Keystone Realtors IPO – Review

Keystone Realtors Limited (rustomjee group company) – one of the prominent “real estate developers” in the Mumbai Metropolitan Region is planning to raise INR 635 Crore via IPO [Fresh Issue 630 Cr + OFS 75 Cr]

keystone realtors share price is fixed at INR 541

Keystone Realtors: History

The Company was incorporated as ‘Keystone Realtors Private Limited’, in Mumbai, under the provisions of Companies Act, 1956 pursuant to a certificate of incorporation dated November 6, 1995 issued by the Registrar of Companies.

Keystone Realtors: Business

The company is engaged primarily in the business of real estate construction, development and other related activities in the micro market.

As of March 31, 2022, Keystone Realtors had 32 completed projects, 12 on-going projects and 19 forthcoming projects across the Mumbai Metropolitan Region (MMR) that includes a comprehensive range of projects under the affordable, mid and mass, aspirational, premium and super premium categories, all under the “Rustomjee” brand.

As of 30 June 2022, the company has developed 20.22 million square feet of –

High-value and affordable residential buildings,

Corporate parks,

Premium gated estates,

Retail spaces,

Schools,

Townships,

Iconic landmarks, and

Other real estate projects

Market Share

Keystone Realtors command a market share of 28% in Khar, 23% market in Juhu, 11% in Bandra East, 14% in Virar, 3% in Thane and 5% in Bhandup in terms of absorption (in units) from 2017 to 2021 (Source: Anarock Report)

Strategies Ahead

- Leverage the ‘Rustomjee’ brand to grow our asset-light operations

- Improve operational efficiency with technological innovation

- Leverage leadership position in the premium category to grow company’s presence in the mid and aspirational category

- Focus on sustainability

Promoters

- Boman Rustom Irani,

- Percy Sorabji Chowdhry,

- Chandresh Dinesh Mehta

IPO DETAILS

Dates = 14 Nov 2022 to 16 Nov 2022

Face Value (FV) = INR 10

Issue Price = INR 514 to INR 541

Minimum Investment Amount = INR 14607

Minimum Bid = 27 Shares

Listing On = BSE, NSE

BOOK RUNNING LEAD MANAGERS

Axis Capital Limited, Credit Suisse Securities (India) Private Limited

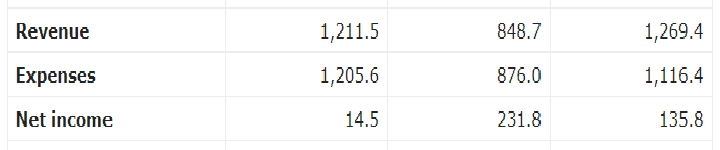

FINANCIALS (Rs in Cr)

Conclusion

FinBlab recommends NEUTRAL ratings on Keystone Realtors IPO

Also Read:

FIIs Increased Stake in these stocks

Disclaimer: The contents and data presented here are just for your information & personal use only. While much effort is made to provide the information, I ( Vishal Dalwadi ) or “FinBlab” do not guarantee the accuracy, correctness, completeness or reliability of any information or data displayed herein and shall not be held responsible.