Lemon Tree Hotels IPO – Analysis, Update

Update

“Launches Second Property in Vishakhapatnam”

Lemon Tree Hotels Limited in its regulatory filing has announced the opening of “Keys Lite” by Lemon Tree Hotels (Sreekanya, Visakhapatnam).

This is the 2nd property of the group in the city, strategically located near Gajuwaka, in the Southwest region of Vishakhapatnam.

The hotel features 44 well-appointed rooms and suites with aesthetically-designed interiors and modern facilities and amenities for the utmost comfort of guests.

Complementing the stay is a multi-cuisine coffee shop – Keys Café. This hotel also features a well-appointed venue for business meetings, conferences, functions, and private events.

“Keys Lite” by Lemon Tree Hotels caters to both business travellers and tourists. Guests can experience the best of both worlds – ancient as well as modern.

The hotel is located around the city’s prime tourist attractions – Rama Krishna Beach, NS Kurusura Submarine Museum, Natural View Point, Kailasagiri and other places of tourist interest.

The stock has delivered a return of 41% over the last quarter (July-Sept 2022).

Also Read: Krishna Institute of Medical Sciences – Value Pick Stock OCTOBER 2022

02 August 2022

Update

Q1 FY23 Numbers

Lemon Tree Hotels Limited – India’s largest hotel chain in the mid-priced sector has posted its quarter one FY2022-23 numbers. Read details –

REVENUE

Revenue from operations on a consolidated basis stood at INR 192.0 Cr in Q1 FY23, up 356% as compared to INR 42.2 Cr in Q1 FY22. On a sequential basis, revenue from operations of the company increased 61% from INR 119.5 Cr in Q4 FY22.

ARR (Average Room Rate) increased by 104% from 2,362 in Q1 FY22 to 4,822 in Q1 FY23. On a sequential basis, ARR increased by 18% from INR 4,093 in Q4 FY22.

Must Read: Nifty Prediction for August 2022

EXPENSES

Total expenses stood at INR 99.7 Cr in Q1 FY23, up 136% as compared to INR 42.2 Cr in Q1 FY22 on back of increase in occupancy level. On a sequential basis, expenses increased by 21% from INR 82.7 Cr in Q4 FY22.

EBITDA

Net EBITDA increased by 4422% from INR 2.0 Cr in Q1 FY22 to INR 92.6 Cr in Q1 FY23. On a sequential basis, Net EBITDA increased 108% from INR 44.5 Cr in Q4 FY22.

Net EBITDA margin increased by 4,354 bps from 4.6% in Q1 FY22 to 48.2% in Q1 FY23. On a sequential basis, the Net EBITDA margin has expanded by 1,320 bps from 35.0% in Q4 FY22.

Profit After Tax

PAT improved from INR (-59.8) Cr in Q1 FY22 to INR 13.6 Cr in Q1 FY23. The PAT in Q4 FY22 was INR (-39.2) Cr

Cash Profit for Q1 FY23 stood at INR 42.9 Cr vs INR (-33.6) Cr in Q1 FY22. The Cash Profit in Q4 FY22 was INR 2.6 Cr

Also Read: A list Q1 results for the week

Chairman & MD’s Message –

Commenting on the performance for Q1 FY23, Mr. Patanjali Keswani said, “FY23 began on a strong note, bolstered by strong demand. Corporate travel increased, resulting in a recovery in our business destinations. We saw increased demand for Meetings, Incentives, Conferences, and Exhibitions, which contributed to the company’s growth.

On the operational front, we are pleased to report that we signed new hotels in Vishakhapatnam, MaladMumbai, Jaipur, Assam, and Kharar-Chandigrah during the quarter, as well as operationalized a Keys hotel in Tapovan, Rishikesh.

Our foremost goal is to expand our portfolio through an asset-light approach in key strategic cities. Consumers are increasingly interested in leisure travel. This, combined with consumer preference for branded hotels, bodes well for organized players in the space. Furthermore, the construction of our largest hotel, Aurika, Mumbai (MIAL) is on track and is set to open by the end of CY23.

In terms of demand, we see a significant improvement in consumer sentiment. Leisure and corporate travel continue to gain traction. We anticipate that consumption will strengthen even further in the coming quarters as we continue to focus on expanding our presence across India and addressing demand across the upper-upscale, upscale, midscale, and economy segments with our portfolio of seven brands.”

Daily Chart –

Share of lemon tree hotel closed at INR 67.80 (down 1.60%) on the NSE with volume of 39,88,236 shares.

Final Comment: The Company has posted solid set of numbers post COVID pandemic. With economic activities are happening in full swings; hotel industries likely to do well in the coming quarters. Finblab maintain neutral ratings for the time being.

