Archean Chemical IPO – Details, Update

Update

Archean Chemical Industries ‘LISTING‘

Archean Chemical Industries Limited made a healthy debut on the stock market today.

The stock was listed at INR 450 (10.50 percent premium) on the National Stock Exchange (NSE) against the issue price of INR 407, while the opening on the Bombay Stock Exchange (BSE) was at INR 449.

The Company made a double-digit gain on the back of reasonable valuations and a fancy demand in specialty chemicals industry which is well supported by China plus one strategy.

The Company is one the leading “specialty marine chemical manufacturers” in India (high entry barriers industry) and the largest exporter of bromine and industrial salt.

At the end of the market, the stock of Archean Chemical Industries closed at INR 458.15 (almost 12.5% higher from its IPO price) with a volume of 2,21,87,351 shares on the NSE.

Also Read: INDIAN STOCK MARKET JOURNEY FROM 100 TO 62000 POINTS

8 November 2022

Archean Chemical Industries Limited – a leading “specialty marine chemical manufacturer” in India is planning to raise INR 1462 Crore via IPO [Fresh Issue 805 Cr + OFS 657 Cr]

archean chemical industries share price fixed at INR 407

Archean Chemical: History

Archean Chemical was originally formed as a partnership firm under the name of Archean Chemical Industries in Chennai, under a partnership deed dated November 20, 2003 which was registered under the Indian Partnership Act, 1932 with the Registrar of Firms, Chennai on November 25, 2003.

Archean Chemical: Business & Products

The Company is a leading specialty chemicals manufacturing company based in India with a wide presence in the global markets.

According to Frost & Sullivan, Archean Chemical is the largest exporter of bromine and industrial salt in India in Fiscal 2021 and has amongst the lowest cost of production globally in both bromine and industrial salt. (Source: Company Commissioned F&S Report)

The Company is the first of its kind integrated plant in India to produce Industrial Salt, Bromine, and Sulfate of Potash.

Find more about archean chemical products

- Bromine is used as key initial-level material, which has applications in agrochemicals, flame retardants, pharmaceuticals, water treatment, additives, oil & gas, and energy storage batteries.

- Industrial salt is an important raw material used in the chemical industry for the production of sodium carbonate (soda ash), bleaching powders, chlorates, caustic soda, hydrochloric acid, chlorine, sodium sulphate (salt cake), and sodium metal.

- Sulphate of potash is used as a fertilizer and also has medical uses.

The Company markets the products to 18 global customers in 13 countries and to 24 domestic customers.

Archean Chemical: Production Facility

The company has an integrated production facility for the bromine, industrial salt, and sulphate of potash operations, located at Hajipir (Gujarat), located on the northern edge of the “Rann of Kutch” brine fields.

Strategies Ahead

- Expand into downstream bromine derivative performance products

- Expand bromine and industrial salt capacities

- Continue to build a global customer base and enter new geographical markets

- Continue to focus on quality, environment, health, and safety

Promoters

- Chemikas Speciality LLP,

- Ravi Pendurthi, and

- Ranjit Pendurthi

IPO DETAILS

Dates = 9 Nov 2022 to 11 Nov 2022

Face Value (FV) = INR 2

Issue Price = INR 386 to INR 407

Minimum Investment Amount = INR 14652

Minimum Bid = 36 Shares

Listing On = BSE, NSE

BOOK RUNNING LEAD MANAGERS

IIFL Securities Limited, ICICI Securities Limited, JM Financial Limited

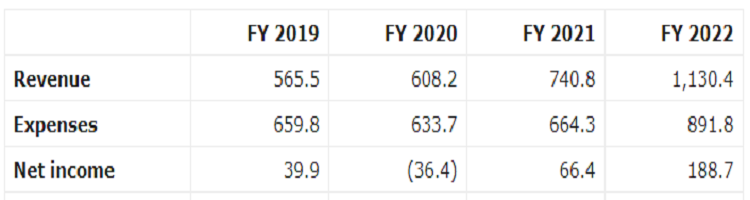

FINANCIALS

Conclusion

Considering the company’s financial parameters, FinBlab recommends SUBSCRIBE ratings on archean chemical industries limited ipo

Also Read

Five Star Business Finance IPO

13 Stocks Where FIIs Have Increased Stake

Disclaimer: The contents and data presented here are just for your information & personal use only. While much effort is made to provide the information, I ( Vishal Dalwadi ) or “FinBlab” do not guarantee the accuracy, correctness, completeness or reliability of any information or data displayed herein and shall not be held responsible.