Divgi TorqTransfer Systems IPO – Review

Divgi TorqTransfer Systems Limited – a Tier 1 product leader in automotive drivetrain components and solutions – is planning to raise INR 412 Crore via IPO [Fresh Issue 180 Cr + 232 Cr OFS]

divgi torqtransfer systems ipo price is fixed at INR 560 to INR 590

Divgi TorqTransfer Systems – History

Divgi Metalwares Private Limited (now Divgi TorqTransfer Systems) was started in the year 1964 as a small-scale manufacturing enterprise (SME) specializing in the manufacturing of gears and screwed machined parts.

With innovation and creativity, the company has evolved to become one of country’s leading Tier 1 companies in the design, development, and manufacturing of advanced drivetrain components and systems.

Also Read – 6 mutual fund investment tips to generate better returns

Divgi TorqTransfer Systems – Business

- The Company is amongst the very few automotive component entities in India who have the capability to develop and provide (1) system level transfer case, (2) torque coupler, and (3) dual clutch automatic transmissions (DCT) solutions (source: CRISIL Report).

- It is one of the leading players supplying transfer case systems to automotive original equipment manufacturers in India and the largest supplier of transfer case systems to PV manufacturers in India (source: CRISIL Report).

- It is the sole player manufacturing and exporting transfer cases to the overseas OEMs from India, and the sole manufacturer of torque couplers in India (source: CRISIL Report).

The Company manufacture and supply a variety of products under the broad categories of –

(i) Torque Transfer Systems (it includes 4 wheel drive – 4WD and all wheel drive – AWD products);

(ii) synchronizer systems for manual transmissions and DCT; and

(iii) components for the above-listed product categories for torque transfer systems and synchronizer systems in manual transmission, EVs, and DCT.

The Company have also developed –

(i) transmission systems for EVs;

(ii) DCT systems; and

(iii) rear wheel drive manual transmissions

Manufacturing Facilities

The company has 3 manufacturing facilities located at –

- Sirsi in Karnataka,

- Shivare in Pune, Maharashtra

- Bhosari near Pune in Maharashtra

Client List

Divgi TorqTransfer Systems has, over the years built an enviable client base which includes Mahindra & Mahindra, Tata Motors, and Toyota.

Global Footprint

The company has stamped its global footprint being a trusted supplier to clients in the USA and UK in the west to China, Korea, Thailand, and Japan in the east.

Strategies Ahead

- Gaining market opportunities in the growing EV space,

- Capturing market opportunities in the fast-growing demand for automatic transmissions in the passenger UVs segment,

- Improve market and wallet share by increasing customer and geographic diversification,

- Cost optimization through product engineering and localisation,

- Focus on Research & Development to manufacture diverse products and expand into products to serve new and emerging trends

Company Promoters

- Jitendra Bhaskar Divgi,

- Hirendra Bhaskar Divgi, and

- Divgi Holdings Private Limited

Anchor Investor

Infosys founder Nandan Nilekani and his trust, NRJN, owns 23.94 lakh shares or 8.7% equity in Divgi Torqtransfer. NRJN Family Trust, will offload 14.4 lakh shares of the company.

IPO Details

Dates = 1 March 2023 to 3 March 2023

Face Value (FV) = INR 5

Minimum Investment Amount = INR 14750

Minimum Bid = 25 Shares

Listing On = BSE, NSE

Book Running Lead Managers

Inga Ventures Private Limited, Equirus Capital Private Limited,

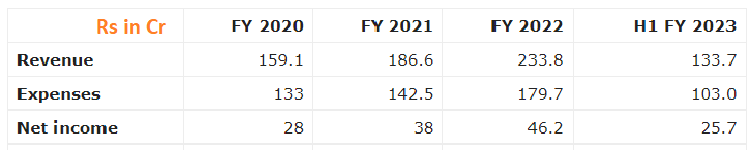

Financials

Conclusion

FinBlab recommends SUBSCRIBE ratings on divgi torqtransfer systems ipo

Disclaimer: The contents and data presented here are just for your information & personal use only. While much effort is made to provide the information, I ( Vishal Dalwadi ) or “FinBlab” do not guarantee the accuracy, correctness, completeness or reliability of any information or data displayed herein and shall not be held responsible.