Indiqube Spaces IPO – Review

Indiqube Spaces Limited, a workspace solutions provider across various business segments in India, is planning to raise INR 700 Crore via an IPO.

[Fresh Issue 650 Cr + OFS 50 Cr]

Indiqube spaces ipo price is INR 225 – 237 per share

Indiqube spaces: History

The Company was incorporated as Innovent Spaces Private Limited, a private limited company under the Companies Act, 2013, on January 14, 2015.

The Company was converted into a public limited company under a special resolution passed in the EGM by the shareholders on November 16, 2024, and its name was changed to Indiqube Spaces Ltd under a fresh certificate of incorporation issued by the RoC on December 17, 2024.

LAST ARTICLE – GNG Electronics IPO review

Indiqube spaces: Business

Indiqube Spaces Ltd is a managed workplace solutions company offering comprehensive, technology-driven, and sustainable workplace solutions dedicated to transforming the traditional office experience.

The Company provides its services (through backward and forward integration) to large corporate offices (hubs) and small branch offices (spokes) for enterprises, transforming the workplace experience of their employees by combining amenities, interiors, and a host of value-added services (VAS).

To service client requirements, Indiqube has developed different business verticals that extend and complement its core offering, such as –

- IndiQube Grow,

- IndiQube Bespoke,

- IndiQube One,

- MiQube,

- IndiQube Cornerstone

Client List

The Company’s clients include GCCs, Indian corporates, unicorns, as well as startups across sectors, such as –

- Automotive,

- Aviation,

- Banking,

- Consulting,

- Ecommerce,

- Educational Technology,

- Engineering,

- Financial Services And Insurance,

- Healthcare,

- Information Technology (It-Enabled Services),

- Manufacturing,

- Logistics, And

- Pharmaceuticals

As of June 30, 2024, Indiqube Spaces has served over 737 clients across various sectors.

Service Portfolio

As of June 30, 2024, IndiQube has managed a portfolio of 103 centers across 13 cities, covering 7.76 million square feet of AUM (area under management) in super SBA (built-up area) with a total seating capacity of 172,451.

In a city like Bengaluru, the company has a portfolio of 60 centers spanning 5.04 million square feet in AUM, as of June 30, 2024.

Network

As of June 30, 2024, we have presence in 13 cities in India.

- Tier I CITY category Bengaluru, Pune, Chennai, Mumbai, Noida, Gurugram, and Hyderabad

- Non-Tier I CITY category Coimbatore, Kochi, Madurai, Jaipur, Calicut, and Vijayawada

Strategies Ahead

- Expand Area Under Management by Balancing Market Presence and Micro Market Penetration

- Enhance Average Revenue Per Square Feet Through an Integrated Workspace Solutions Ecosystem

- Become a Preferred Workspace Outsourcing Solutions Partner for Enterprises

- Scale company’s Bespoke and Offer Comprehensive Office Interiors Solutions

- Expand ‘Sustainability as a Service’ Offerings

- Leverage Technology to Expand Client-Base

Company Promoters

- Rishi Das,

- Meghna Agarwal,

- Anshuman Das.

IPO Details

IPO date = 23 July to 25 July 2025

Minimum Amount = INR 14,931

Minimum Bid = 63 Shares

Face Value (FV) = INR 1

Listing On = NSE, BSE

Book Running Lead Manager

ICICI Securities Limited

JM Financial Limited

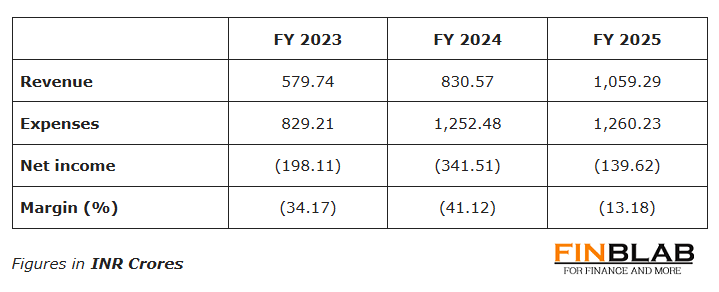

Financials

CONCLUSION

FinBlab recommends ‘AVOID‘ ratings (for the time-being) on Indiqube spaces ipo

Disclaimer: The contents and data presented here are just for your information & personal use only. While much effort is made to provide the information, I ( Vishal Dalwadi ) or “FinBlab” do not guarantee the accuracy, correctness, completeness or reliability of any information or data displayed herein and shall not be held responsible.