Fusion Micro Finance Limited IPO – Review, Update

Update

Fusion Micro Finance ‘LISTING‘

Fusion Micro Finance Limited made a weak/disappointing debut on the stock market today.

The stock was listed at INR 359.50 (2.3% discount) on the National Stock Exchange (NSE) against the issue price of INR 368, while the opening on the BSE was at INR 360.50.

In a higher inflation rate scenario; declining in profit margins and fear of possible bad loans are some of the reasons that pull the stock price down.

The Company is among the top 10 microfinance companies in India and offers loans to women entrepreneurs.

At the end of the market, the stock of Fusion Micro Finance closed at INR 325 (almost 12% lower from its IPO price) with a volume of 1,67,28,869 shares on the NSE.

Also Read: FinBlab view on Keystone Realtors IPO

31 Oct 2022

Fusion Micro Finance Limited – a registered NBFC (MFI) which operates in a “Joint Liability Group” lending model of Grameen is planning to raise INR 1135 Cr via IPO [Fresh Issue 600 Cr + OFS 535 Cr]

Fusion Micro Finance Limited: Company Profile

Fusion Micro Finance Limited was incorporated in the year 1994 with the core idea of creating opportunities at the bottom of the pyramid, and the company does so by providing financial services to underserved and unserved women in rural and semi-rural areas across India.

Fusion Micro Finance Limited: Business

Fusion Micro Finance is engaged in the business of providing financial services to women entrepreneurs belonging to the economically and socially deprived section of society.

The Company’s responsibilities are not restricted merely to providing financial support to women entrepreneurs but also to explaining to the clients to manage their financials by spreading Financial Literacy to them.

Fusion Micro Finance is one of the youngest companies among the top ten Non-Banking Financial Company-MFIs in India in terms of AUM as of March 31, 2021 (CRISIL Report).

In addition, the company had the third fastest gross loan portfolio growth of 44% among the top NBFC-MFIs in India between the financial year 2018 and 2021 (CRISIL Report).

Fusion Micro Finance: Network

As of March 31, 2021, the company has 2.90 million active borrowers which were served through a network of 966 fusion microfinance branches and 9,262 employees spread across 377 districts in 19 states and union territories in India.

Company Strengths

- Well Diversified and Extensive Pan-India Presence

- Proven Execution Capabilities with Strong Rural Focus

- Robust Underwriting Process and Risk Management Policies

- Technologically Advanced Operating Business Model

- Stable and Experienced Management Team

Strategies Ahead

- Deepen, Strengthen, and Expand Geographic Presence

- Leverage its Network, Domain Expertise, and Data to Enhance Product Offering

- Continue to Diversify the Borrowing Mix and Reduce the Cost of Funds

- Customer interaction and collections

- Maintaining liquidity position and reducing our cost of funds

Promoters

- Devesh Sachdev,

- Creation Investments Fusion LLC,

- Creation Investments Fusion LLC

- Honey Rose Investment Ltd

IPO DETAILS

Dates = 02 Nov 2022 to 04 Nov 2022

Face Value (FV) = INR 10

Issue Price / Floor Price = INR 350 to INR 368

Application per Share = INR 368

Minimum Investment Amount = INR 14720

Minimum Bid = 40 Shares

Maximum Shares for Retail = N.A.

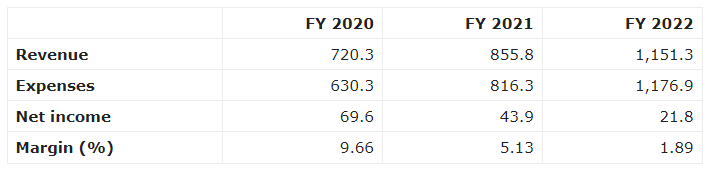

FINANCIALS

Conclusion

Considering the company’s financial parameters, FinBlab recommends AVOID ratings on fusion microfinance limited ipo

Also Read: DCX Systems Limited IPO

Disclaimer: The contents and data presented here are just for your information & personal use only. While much effort is made to provide the information, I ( Vishal Dalwadi ) or “FinBlab” do not guarantee the accuracy, correctness, completeness or reliability of any information or data displayed herein and shall not be held responsible.