VMS TMT IPO – Review

VMS TMT Limited, a company primarily engaged in the manufacturing of TMT Bars in India, is planning to raise ₹148.5 Crore via an IPO.

[Fresh Issue ₹148.50 Cr + OFS NIL]

Vms tmt ipo price is ₹94 – ₹99 per share

VMS TMT: History

The Company was originally incorporated as VMS TMT Private Limited, a private limited company under the Companies Act, 1956, on April 9, 2013.

The Company was converted into a public limited company under a special resolution adopted by the shareholders on November 10, 2023, and its name was changed to VMS TMT Limited under a fresh certificate of incorporation issued by the Registrar of Companies on December 1, 2023.

LAST ARTICLE – Euro Pratik Sales IPO Review

VMS TMT: Business

VMS TMT Ltd. is engaged in the manufacturing of Thermo Mechanically Treated Bars (TMT Bars).

The Company manufactures TMT Bars by utilizing modern TMT rolling mill machines from billets.

These TMT Bars are high-strength reinforcement steel used widely in construction due to their exceptional strength, ductility, and corrosion resistance.

In June 2024, the company entered into a factory lease agreement with Hans Industries Private Limited for the production of mild steel pipes (MS Pipes).

The company markets and sells TMT Bars in the State of Gujarat under the brand ‘Kamdhenu NXT’.

Manufacturing Facility

TMT Bars of the company are manufactured at Bhayla Village near Ahmedabad. The facility utilizes advanced machinery and automation for production.

Distribution Network

As of July 31, 2025, the company markets and sells its TMT Bars through a non-exclusive distribution network, comprising three distributors and 227 dealers.

Workforce

The company is supported by a professional and experienced management team along with a workforce of 230 employees as of July 31, 2025.

Strategies Ahead

- Focus on the backward integration project to reduce operational costs.

- Diversifying into the production and sale of MS Pipes

- Setting up a 15MW “Solar Power Plant” to lower power expenses

- Focus on cost optimization and improving operational efficiency.

IPO Objectives

The Company proposes to utilize the Net Proceeds of the Issue towards the following objects –

- Funding capital expenditure for setting up of a solar power plant in Gujarat

- Funding long-term working capital requirements of the Company

- Repayment/prepayment of certain borrowings availed by the Company

- General corporate purposes

Company Promoters

- Varun Manojkumar Jain,

- Rishabh Sunil Singhi,

- Manojkumar Jain,

- Sangeeta Jain.

Refer to VMS TMT DRHP for detailed information.

IPO Details

Vms tmt ipo date = 17 to 19 September 2025

Minimum Amount = ₹14,850

Minimum Bid = 150 Shares

Face Value (FV) = ₹10

Listing On = NSE, BSE

Book Running Lead Manager

Arihant Capital Markets

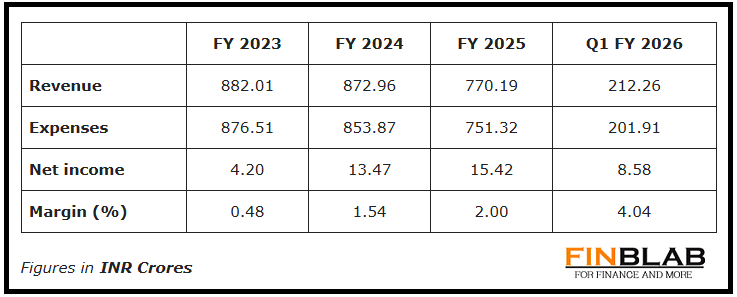

Financials

CONCLUSION

FinBlab recommends ‘MAY SUBSCRIBE‘ ratings on VMS TMT IPO

Do come back to know more about “upcoming ipos“

Disclaimer: The contents and data presented here are just for your information & personal use only. While much effort is made to provide the information, I ( Vishal Dalwadi ) or “FinBlab” do not guarantee the accuracy, correctness, completeness or reliability of any information or data displayed herein and shall not be held responsible.