IndoStar Capital Finance Limited IPO – Details, Update

Update

Q1 FY 2022-23 Earnings

IndoStar Capital Finance Limited – a non-banking finance company engaged in providing structured term financing solutions to corporates has posted its Q1 numbers today.

The consolidated total revenue of the company for the quarter ended 30 June 2022 stood at INR 313.82 Cr as against INR 264.76 Cr for the same period last year, registering a growth of 18.53% year-on-year basis,

However the revenue for the last quarter ended 31 March 2022 of the company was INR 340.62,

Interest income from commercial vehicles is the highest revenue generator for the company followed by SME income, then Housing finance, and lastly large corporate,

Expenses

INR 247.78 Cr as on 30 June 2022,

INR 314.51 Cr as on 30 June 2021,

INR 1260 Cr as on 31 March 2022

PAT

For the quarter ended 30 June, 2022 the PAT of the company stood at INR 60.93 Cr (driven by lower credit cost provisions in the commercial vehicle loan segment from Q4 FY22) which was a net loss of INR 36.82 Cr for the same period last year,

The company posted a net loss of INR 753.66 Cr for the previous quarter ended 31 March 2022; (impairment on financial instruments of INR 1036.34 Cr occurred last quarter)

Credit Ratings

The credit ratings of the Company have been recently reviewed, after the release of financial results for the year ended 31 March 2022.

CRISIL has maintained the AA- / A1+ rating (with negative implications).

CARE has assigned ratings of A+ / A1+ (with negative implications).

Daily Chart –

indostar capital share price is INR 155.60 on the NSE when the market close last Friday, while the volume is 2,04,449 shares.

Indostar capital is currently trading at 62.5 percent lower when compared to its 52-week high of INR 417.

Must Read: Nifty prediction for August 2022

7 May 2018

IndoStar Capital Finance – a non-banking finance company (NBFC) registered with the Reserve Bank of India (RBI) is planning to raise INR 1840 – 1844 Cr via initial public offer (IPO) [Fresh Issue (INR 700 Cr) and Offer for Sale (INR 1140 – 1144 Cr)]

IndoStar Capital Finance – Company Profile

Incorporated in the year 2009, Mumbai based IndoStar Capital Finance Limited is a leading non-banking finance company (NBFC) registered with the Reserve Bank of India as a systemically important non-deposit taking company.

Working Area

- IndoStar Capital Finance Limited is a professionally managed and institutionally owned organization.

- The Company is primarily engaged in providing structured term financing solutions to corporates and loans to small and medium enterprise (SME) borrowers in India.

- The Company has recently expanded its portfolio to offer (1) Vehicle Finance, and (2) Housing Finance products through its wholly-owned subsidiary IndoStar Home Finance Private Limited.

Product Portfolio

1) CORPORATE LENDING

- Lending to mid-to-large sized corporates in manufacturing, services and infrastructure industries, by way of senior secured debt, structured financing, promoter financing and special situation funding.

- Lending to real estate developers, mainly for financing project level construction of residential and commercial building projects and take-out of early-stage equity investors.

- The Company generally provides lending solutions against tangible collateral as well as security in other forms, such as charge on operating cash flows.

2) SME LENDING

- The Company provides secured loans for business purposes to small and medium size enterprises, including businessmen, traders, manufacturers and self-employed professionals. The property securing these loans is typically completed and largely self-occupied residential and commercial property.

- The Company currently provide SME loans from our branches located in ten key locations across India, namely Ahmedabad, Bengaluru, Chennai, Delhi, Hyderabad, Indore, Jaipur, Mumbai, Pune, and Surat.

3) VEHICLE FINANCE

- The Company commenced Vehicle Finance operations from November 2017.

- The Company provides financial assistance for purchases of used or new commercial vehicles, passenger vehicles and two-wheelers.

4) HOUSING FINANCE

- The Company operates its housing finance business through its wholly-owned subsidiary IndoStar Home Finance Private Limited.

- The Company provides affordable home finance to the salaried and self-employed customers for the purchase of residential properties.

Lenders

The lenders of the company include, among others, 14 public sector banks, 13 private sector banks, 21 mutual funds and four insurance companies and other financial institutions.

Company Network

The distribution network includes approximately 210 personnel in its in-house sales team, and approximately 648 third-party direct sales associates (DSAs) and other third-party intermediaries.

IndoStar Capital Finance – CREDIT RATINGS

- IndoStar is rated by CARE Ratings Ltd., ICRA Limited, CRISIL Limited and India Rating & Research Private Limited (Fitch Group).

- IndoStar enjoys AA – (minus) rating for Long Term borrowings and highest short term rating of A1+ (plus) for Short Term borrowings.

Company Promoters:

The Promoter of the Company is Indostar Capital

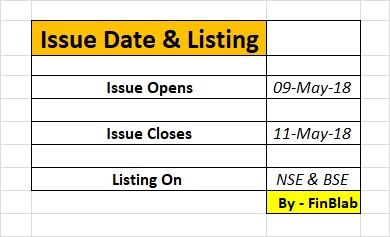

IPO Opening / Closing Date

IPO Details – Price, Minimum Bid and Other

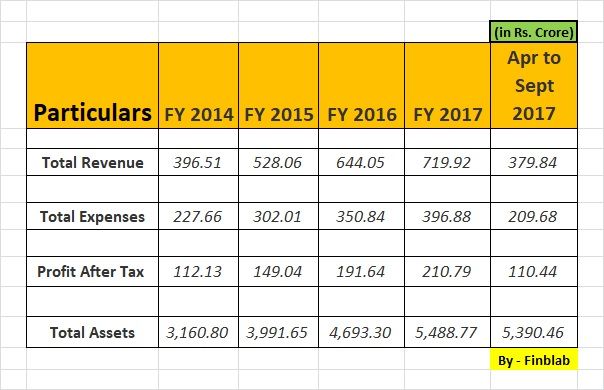

Financial Performance

Revenues

IndoStar Capital Finance shows steady revenue growth in recent years. Top-line has been increasing regularly for the last 4 years and jumped from INR 396.51 Cr in FY 2014 to INR 719.92 Cr for the period ended FY 2017. (379.84 Cr till Sept 2017)

Profits

Though the company has shown steady growth in revenue, the company has also registered growth in profits in these 4 years. Starting from INR 112.13 Cr of profits in FY2014, the company’s earnings improved to INR 210.79 Cr for the period ended FY 2017. (110.44 Cr till Sept 2017)

CONCLUSION –

Considering company’s valuation, financial parameters, and the sector potential in which it is operating, FinBlab recommends SUBSCRIBE ratings on IndoStar Capital Finance Limited IPO

Also Read –

1) Indian Stock Market Weekly Analysis by Finblab

2) Finblab’s Valuepick Stock for the month of May – GMM PFAUDLER LIMITED

Disclaimer: The contents and data presented here are just for your information & personal use only. While much effort is made to provide the information, I ( Vishal Dalwadi ) or “Fin Blab” do not guarantee the accuracy, correctness, completeness or reliability of any information or data displayed herein and shall not be held responsible.