Dharmaj Crop Guard IPO – Review

Dharmaj Crop Guard Limited – a company engaged in the business of agrochemical formulations is planning to raise INR 251 Crore via IPO [Fresh Issue 216 Cr + OFS 35 Cr]

dharmaj crop guard share price fixed at INR 237

Dharmaj Crop Guard: History

The Company was incorporated on January 19, 2015, in Ahmedabad (Gujarat) as a public limited company under the Companies Act, 2013 under a certificate of incorporation issued by the Registrar of Companies.

Dharmaj Crop Guard: Business

Dharmaj Crop Guard Ltd (DCGL) is engaged in the business of manufacturing, distributing, and marketing a varied range of agrochemical formulations.

The Company’s product portfolio consists of insecticides, antibiotics, herbicides, plant growth regulators, and micro fertilizers and sells to B2C and B2B customers.

The Company also engages in the marketing and distribution of agrochemical products (under brands in-licensed owned by itself and through generic brands) to Indian farmers through its established distribution network.

The Company also make available ‘crop protection solutions’ to the farmer to assist them to exploit productivity and profitability.

The Company also manufacture and sells general insect and ‘pest control chemicals’ for Public Health and Animal Health protection.

The Company sells its agrochemical products in the forms of granules, liquid, and powder to its customers.

Registered Formulation

As on filling this Red Herring Prospectus, the company has obtained 464 registrations for agrochemical formulations from the CIB & RC, of which 269 formulations are for sale in India as well as for export and 195 formulations are entirely for exports.

Client List

The Company exported its products and agro based formulations to more than 66 clients across 25 countries in East African Countries, Latin America, the Middle East, and Far East Asia.

Promoters

- Rameshbhai Ravajibhai Talavia

- Jamankumar Hansarajbhai Talavia

- Jagdishbhai Ravjibhai Savaliya

- Vishal Domadia

IPO DETAILS

dharmaj crop guard ipo date 28 Nov 2022 to 30 Nov 2022

Face Value (FV) = INR 10

Issue Price = INR 216 to INR 237

Minimum Investment Amount = INR 14220

Minimum Bid = 60 Shares

Listing On = BSE, NSE

BOOK RUNNING LEAD MANAGERS

Elara Capital (India) Private Limited, Monarch Networth Capital Limited

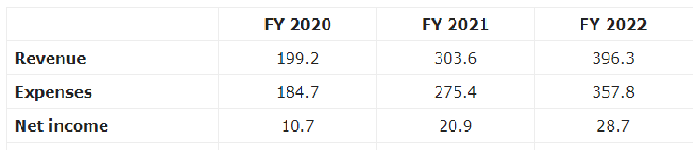

FINANCIALS

Conclusion

FinBlab recommends SUBSCRIBE ratings on Dharmaj Crop Guard IPO

Also Read

indian stock market journey ‘from 100 to 62000 points’

Disclaimer: The contents and data presented here are just for your information & personal use only. While much effort is made to provide the information, I ( Vishal Dalwadi ) or “FinBlab” do not guarantee the accuracy, correctness, completeness or reliability of any information or data displayed herein and shall not be held responsible.