Clean Max Enviro Energy IPO Review

Clean Max Enviro Energy Solutions Limited, a leading industrial and commercial renewable energy provider in India, is planning to raise ₹3,100 crore through an Initial Public Offering (IPO).

[Fresh Issue ₹1,200 Cr + OFS ₹1,900 Cr]

Clean max enviro energy solutions ipo price is ₹1000 – ₹1053 per share

Clean Max Enviro Energy: History

The company was originally incorporated as Clean Max Enviro Energy Solutions Private Limited, at Mumbai, Maharashtra, India, as a private limited company under the provisions of the Companies Act, 2013, on September 29, 2010.

It was then converted into a public limited company under a special resolution passed by the shareholders at the extraordinary general meeting (EGM) on July 14, 2025.

Its name was subsequently changed to Clean Max Enviro Energy Solutions Limited under a fresh certificate of incorporation issued by the Registrars of Companies (RoC) on August 7, 2025.

Clean Max Enviro Energy: Business

With nearly 15 years of experience since its inception in 2010, Clean Max specializes in delivering Net Zero and decarbonization solutions.

The Company offers a range of renewable energy offerings to clients under two business segments:

- Renewable Energy Power Sales Segment; and

- Renewable Energy Services Segment.

Its expertise spans providing energy contracting, EPC services, and operation and maintenance services of renewable energy plants, including wind, solar, and hybrid plants, within clients’ premises and within CleanMax-developed renewable energy farms.

The Company provides its services to data centres, AI and technology industries, and commercial & industrial enterprises across a range of sectors, including cement, FMCG, infrastructure, industrial manufacturing, pharmaceuticals, real estate, steel, and global capability centres (GCC).

Clean Max also provides end-to-end decarbonization solutions to clients, including turnkey development and O&M solutions for renewable energy power plants, as well as carbon credits solutions.

Largest Energy Provider

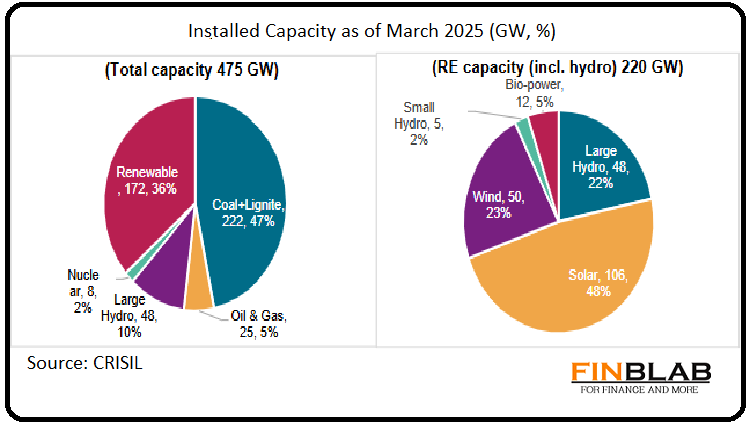

According to the CRISIL report, Clean Max is India’s largest commercial and industrial (C&I) renewable energy provider, as of March 31, 2025.

Capacity

As of July 31, 2025, Clean Max has 2.54 gigawatt (GW) of operational, owned, and managed capacity and an additional 2.53 GW of contracted capacity under execution.

Strategies Ahead

- Preserving Core Purpose and Values

- Evolving Operating Practices and Strategies

Company Promoters

- Kuldeep Jain,

- Pratap Jain,

- Nidhi Jain,

- BGTF One Holdings (DIFC) Limited,

- Kempinc LLP

Refer to Clean Max Enviro DRHP for detailed information.

IPO Details

ipo date: 23 Feb – 25 Feb 2026

Minimum Amount: ₹14,742

Minimum Bid: 14 Shares

Face Value: ₹1

Listing On: NSE, BSE

Financial

Book Running Lead Managers

Axis Capital, BNP Paribas, BOB Capital, HSBC Securities and Capital Markets, IIFL Capital, Nomura Financial Advisory, SBI Capital, and J.P.Morgan India.

CONCLUSION

FinBlab recommends ‘NEUTRAL‘ ratings on Clean Max Enviro Energy Solutions Limited IPO.

Do come back to know more about “upcoming ipos“

Disclaimer: The contents and data presented here are just for your information & personal use only. While much effort is made to provide the information, I (Vishal Dalwadi) or “FinBlab” do not guarantee the accuracy, correctness, completeness or reliability of any information or data displayed herein and shall not be held responsible.