Rail Vikas Nigam Limited IPO: Company Profile, Price, Analysis

Rail Vikas Nigam Limited (RVNL), a wholly owned government company, a Miniratna (Category – I) Schedule ‘A’ Central Public Sector Enterprise, is planning to raise INR 430.88 Cr to 481.57 Cr (all OFS) via initial public offer (IPO)

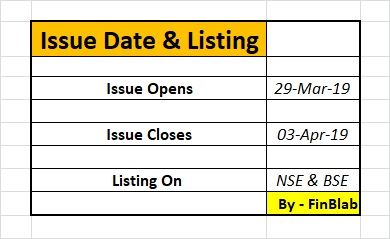

rail vikas nigam ipo date is 29 March 2019 to 3 April 2019

Rail Vikas Nigam Limited – Company Profile

Rail Vikas Nigam Limited was incorporated on 24-1-2003 with an objective to undertake rail project development, mobilization of financial resources and implementation of rail projects pertaining to strengthening of golden quadrilateral and port connectivity and rising of extra-budgetary resources for project execution.

RVNL functions as an extended arm of the Ministry of Railways working for & on behalf of MoR.

Since its inception in 2003, MoR has transferred 172 projects to Rail Vikas Nigam of which 166 projects are sanctioned for execution. Out of these, 60 projects have been fully completed totaling to INR 167,777.00 million and the balance is on-going.

The Company has an order book of INR 686,836.20 million as on February 28, 2018, which includes 106 on-going projects.

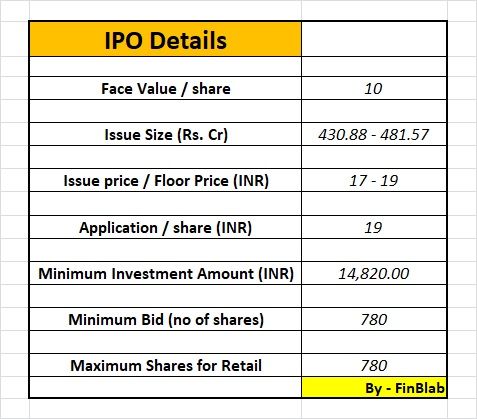

rail vikas nigam limited ipo price set at INR 17 to INR 19

Rail Vikas Nigam Limited – Business Activities

RVNL is in the business of executing all types of railway projects including new lines, doubling, gauge conversion, railway electrification, metro projects, workshops, major bridges, construction of cable stayed bridges, institution, buildings etc…

New Lines: This includes augmenting the rail network by laying new lines. The objective of laying new lines includes achieving seamless multi-modal transportation network across the country and connecting remote areas.

Doubling: Doubling involves the provision of additional lines by way of doubling the existing routes to enable the Indian Railways to ease out traffic constraints of single line and increase the charted capacity.

Gauge Conversion: This includes conversion of meter gauge lines to broad gauge railway lines.

Railway Electrification: This includes electrification of the current un-electrified rail network and electrification on the new rail network.

Metropolitan Transport Projects: This includes setting up of metro lines and suburban network in metropolitan cities.

Workshops: This includes workshops for repairing rolling stock and other repairs.

Others: This includes but is not limited to the construction of car sheds, construction of bridges including rail over bridges, the building of subways in lieu of crossings etc.

Work Execute

During the financial year ending 31 March 2018, RVNL has completed a total of 885.50 rkm (Route Kilometers) of project length which included 315.20 rkm of doubling and 425 rkm of railway electrification.

Company Promoters

The promoter of the company is the President of India.

IPO Opening / Closing Date

IPO Details – Price, Minimum Bid and Other

Rail Vikas Nigam Limited – Financials

Revenue

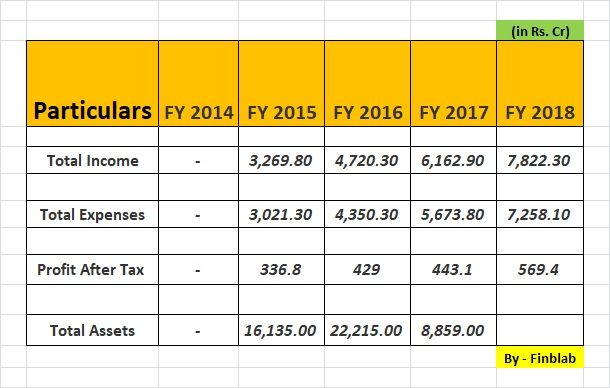

RVNL posted steady revenue growth in the last four years. Top-line for FY 2015 stood at INR 3269.80 Cr and the same was stood at INR 7822.30 Cr for the period ended 31 March 2018

Profit

Same as Revenues, the company able to post steady growth in the bottom-line. RVNL reported a Net Profit of INR 336.80 Cr for FY 2015 and the same was stood at INR 569.40 Cr for the period ended 31 March 2018

CONCLUSION –

Considering the company’s valuation and financial parameters, FinBlab recommends SUBSCRIBE ratings on Rail Vikas Nigam Limited IPO

Also Read

Value Pick Stock for the month of March 2019 – Kirloskar Brothers Limited

5 Lessons To Learn From Long Term Investors

Disclaimer: The contents and data presented here are just for your information & personal use only. While much effort is made to provide the information, I ( Vishal Dalwadi ) or “FinBlab” do not guarantee the accuracy, correctness, completeness or reliability of any information or data displayed herein and shall not be held responsible.