Pine Labs IPO – Review

Pine Labs Limited, an Indian company that provides point-of-sale (POS) and payment systems, is planning to raise ₹3,900 Crore through an IPO.

[Fresh Issue ₹2,080 Cr + OFS ₹1,820 Cr]

Pine labs ipo price is ₹210 – ₹221 per share

Pine Labs: History

The Company was originally incorporated as Pine Labs Private Limited, a private limited company under the Companies Act, 1956, at New Delhi, India, on May 18, 1998.

The Company was then converted into a public limited company under a special resolution passed by the shareholders on May 16, 2025, and its name was changed to Pine Labs Limited under a fresh certificate of incorporation issued by the RoC on June 06, 2025.

LAST ARTICLE – Groww ipo review

Pine Labs: Business

Pine Labs Ltd, a technology company in India focused on digitizing commerce through digital payments and issuing solutions for consumer brands & enterprises, merchants, and financial institutions.

The Company’s Digital Infrastructure and Transaction Platform comprises –

- In-Store and Online Payments,

- Affordability,

- Value-Added Services,

- Prepaid Card Issuance,

- FinTech Infrastructure Solutions

The Company’s Issuing and Acquiring Platform comprises issuing, processing & distribution of prepaid solutions and engagement solutions, along with unified issuing and acquirer processing platforms.

With the help of cloud-based software technology, the company helps digitize, simplify, and make commerce more secure for the ecosystem of consumer brands & enterprises, merchants, and financial institutions, ultimately empowering them to serve customers and enable consumption.

In addition to this, the company offers issuing and acquiring solutions to financial institutions, enabling the issuance of debit cards, credit cards, foreign exchange cards, and prepaid cards to customers, as well as providing merchant acquiring solutions.

Transaction Value

In FY 2025, the company has processed ₹11,42,497 Cr in gross transaction value (GTV) across 568 cr transactions, serving 716 consumer brands and enterprises, 9,88,304 merchants, and 177 financial institutions.

Client Base

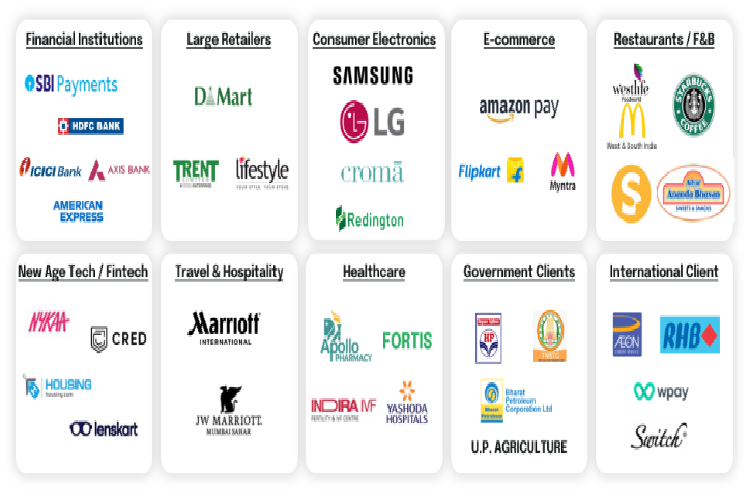

The Company’s client base spans industries such as consumer electronics, department stores and retailers, e-commerce, financial institutions and banks, FinTech companies, grocery, healthcare, lifestyle, restaurants, supermarkets, travel and hospitality, and new-age technology companies.

Certain prominent ecosystem partners of the company are –

Strategies Ahead

- Increase adoption of existing offerings and expand the offerings suite.

- Enter new overseas markets and expand within existing overseas markets.

- Broaden and deepen the partnership ecosystem.

- Invest in a technology platform.

- Continue to pursue strategic acquisitions and investments.

Refer to Pine Labs IPO DRHP for detailed Information.

IPO Details

Pine Labs IPO date = 07 – 11 Nov 2025

Minimum Amount = ₹14,807

Minimum Bid = 67 Shares

Face Value (FV) = ₹1

Listing On = NSE, BSE

Book Running Lead Managers

Axis Capital

Morgan Stanley India

Citigroup Global Markets

J.P. Morgan India

Jefferies India

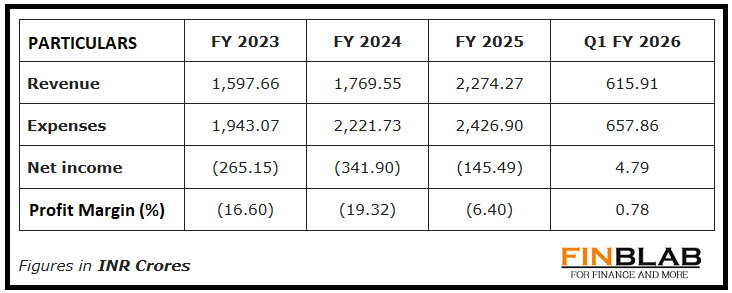

Financial

CONCLUSION

FinBlab recommends ‘NEUTRAL‘ ratings (for the time being) on Pine Labs IPO

Do come back to know more about “upcoming ipos“

Disclaimer: The contents and data presented here are just for your information & personal use only. While much effort is made to provide the information, I (Vishal Dalwadi) or FinBlab do not guarantee the accuracy, correctness, completeness or reliability of any information or data displayed herein and shall not be held responsible.