Finblab Research: Indian Stock Market Weekly Analysis (21 May ’18 to 25 May ’18)

Both the Sensex and Nifty ends the week on a flat note! A Downward journey for both the index for the first couple of days (backed by Karnataka government formation, crude oil price movement, quarterly results, and certain geopolitical news) and then a smart recovery in the last two trading session!

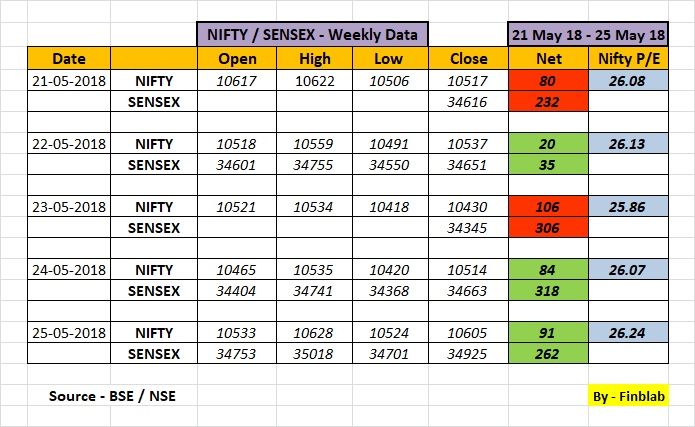

The BSE Sensex gained only 77 points whiles the NSE Nifty up just 9 points on a weekly basis as compared to previous week. Here is an Indian Stock Market Weekly Analysis (21 May 2018 to 25 May 2018) by Finblab.

21-05-2018

Weak trading session and a poor opening of the new week as far as Indian Stock Market is concern!

The Indian Stock Markets today open on a weak note due to the political drama played at Karnataka last Saturday (when BS Yeddyurappa of BJP failed to prove the majority and resigned immediately and Congress with the help of JDS will form the government). Weaker rupee and higher crude oil prices also spoiled the mood of the market.

The BSE Sensex today was down by 232 points and closed at 34,616 while the NSE Nifty cracking 80 points to close at 10,517.

IndoStar Capital Finance Limited – Mumbai based leading non-banking finance company (NBFC) which recently came up with an IPO of INR 1140 Cr got listed on the market today. The Company saw decent gains in the first couple of hours of trade despite weak market sentiments, finally closing up 2.3% at INR 585.

22-05-2018

Range-bound trading session at the Indian Stock Market!

After shedding more than 900 points on the Sensex and 290 points on the Nifty index in last 5 trading session, bulls finally managed to get charge at Dalal Street on Tuesday’s session as benchmark indices ended in the green for the first time in last five sessions – thanks to the smart recovery in the most beaten down stocks.

The BSE Sensex was up by 35 points to close at 34,651 whiles the NSE Nifty gained 20 points to close at 10,537 amid high volatility.

The Country’s largest bank State Bank of India (SBI) today announced its number after the market hours. The Bank reported a net loss of INR 7,718 Cr for the March quarter while the provisions surged to INR 28,096 Cr, up from INR 11,740 Cr in the corresponding quarter last year. The bank’s non-performing assets (NPAs) to its total loans deteriorated to 10.91% as on March 31, 2018, from 10.35% as on December 31, 2017, and 9.1% at the end of March last year.

23-05-2018

Selling pressure was seen on the Indian Stock Market today!

The Wednesday’s trading session began on a flat note and traded range bound all through the day. However, a heavy selloff in the last half an hour of trade brought more weakness in the equity markets.

The Sensex today closed lower by 306 points at 34345, while the Nifty was down by 106 points and closed at 10430.

Tata Motors, India’s largest automotive player by revenue, declared its Q4 result post market hours today.

The Company registered a 50% year-on-year (YOY) fall in its consolidated net profit for the March quarter to INR 2,176.16 Cr. Revenue from operations of the company grew by 16% to INR 91,279.09 Cr in the quarter under review.

The Company’s standalone sales soared as many as 36% to 204,255 units in Q4, as against 150,448 units in the same quarter last year. Domestic sales were up 39% at 187,874 units from 135,416 units.

Guenter Butschek, Managing Director and Chief Executive Officer, Tata Motors looks optimistic about the company and during the press conference he said – FY18 has been a hallmark year for Tata Motors with (1) record-breaking sales performance, (2) increase in market share, and (3) the standalone business turning profitable before one-time exceptional charges.

24-05-2018

Strong trading session amid high volatility at the Indian Stock Market!

After closing flat to negative on the Wednesday’s trade, the Indian Stock Market today opened on a strong note – thanks to the positive global cues and marginally lower crude oil prices (oil prices fell today on expectations that OPEC will increase the production following concerns over supply from Venezuela and Iran)

The BSE Sensex today closed 318 points higher at 34,663 while the Nifty50 rose 83 points to close at 10,513.

The price of Jet Airways today fell more than 8% on the early trade to hit its 52-week new low of INR 386.05 on the BSE after the company reported a standalone net loss of INR 1,036 Cr in the quarter four due to the upswing in (1) oil prices and (2) a weaker rupee.

25-05-2018

Solid trading session at the Dalal Street!

The Indian Stock Markets today soared for the second straight day again for that old factor, (1) sharp fall in crude oil prices, and (2) upside in the Indian rupee against the US dollar. Positive European market cues also augmented the rally.

The 30-share Sensex today was up by 262 points and closed at 34,925 and the 50-share NSE Nifty gained 91 points to close at 10,605.

Indian Stock Market Weekly Analysis – A Week Gone By

Future Outlook –

Indian Stock Markets ended on a flat note last week! Nifty ended the week on a flat note, up 0.08%, while the Sensex up 0.22%. With the earning seasons come to an end the major events that the Markets will be eying at this moment expiry which will happen in the next week.

On the technical front, as predicted in the last Indian Stock Market Weekly Analysis that Nifty may find support around 10450 to 10490 levels and it did exactly the same and kissed the low of 10418 and bounced back smartly from those levels.

Next week is the week of expiry. Finblab believes that both the Sensex and Nifty may face volatility/consolidation during the week in the absence of a positive trigger. On the upper side, Nifty Index may find resistance around 10750 to 10800 levels while on the lower side it may find support near 10500.

Nifty has formed a bullish Dragon-Fly Doji pattern on the weekly chart, indicating a positive bias for the index. 10270 levels will act as a strong support as far as Nifty is concern!

Also Read –

1) Finblab’s Valuepick Stock for the month of May – GMM PFAUDLER LIMITED

Disclaimer: The contents and data presented here are just for your information & personal use only. While much effort is made to provide the information, I ( Vishal Dalwadi ) or “Fin Blab” do not guarantee the accuracy, correctness, completeness or reliability of any information or data displayed herein and shall not be held responsible.