TruAlt Bioenergy IPO – Review

TruAlt Bioenergy Limited, one of India’s largest biofuels producers – primarily in the production of Ethanol, is planning to raise ₹839 Crore through an IPO.

[Fresh Issue ₹750 Cr + OFS ₹89 Cr]

Trualt bioenergy ipo price is ₹472 – ₹496 per share

TruAlt Bioenergy: History

The Company was originally incorporated as TruAlt Energy Limited, a public company under the Companies Act, 2013, on March 31, 2021.

The name of the Company was subsequently changed to TruAlt Bioenergy Limited, under a special resolution passed by the shareholders in the extraordinary general meeting held on June 1, 2022, and a fresh certificate of incorporation was issued by the RoC on July 1, 2022.

LAST ARTICLE – Jinkushal Industries IPO Review

TruAlt Bioenergy: Business

TruAlt Bioenergy Ltd. is one of India’s largest biofuels producers, having strategically positioned itself as a prominent and diversified player in the biofuels industry (particularly in the Ethanol sector).

The company’s business operations span across ethanol production and compressed biogas (CBG) production.

It is a green energy company, steadfastly pursuing its objectives through a harmonious amalgamation of various policies laid out by the Government of India (GOI) in its transition towards sustainable growth.

As of March 31, 2025, it holds the distinction of being the largest Ethanol producer in India (based on installed capacity), with an aggregate production capacity of 1,800 kilo litres per day (KLPD).

As of the date of the DRHP, the company has five distillery units in Karnataka (four are operated on molasses and syrup-based feedstocks).

Strategies Ahead

- Expand production capacity and diversify sources of ethanol production.

- Focus on increasing CBG capabilities.

- Commence production of 2G ethanol.

- Venture into sustainable aviation fuel supply.

- Establish biofuel dispensing stations to cater to retail energy and flex-fuel requirements.

- Increase the supply of products allied with production processes.

- Grow through MoUs, Pilot Projects, Joint Ventures (JVs), and Strategic Acquisitions

Object of the Issue

The company plans to use the net proceeds to finance the following goals –

- Funding capex for setting up multi-feed stock operations to pave the way for utilizing grains as an extra raw material in ethanol plants at “TBL Unit 4” of 300 KLPD capacity,

- Funding working capital requirements,

- General corporate purposes.

ALSO READ – New gst rate cut

Company Promoters

- Vijaykumar Murugesh Nirani,

- Vishal Nirani,

- Sushmitha Vijaykumar Nirani

IPO Details

IPO date = 25 to 29 September 2025

Minimum Amount = ₹14,880

Minimum Bid = 30 Shares

Face Value (FV) = ₹10

Listing On = NSE, BSE

Book Running Lead Managers

DAM Capital Advisors

SBI Capital Markets

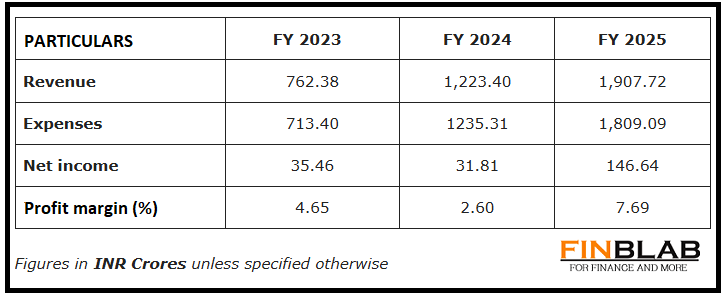

Financials

CONCLUSION

FinBlab recommends ‘ MAY SUBSCRIBE‘ ratings on TruAlt Bioenergy IPO (keeping a long-term view in mind)

Do come back to know more about “upcoming ipos“

Disclaimer: The contents and data presented here are just for your information & personal use only. While much effort is made to provide the information, I ( Vishal Dalwadi ) or “FinBlab” do not guarantee the accuracy, correctness, completeness or reliability of any information or data displayed herein and shall not be held responsible.