Saatvik Green Energy IPO – Review

Saatvik Green Energy Limited, one of the fastest-growing module manufacturing companies in India, plans to raise ₹900 Crore through an IPO.

[Fresh Issue ₹700 Cr + OFS ₹200 Cr]

Saatvik green energy ipo price is ₹442 – ₹465 per share

Saatvik Green Energy: History

The Company was originally incorporated as Saatvik Green Energy Private Limited, a private limited company under the provisions of the Companies Act, 2013, on May 29, 2015.

The Company was converted into a public limited company under a special resolution passed by the shareholders on September 21, 2024, and its name was changed to Saatvik Green Energy Limited under a fresh certificate of incorporation issued by the RoC on October 3, 2024.

LAST ARTICLE – Ivalue infosolutions ipo review

Saatvik Green Energy: Business

Saatvik Green Energy Ltd. is a major player in the Indian solar energy sector and one of the fastest-growing module manufacturing companies in the country.

The Company has an operational capacity of approximately 3.80 gigawatts (GW) of modules, making it one of the top module producers in India for solar photovoltaic (PV) modules as of February 28, 2025.

According to the CRISIL Report, the company is regarded as one of the few in India that can manufacture modules in addition to engineering, procurement, and construction (with a 69.12 MW installed EPC base as of FY 2024).

Since its inception, the company has supplied more than 2 GW of high-efficiency solar PV modules both locally and abroad.

Portfolio

The Company’s solar energy products portfolio includes –

- Monocrystalline passive emitter and rear cell “Mono PERC” modules,

- N-TopCon solar modules,

Both types of company products are suitable for various applications, including commercial, residential, and utility-scale solar projects.

Completed Projects

A prominent EPC service provider, Saatvik Energy, installed 69.12 MW in Fiscal 2025 and completed major projects such as a 61.42 MW floating plant in Telangana and rooftop installations for Jindal Steel Limited.

Its domestic order book stood at 4.01 GW as of 31 March 2025.

ALSO READ – VMS TMT IPO Review

Diversified Client

The Company possesses one of the most diversified client bases in the industry, with presence in various segments, namely

- Large Utility,

- Commercial & Industrial,

- Open Access,

- Residential Rooftop, And

- Solar Pump.

Some of the important clients of the company are –

- Shree Cement Limited, SJVN Green Energy Limited, Prozeal Green Energy Limited, JSW Neo Energy Limited, and Megha Engineering & Infrastructure Limited.

Strategies Ahead

- Backward Integration into Cell Manufacturing

- Maintain position in the Solar Industry in the country.

- Focus on growing share of export sales and EPC services internationally.

- Expanding customer base in India and internationally

- Continue to develop and reinforce technology to manufacture quality modules.

- Expand the distribution network across India and create a retail brand for solar panels

Company Promoters

- Neelesh Garg,

- Manik Garg,

- Manavika Garg,

- SPG Trust

Refer to Saatvik Green Energy DRHP for detailed information.

IPO Details

Saatvik green energy ipo date = 19 to 23 September ‘25

Minimum Amount = ₹14,880

Minimum Bid = 32 Shares

Face Value (FV) = ₹2

Listing On = NSE, BSE

Book Running Lead Managers

DAM Capital Advisors

Ambit Private Limited

Motilal Oswal Investment Advisors

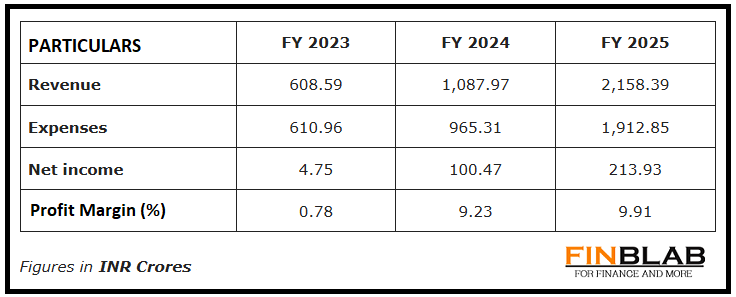

Financials

CONCLUSION

FinBlab recommends ‘SUBSCRIBE‘ ratings on Saatvik Green Energy IPO (keeping a long-term view in mind)

Do come back to know more about “upcoming ipos“

Disclaimer: The contents and data presented here are just for your information & personal use only. While much effort is made to provide the information, I ( Vishal Dalwadi ) or “FinBlab” do not guarantee the accuracy, correctness, completeness or reliability of any information or data displayed herein and shall not be held responsible.