Amanta Healthcare IPO – Review

Amanta Healthcare Limited, the most versatile manufacturer and marketer of sterile dosage forms in India, is planning to raise ₹126 Crore through an IPO.

[Fresh Issue ₹126 Cr + OFS NIL]

Amanta healthcare ipo price is ₹120 – ₹126 per share

Amanta Healthcare: History

The Company was originally incorporated on December 21, 1994, as Marck Parenterals (India) Limited with RoC, Gujarat (Ahmedabad, India).

The Company was converted into a public limited company under a special resolution approved by the shareholders on June 12, 2014, and its name was changed to Amanta Healthcare Limited under a fresh certificate of incorporation issued by the RoC on June 24, 2014.

LAST ARTICLE – Anlon Healthcare IPO

Amanta Healthcare: Business

Amanta Healthcare Ltd. is a pharmaceutical company engaged in the development, manufacturing, and marketing of a diverse range of sterile liquid products.

These sterile liquid products (parenteral products) are being packed in plastic containers with Aseptic Blow-Fill-Seal (ABFS) and Injection Strech Blow Moulding (ISBM) technology.

The Company manufactures large-volume parenterals (LVPs) and small-volume parenterals (SVPs) in six therapeutic segments.

It also manufacturers medical devices that find their uses in irrigation, first-aid solutions, and eye lubricants.

The Company does offer a wide range of closure systems, such as nipple head, twist-off, leur-lock, and screw types, and container fill-volume ranging from 2ml to 1000 ml.

Product Portfolio

The Company’s product portfolio can be categorized into the following six therapeutic segments –

- Fluid therapy – (IV Fluid)

- Formulations

- Diluents and Injectables

- Ophthalmic

- Respiratory care, and

- Irrigation solutions in the therapeutic segment

The Company manufactures and manages over 45 diverse generic product portfolios and markets them under its own brands in the Indian market through a network of more than 316 stockists and distributors.

F&D Lab

The Company has a dedicated Formulation and Development (F&D) and quality control laboratory located in its own manufacturing facility in Hariyala (Kheda, Gujarat, India).

ALSO READ – Vikran Engineering IPO

Certifications

The manufacturing facility of the company has good manufacturing practices (GMP) certifications from the Food & Drugs Control Administration (Gujarat), in conformity with the format recommended by the World Health Organization (WHO).

It also has a certificate from DNV for exports of its medical device products.

Export Market

The Company’s products are currently registered with 19 countries and sell them in countries including Africa, Latin America, the UK, and the Rest of the world.

Strategies Ahead

- Expansion of manufacturing capacities

- Expand National Sales Network

- Expand the wallet share of existing customers & develop new customers

Company Promoters

- Bhavesh Patel,

- Vishal Patel,

- Jayshreeben Patel,

- Jitendrakumar Patel,

- Milcent Appliances Pvt Ltd

IPO Details

Amanta healthcare ipo date = 01 to 03 September 2025

Minimum Amount = ₹14,994

Minimum Bid = 119 Shares

Face Value (FV) = ₹10

Listing On = NSE, BSE

Book Running Lead Manager

Beeline Capital Advisors Pvt Ltd

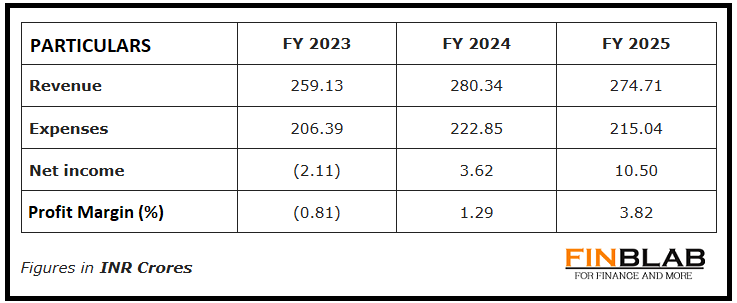

Financials

CONCLUSION

FinBlab recommends ‘May SUBSCRIBE‘ ratings on Amanta Healthcare IPO

Disclaimer: The contents and data presented here are just for your information & personal use only. While much effort is made to provide the information, I ( Vishal Dalwadi ) or “FinBlab” do not guarantee the accuracy, correctness, completeness or reliability of any information or data displayed herein and shall not be held responsible.