Vikram Solar IPO – Review, Update

Vikram Solar Update

“Secured New Order Of High-Efficiency Solar Modules”

Vikram Solar Limited, a prominent solar PV module manufacturer in India, on Wednesday, February 25, 2026, said that,

The Company has secured a new business order from Indian Oil NTPC Green Energy Private Limited, to supply 378.75 MW of high-efficiency modules for a major project in Gujarat. Source – BSE

LAST ARTICLE – Omnitech Engineering IPO Review

Order Details

Under the new order, Vikram Solar will supply its advanced N-TOPCon modules, designed to provide enhanced performance, dependability, and energy yield in utility-scale installations, according to the company’s management.

The modules will be installed in Kutch, Gujarat, India, as part of the 600 MW solar project by Indian Oil NTPC Green Energy Private Limited (INGEL), a joint venture between Indian Oil Corporation and NTPC Green Energy.

Duration

According to a company spokeswoman, the modules should start to be delivered in FY26.

Deal Value

The deal value has not been revealed by the company.

Refer to Vikram solar limited news today for further details.

Chairman’s Speech –

Commenting on securing a new order, Mr. Gyanesh Chaudhary, Chairman & Managing Director, Vikram Solar Ltd, said

This order marks an important milestone for Vikram Solar as we commence our first engagement with INGEL on a large-scale, strategically significant project in Gujarat.

It reinforces our ability to deliver high-performance N-TOPCon technology for complex utility-scale deployments, backed by execution certainty and manufacturing strength.

We see this as the beginning of a strong, long-term collaboration supporting India’s accelerated clean energy transition.

The company’s market capitalization is ₹6,350 Cr.

The stock is currently trading below its 20-day Simple Moving Average (SMA).

Also Read –

PNGS Reva Diamond Jewellery IPO Review

17 August 2025

Vikram Solar Limited, one of the largest solar module manufacturers (by capacity) in India, is planning to raise ₹ 2079 Crore through an IPO.

[Fresh Issue ₹ 1500 Cr + OFS ₹ 579 Cr]

Vikram Solar ipo share price is ₹ 315 – ₹ 332 per share

Vikram Solar: History

The Company was originally incorporated as International Leather Clothiers Private Limited, a private limited company under the Companies Act, 1956.

The Company was converted into a public limited company and its name was changed to Vikram Solar Limited under a fresh certificate of incorporation issued by the RoC on August 22, 2017.

LAST ARTICLE – Patel retail ipo review

Vikram Solar: Business

Vikram Solar Limited is an Indian company based in Kolkata.

The company’s primary business focus is manufacturing solar Photovoltaic (PV) modules, as well as carrying out engineering, procurement, and construction (EPC) services & operations, and maintenance of solar power plants.

With 3.50 GW of installed manufacturing capacity for solar PV modules as of the date of this Draft Red Herring Prospectus (DRHP), it is one of the largest enlisted capacities among pureplay non-captive manufacturers in the Ministry of New & Renewable Energy’s Approved List of Module Manufacturers (ALMM).

The Company’s portfolio of solar energy products consists of the following high-efficiency solar PV modules,

- P-type monocrystalline silicon-based Passivated Emitter and Rear Contact (PERC) modules;

- N-type monocrystalline silicon-based Tunnel Oxide Passivated Contact (TOPCon) modules; and

- N-type monocrystalline silicon-based heterojunction technology (HJT) modules

To meet growing demand, the company is currently undertaking significant greenfield and brownfield expansion plans, which are expected to increase its installed manufacturing capacity to 10.50 GW by FY 2026 and 15.50 GW by FY 2027.

Manufacturing Facilities

The Company’s manufacturing facilities are strategically located at Falta SEZ in Kolkata (West Bengal, India) and Oragadam in Chennai (Tamil Nadu, India) with access to ports, rail, and roads, helping it to facilitate both domestic and international operations.

Client List

Vikram Solar’s key domestic clients include National Thermal Power Corporation (NTPC), Neyveli Lignite Corporation Limited, and Gujarat Industries Power Company Limited (GIPCL).

Large private Independent Power Producers (IPPs), such as ACME Cleantech Solutions Pvt. Ltd, Ampin Energy Transition Private Limited, Azure Power India Private Limited, JSW Energy Limited, First Energy 7 Private Limited, and Rays Power Infra Private Limited, among others.

Distributor Network

As of the date of this DRHP, the company has established a pan-India presence, serving 23 states and 3 union territories (UTs), through an extensive distributor network of 41 authorized distributors, 64 dealers, and 67 system integrators.

Strategies Ahead

- Maintain domestic market position through strategic expansion of solar PV module manufacturing and backward integration into solar cell manufacturing

- Focus on developing new and innovative products and services

- Strengthen domestic presence through a dedicated retail network and distribution model

- Become a significant global player in the international solar PV module market

- Diversify the supply chain

Company Promoters

- Gyanesh Chaudhary,

- Gyanesh Chaudhary Family Trust,

- Vikram Capital Management Private Limited

Refer to Vikram Solar IPO DRHP for detailed information.

IPO Details

Vikram Solar IPO date = 19 to 21 August 2025

Minimum Amount = INR 14,940

Minimum Bid = 45 Shares

Face Value (FV) = INR 10

Listing On = NSE, BSE

Book Running Lead Manager

JM Financial

Nuvama Wealth Management

UBS Securities (I) Pvt Ltd

Equirus Capital Pvt Ltd

Phillip Capital (I) Pvt Ltd

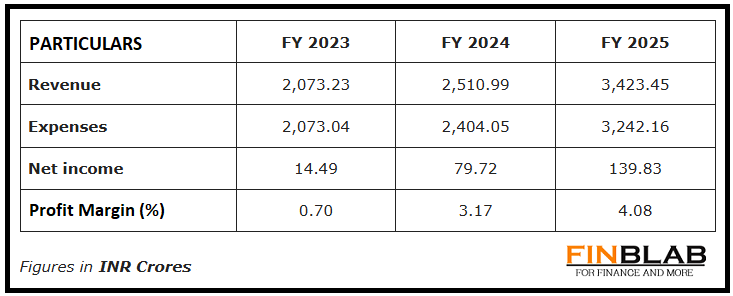

Financials

CONCLUSION

FinBlab recommends ‘SUBSCRIBE‘ ratings on Vikram Solar IPO

Disclaimer: The contents and data presented here are just for your information & personal use only. While much effort is made to provide the information, I ( Vishal Dalwadi ) or “FinBlab” do not guarantee the accuracy, correctness, completeness or reliability of any information or data displayed herein and shall not be held responsible.