and ride performance products, plans to raise ₹3,600 crore through an IPO.

[Fresh Issue NIL + OFS ₹3,600 Cr]

Tenneco clean air ipo price is ₹378 – ₹397 per share

Tenneco Clean Air: History

The Company was originally incorporated as Tenneco Clean Air India Private Limited, a private limited company under the Companies Act, 2013, at Chennai, Tamil Nadu, India, on December 21, 2018.

The Company was then converted into a public limited company under a special resolution passed by the shareholders on February 21, 2025, and its name was changed to Tenneco Clean Air Limited under a fresh certificate of incorporation issued by the RoC on May 16, 2025.

LAST ARTICLE – Emmvee photovoltaic ipo review

Tenneco Clean Air: Business

Tenneco Clean Air Ltd., is a part of the Tenneco Group (headquartered in the USA), is a key global Tier I automotive component supplier.

The Company manufactures and supplies critical, highly engineered, and technology-intensive clean air, powertrain, and suspension solutions tailored for Indian OEMs and export markets.

The Company operates in two business divisions: (1) Clean Air & Powertrain Solutions and (2) Advanced Ride Technologies.

- In Clean Air Solutions, Tenneco designs, manufactures, and sells exhaust after-treatment systems, such as catalytic converters, exhaust pipes, and mufflers to OEMs,

- In Powertrain Solutions, Tenneco designs, manufactures, and sells engine bearings, sealing systems, and ignition products (such as ignition coils and spark plugs) to OEMs and the aftermarket under the Champion brand.

- In the Advanced Ride Technologies division, the company designs, manufactures, and sells shock absorbers, struts, and advanced suspension systems under the Monroe brand to OEMs and the aftermarket. These products are used for both internal combustion engine (ICE) vehicles and electric vehicles (EVs).

Market Share

- The Company is the largest supplier of Clean Air Solutions to Indian CT OEMs, with a market share of 60 percent.

- It is among the top two suppliers of Clean Air Solutions to Indian OH OEMs (excluding tractors) with a market share of 42 percent.

- It is among the top four suppliers of Clean Air Solutions to Indian PV OEMs, with a market share of 20 percent, and

- It is the largest supplier of shock absorbers and struts to Indian PV OEMs, with a market share of 48 percent.

Manufacturing Facilities

As of March 31, 2025, Tenneco has 12 manufacturing facilities, comprising 7 Clean Air & Powertrain Solutions facilities and 5 Advanced Ride Technology facilities, across 7 states and 1 union territory (UT) in India.

Client List

The Company’s client list includes well-known names such as Ashok Leyland, Bajaj Auto, Cummins, Daimler India Commercial Vehicle, Honda Motorcycle, Hyundai Motor, Kirloskar Oil Engines, Mahindra & Mahindra, Maruti Suzuki, Renault Nissan Automotive, Royal Enfield, Skoda Auto, Tata Motors, Toyota Kirloskar Motor, and VE Commercial Vehicles Limited.

ALSO READ – PhysicsWallah ipo review

Strategies Ahead

- Capturing market opportunities driven by tightening emission standards

- Capitalizing on trends toward premiumization, EVs, Hybrids, and SUVs,

- Enhancing competitiveness through the “Make in India” initiative

- Positioning operations in India as an export hub with global manufacturing standards

- Focus on R&D and innovation.

- Leverage efficiencies and cross-selling across two divisions to drive the overall growth profile

- Focus on operational efficiencies to ensure sustained improvement in cash generation and profit.

Company Promoters

- Tenneco Mauritius Holdings Limited,

- Tenneco (Mauritius) Limited,

- Federal-Mogul Investments B.V.,

- Federal-Mogul Pty Ltd,

- Tenneco LLC.

Refer to Tenneco Clean Air DRHP for detailed Information.

IPO Details

IPO date: 12 – 14 Nov 2025

Minimum Amount: ₹14,689

Minimum Bid: 37 Shares

Face Value (FV): ₹10

Listing On = NSE, BSE

Book Running Lead Managers

JM Financial

Citigroup Global

Axis Capital

HSBC Securities and Capital

Financial

CONCLUSION

FinBlab recommends ‘SUBSCRIBE‘ ratings on Tenneco Clean Air IPO

Do come back to know more about “upcoming ipos“

Disclaimer: The contents and data presented here are just for your information & personal use only. While much effort is made to provide the information, I (Vishal Dalwadi) or “FinBlab” do not guarantee the accuracy, correctness, completeness or reliability of any information or data displayed herein and shall not be held responsible.