Also Read: Q1 FY23 Earnings of TUBE INVESTMENTS OF INDIA

23 MARCH 2018

Lemon Tree Hotels (LTH) – India’s largest chain in the mid-priced hotels sector and 3rd largest overall (on the basis of controlling interest in owned and leased rooms) – is planning to raise INR 1038.70 Cr (all OFS) via initial public offer (IPO)

Lemon Tree Hotels – Company Profile

- Incorporated in the year 1992, Delhi based Lemon Tree Hotels (LTH) is India’s largest hotel chain.

- This award winning Indian hotel chain opened its first hotel with 49 rooms in May 2004 and operates 45 hotels in 28 cities with 4697 rooms and over 5000 employees (as on January 31, 2018)

- Lemon Tree hotels are located across India, in metro regions, including the Bengaluru, Chennai, Hyderabad, NCR, as well as tier I and tier II cities such as Ahmedabad, Aurangabad, Chandigarh, Indore, Jaipur, and Pune.

Lemon Tree Hotels – Brands

The Lemon Tree Hotels offers 3 brands to meet hotel needs across all levels –

- Lemon Tree Premier

- Lemon Tree Hotels

- Red Fox by Lemon Tree Hotels

Lemon Tree Premier

- This chain of upper midscale business and leisure hotels elevates the Lemon Tree experience while retaining the same freshness, quirkiness and energy that Lemon Tree is well known for.

- Lemon Tree Premier pampers the style conscious and upbeat traveler with its personalized services, premium in-room amenities, award winning restaurants and fun experiences.

Lemon Tree Hotels

- This stylish business hotel with fresh and bright interiors refreshes you with its witty humor and spirited environment.

- Targeted primarily at the midscale hotel segment.

Red Fox by Lemon Tree Hotels

- It is targeted primarily at the economy hotel segment but welcomes you with its fresh bold interiors as well as crisp and clean rooms.

- These economy hotels delight you with its unbeatable value and reliable safety standards.

- Here friendly smiles and a lively environment go hand in hand with professional service.

Company Promoters

- Mr. Patanjali Govind Keswani

- Spank Management Services Private Limited

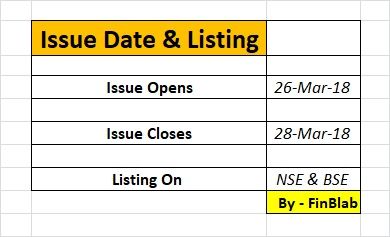

IPO Opening / Closing Date

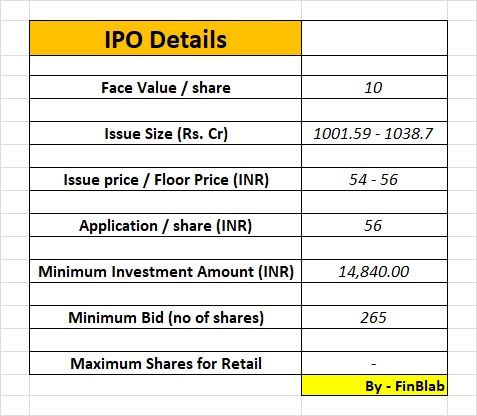

IPO Details – Price, Minimum Bid and Other

Financial Performance

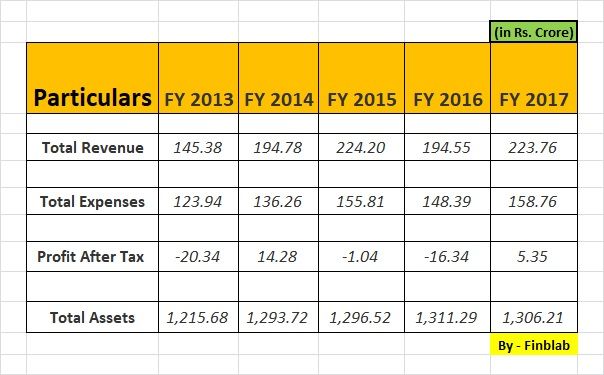

Revenues

The Company shows steady revenue growth in recent years. Top-line has been increasing regularly for the last 5 years and jumped from INR 145.38 crore in FY 2013 to INR 223.76 crore for the period ended FY 2017.

Profits

Though the company has shown steady growth in revenue, the company fails to register steady profit growth in those 5 years. Starting from a loss of INR 20.34 crore in FY 2013, the company’s earnings were INR 5.35 crore in FY 2017.

CONCLUSION –

Considering company’s valuation, financial parameters, and the sector potential in which it is operating, FinBlab recommends NEUTRAL ratings on Lemon Tree Hotels Limited IPO for the time being

Also Read –

(1) Detail Analysis and Finblab View on ICICI SECURITIES LTD IPO

(2) Finblab’s Valuepick of the month BALKRISHNA INDUSTRIES LIMITED

Disclaimer: The contents and data presented here are just for your information & personal use only. While much effort is made to provide the information, I ( Vishal Dalwadi ) or “Fin Blab” do not guarantee the accuracy, correctness, completeness or reliability of any information or data displayed herein and shall not be held responsible.