Capillary Technologies IPO – Review

Capillary Technologies Limited, an industry-leading loyalty management platform in India, is planning to raise ₹878 Crore through an IPO.

[Fresh Issue ₹345 Cr + OFS ₹533 Cr]

Capillary technologies ipo price is ₹549 – ₹577 per share

Capillary Technologies: History

The Company was originally incorporated as Kharagpur Technologies Private Limited, a private limited company under the Companies Act, 1956, on March 15, 2012.

The Company was then converted into a public limited company under a special resolution passed by the shareholders on November 9, 2021. Its name was subsequently changed to Capillary Technologies Limited, as per a fresh certificate of incorporation issued by the RoC on November 23, 2021.

LAST ARTICLE – Fujiyama Power Systems IPO Review

Capillary Technologies: Business

Capillary Technologies Ltd. is a technology-first company and offers Software-as-a-Solution (SaaS) and artificial intelligence (AI)-based cloud-native products and solutions (customer data platforms and automated loyalty management) that enable large enterprises to develop loyalty of their clients and channel partners.

The Company’s diversified product suite and technology platform allow clients to run end-to-end loyalty programs, gain a comprehensive view of clients, and offer unified, cross-channel strategies that deliver a real-time, omni-channel, personalized, and consistent experience for clients.

Capillary is the market leader in the Asia-Pacific region, with a 39 percent market share in terms of loyalty management capabilities in 2020, based on the geographies in which it operates.

Client Base

As of September 30, 2025, the company served over 410 brands in more than 47 countries across China, India, Indonesia, Malaysia, Singapore, Saudi Arabia, Thailand, the United Arab Emirates, and the United States.

Strategies Ahead

- Focus on Go-to-Market Strategy on Larger Enterprises in Asia

- Focus on improving NRR in Asia to achieve Higher Growth.

- Expansion through the addition of New Verticals

- Acquisitions in North America and other Western Markets

- Scale Anywhere Commerce+ by focusing on the Full Stack Model and undertaking Strategic Acquisitions

- Invest in Platform to Support Large Enterprises, New Verticals, New Geographies

- Enable AI use-cases for Clients

Company Promoters

- Capillary Technologies International

- Aneesh Reddy Boddu

Refer to Capillary Technologies IPO RHP for more information.

IPO Details

IPO date: 14 – 18 Nov 2025

Minimum Amount: ₹14,425

Minimum Bid: 25 Shares

Face Value (FV): ₹2

Listing On = NSE, BSE

Book Running Lead Managers

ICICI Securities

Kotak Mahindra Capital

Nomura Financial Advisory and Securities

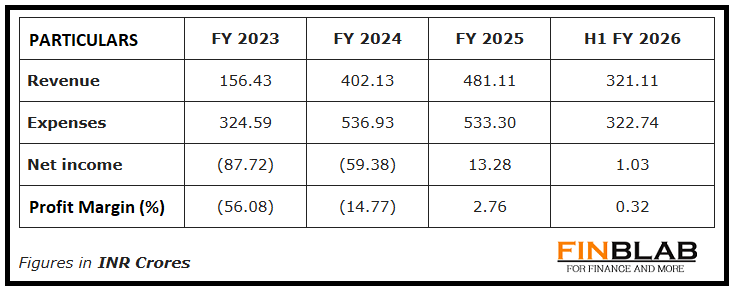

Financial

CONCLUSION

FinBlab recommends ‘NEUTRAL‘ ratings (for the time being) on Capillary Technologies IPO

Do come back to know more about “upcoming ipos“

Disclaimer: The contents and data presented here are just for your information & personal use only. While much effort is made to provide the information, I (Vishal Dalwadi) or FinBlab do not guarantee the accuracy, correctness, completeness or reliability of any information or data displayed herein and shall not be held responsible.