Vikran Engineering IPO – Review

Vikran Engineering Limited, a company specializing in providing comprehensive solutions in the fields of engineering, renewable energy, and project management, plans to raise ₹772 Crore through an IPO.

[Fresh Issue ₹ 721 Cr + OFS ₹ 51 Cr]

Vikran engineering ipo price is ₹ 92 – ₹ 97 per share

Vikran Engineering: History

The Company was originally incorporated as Ratangiri Financial Advisory Private Limited, as a private limited company under the Companies Act, 1956, on June 04, 2008.

The Company was converted into a public limited company under a special resolution approved by the shareholders at the EGM held on August 12, 2024, and its name was changed to Vikran Engineering Limited under a fresh certificate of incorporation issued by the RoC on September 20, 2024.

LAST ARTICLE – Mangal electrical ipo review

Vikran Engineering: Business

Vikran Engineering Ltd. is one of the fast-growing Engineering, Procurement, and Construction (EPC) companies in India.

The Company provides end-to-end services from conceptualisation, design, supply, installation, testing, and commissioning of a project on a turnkey basis and has presence across multiple sectors, including power transmission & distribution, energy, water, and railway infrastructure, with majority revenue from energy and water infrastructure verticals (contributing 49 percent each).

According to the CRISIL Report, the company also has experience in Solar EPC of ground-mounted solar projects and smart metering.

As part of railway projects, the company undertakes 132 kV traction substation projects and underground EHV cableling projects.

The company has successfully executed projects for government entities, private companies, and public sector undertakings.

Completed Projects

As of August 31, 2024, the company has successfully completed 44 projects across 11 states in India with a total executed contract value of ₹ 1896 Cr

As of August 31, 2024, the company has 34 ongoing projects across 17 states, aggregating orders of ₹ 3957 Cr, of which the Order-Book of ₹ 1956 Cr.

Client List

Some of the reputed clients of the company in the government sector include NTPC Limited, Power Grid Corporation of India Limited, Transmission Corporation of Telangana Limited, Madhya Pradesh Power Transmission Company Limited, District Water and Sanitation Mission (PHED), and State Water and Sanitation Mission (SWSM).

Strategies Ahead

- Strengthen core competencies in power transmission & distribution and water infrastructure sectors

- Expanding geographical footprint globally

- Expand the EPC portfolio into other EPC sectors

- Capitalizing on Government initiatives and policies

Company Promoters

- Rakesh Ashok Markhedkar,

- Avinash Markhedkar,

- Nakul Markehdkar

Refer to Vikran Engineering DRHP for detailed information.

IPO Details

Vikran Engineering IPO date = 26 to 29 August 2025

Minimum Amount = INR 14,356

Minimum Bid = 148 Shares

Face Value (FV) = INR 1

Listing On = NSE, BSE

Book Running Lead Managers

Pantomath Capital Advisors Pvt Ltd

Systematix Corporate Services Ltd

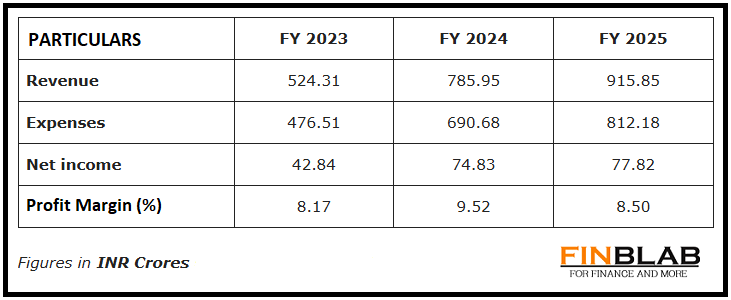

Financials

CONCLUSION

FinBlab recommends ‘SUBSCRIBE‘ ratings on Vikran Engineering IPO (keeping a long-term view in mind)

Disclaimer: The contents and data presented here are just for your information & personal use only. While much effort is made to provide the information, I ( Vishal Dalwadi ) or “FinBlab” do not guarantee the accuracy, correctness, completeness or reliability of any information or data displayed herein and shall not be held responsible.