Chalet Hotels IPO – Company Profile, Price, Analysis

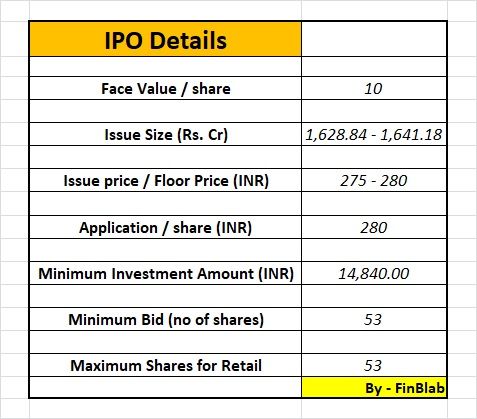

Chalet Hotels Limited (CHL) – a part of the K. Raheja Corp, a developer and asset manager of high-end hotels in key metro cities in India is planning to raise INR 1,628.84 Cr to 1,641.18 Cr via IPO [Fresh Issue (INR 950 Cr) and Offer for Sale (INR 678.84 Cr to INR 691.18 Cr)]

Chalet Hotels – Company Profile

Incorporated in the year 1986, Mumbai based Chalet Hotels Limited is a company engaged in the business of owing, developing and asset manager of high-end hotels in key metro cities in India.

CHL’s hotel platform comprises 5 operating hotels including a hotel with a co-located serviced residence, located in the key Indian cities like Mumbai, Hyderabad and Bengaluru, representing 2,328 keys as of March 31, 2018.

The Company’s hotels are currently branded with global hospitality brands such as JW Marriott, Westin, Marriott, Marriott Executive Apartments, and Renaissance etc…

Chalet Hotels – Company Strength

The strength of the CHL’s hotel platform is based on strategic locations, efficient design and development of the hotels. The company generally develops its hotels in strategic, high density locations on large land parcels, allowing it to situate a greater number of rooms, as well as provide a wide range of amenities, such as, fine dining and specialty restaurants, large banquet and outdoor spaces.

CHL also endeavour to build hotels to superior standards targeting the luxury-upper upscale and upscale hotel segments at an efficient gross built up area and development cost per key.

All the hotel assets are located in high density business districts of their respective metro cities with high barriers-to-entry close to airports, major business centres or commercial districts and other convenient locations.

Awards and Accreditations

CHL received several awards and accreditations which includes –

- ‘Most Preferred Business Hotel of the Year’ & ‘Most Preferred Luxury Hotel of the year’ awarded to JW Marriott Mumbai Sahar by CMO Asia Awards, 2017,

- ‘Best Business Hotel’ of the year awarded to The Westin Hydrabad Mindspace, by CMO Asia Awards, 2016 to name a few.

Company Promoters

Promoters of Chalet Hotels Limited include Ravi C Raheja, Neel C Raheja, K Raheja Corp Private Limited, K Raheja Private Limited, Ivory Properties and Hotels Private Limited, Genext Hardware & Parks Private Limited, Touchstone Properties and Hotels Private Limited, Cape Trading LLP, Capstan Trading LLP, Casa Maria Properties LLP, Anbee Constructions LLP, Palm Shelter Estate Development LLP, Raghukool Estate Development LLP and Ivory Property Trust

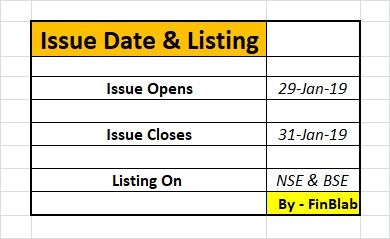

IPO Opening / Closing Date

IPO Details – Price, Minimum Bid and Other

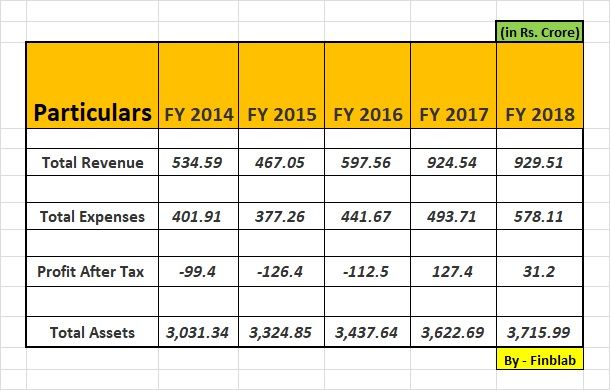

Chalet Hotels – Financial Performance

Revenues

Chalet Hotels Limited shows a steady revenue growth in the recent past. Top-line has been increasing regularly for the last 4 years and jumped from INR 467.05 Cr in FY 2015 to INR 929.51 Cr for the period ended FY 2018.

Profits

Though the company has shown steady growth in revenue since last four years, the company failed to registered growth in profits in these years. The Company registered loss of INR 99.4 Cr in FY 2015, and the same was stood at INR 31.2 Cr for the period ended FY 2018.

CONCLUSION –

Considering company’s valuation and financial parameters, FinBlab recommends AVOID ratings on Chalet Hotels Limited IPO

Also Read –

1) Finblab’s Value Pick Stock for the month of January 2019 – Vadilal Industries Limited

Disclaimer: The contents and data presented here are just for your information & personal use only. While much effort is made to provide the information, I ( Vishal Dalwadi ) or “FinBlab” do not guarantee the accuracy, correctness, completeness or reliability of any information or data displayed herein and shall not be held responsible.