Avalon Technologies Limited IPO – Review

Avalon Technologies Limited – a global, vertically integrated electronic manufacturing services company is planning to raise INR 865 Crore via IPO [Fresh Issue 320 Cr + 545 Cr OFS]

avalon technologies ipo price is fixed at INR 415 – 436 per share

Avalon Technologies: History

The Company was originally incorporated as Avalon Technologies Private Limited, at Chennai under the Companies Act, 1956 on 3rd November, 1999, and was issued the certificate of incorporation by the Registrar of Companies.

The name of the Company was changed to “Avalon Technologies Limited” on 6th July, 2022, pursuant to a special resolution passed by the shareholders of the Company and a fresh certificate of incorporation was issued by the Registrar of Companies on 29th July, 2022 under the Companies Act, 2013.

Must Read: 6 mutual fund investment tips to generate better returns

Avalon Technologies: Business

The Company is one of the leading fully integrated “Electronic Manufacturing Services” (EMS) companies with end-to-end capabilities in delivering box build solutions in India.

It provides a full stack product and solution suite, right from Printed Circuit Board (PCB) design and assembly to the manufacture of complete electronic systems (Box Build), to the global original equipment manufacturers (OEMs), including OEMs located in the China, Japan, Netherlands, and the United States.

The company’s capabilities include –

- PCB design and assembly,

- cable assembly and wire harnesses,

- sheet metal fabrication and machining,

- magnetics,

- injection molded plastics, and

- end-to-end box build of electronic systems

Avalon Technologies specialize in manufacturing and providing design support for sub-assemblies, critical integrated assemblies, components & enclosures for multiple industry verticals.

The end-use industries the company cater to include an established and long product lifecycle industries (like mobility, industrial, and medical devices) and high growth/sunrise industries (like electric vehicles, solar, and hydrogen in the clean energy sector and digital infra in the communications sector.

Key Client List

- Collins Aerospace,

- e-Infochips Private Limited,

- Kyosan India Private Limited,

- The US Malabar Company,

- Zonar Systems Inc.,

- Meggitt (Securaplane Technologies Inc) and

- Systech Corporation

Manufacturing Facilities

The Company has 12 manufacturing facilities,

- In India ( 8 + 2 manufacturing plats in Chennai and Bengaluru )

- In the United States ( 1 + 1 plants in California and Atlanta )

Strategies Ahead

- Catering to high-growth sunrise industry

- Consolidate and expand position in global markets for existing industry verticals

- Creating high growth opportunities for existing offerings

- Focus on expanding local manufacturing presence in largest markets

- Continue to build on hybrid business model of delivery leveraging access to low cost production base and high value market

- Invest in expanding manufacturing capacities and technological capabilities

Company Promoters

- Kunhamed Bicha

- Bhaskar Srinivasan

IPO Details

Dates = 3 to 6 April 2023

Minimum Amount = INR 14824

Face Value (FV) = INR 2

Minimum Bid = 34 Shares

Listing On = NSE, BSE

Book Running Lead Managers

JM Financial Limited,

DAM Capital Advisors Limited,

IIFL Securities Limited,

Nomura Financial Advisory and Securities (India) Private Limited,

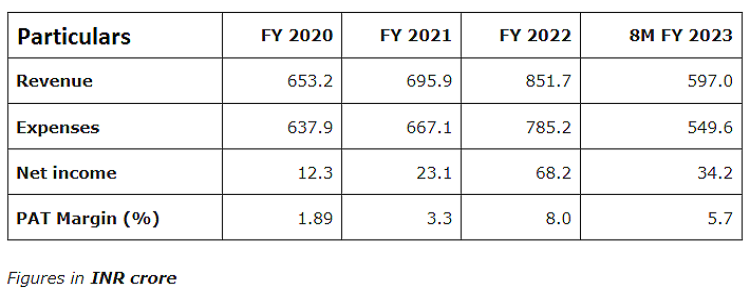

Financials

CONCLUSION

FinBlab recommends SUBSCRIBE ratings on avalon technologies ipo

Last Article: global surfaces ltd ipo

Disclaimer: The contents and data presented here are just for your information & personal use only. While much effort is made to provide the information, I ( Vishal Dalwadi ) or “FinBlab” do not guarantee the accuracy, correctness, completeness or reliability of any information or data displayed herein and shall not be held responsible.