FINBLAB RESEARCH: INDIAN STOCK MARKET WEEKLY REVIEW

Fabulous week as far as Indian Stock Markets are concern! Both, the Sensex and Nifty witness gains all through the week (straight 7 days gains, considering gains of last 2 days of the previous week).

All sorts of news whether US-China trade war tension, US-Russia clash on Syria issue, high crude oil prices or various domestic problems; the Indian Stock Markets absorb all that and keep the momentum intact throughout the week and also help the Sensex close above 34000 marks.

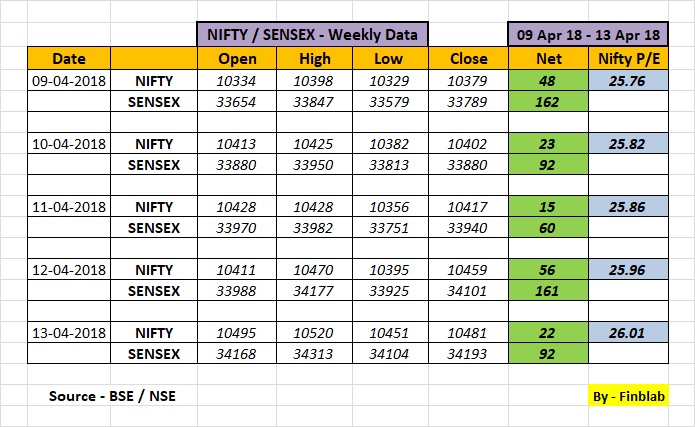

The BSE Sensex gained 567 points or 1.68% on a weekly basis while The NSE Nifty gains 164 points or 1.44% as compared to previous week. Here is the Indian Stock Market Weekly Review (9 Apr 2018 to 13 Apr 2018) by Finblab.

09-APR-2018

- Once again a good start for the Indian Stock Markets one the very first day of the 2nd week of April (in fact, the market extended gains for the 3rd consecutive session on Monday) following positive cues and news from the overseas stock markets, especially after the US-China trade war tensions, decreased.

- The 30 share BSE Sensex was up 162 points and close at 33,789 while the 50-share NSE Nifty rose 48 points to close at 10,379.

- IPO of Lemon Tree Hotels gets listed on the markets today. The stock opened 10% higher to the issue price of INR 56 and rallied almost 32% in the intraday trade, before closing at INR 71.65, up 28%.

10-APR-2018

- It was a lacklustre trading session as far as Indian Stock Markets are concern. Both the indices traded in a narrow range all through the day considering positive global cues and after China’s comments soothed trade war tensions.

- The BSE Sensex rose 92 points to close at 33,880 and the NSE Nifty gained 23 points at 10,402. The market today extended gains for the 4th consecutive day, with the Nifty closing above 10,400 levels for the 1st time since March 14.

- One thing is clear from today’s session is that investors are waiting for the Q4 earnings that will start from 14th April with Infosys numbers.

11-APR-2018

- It was a 5th straight trading session where the Indian Stock Markets registered gain (narrow gains though) thanks to positive news (like, metal sector shine today – thanks to the rally in the metal sector on London Metal Exchange and likely to ease problems between US & China) as well as negative news (like, the Crude Oil prices which reached to 72 USD a barrels – trading near its highest levels in 4 years due to political tension in the Middle-East countries and problems arises between US and Russia because of Syria issue)

- The Nifty Index managed to close above 10,400 levels, rising 15 points to 10,417 while the BSE Sensex gained 60 points to close at 33,940.

12-APR-2018

- Wonderful trading session at the Dalal Street in anticipation of better Q4 numbers from IT major Infosys; ignoring the geopolitical tensions and higher crude oil pieces – trading at 73 USD a barrel now.

- The BSE Sensex rallied 161 points to close at 34,101 while the NSE Nifty rose 56 points to 10,459.

13-APR-2018

- Positive momentum in the Indian Stock Market continued for a 7th consecutive trading session on Friday, helping both the Sensex and Nifty post a solid performance for the 3rd week in a row.

- IT major Infosys declared its Q4 result aftermarket hours today. The Company has reported a net profit of INR 3,690 Cr which was in-line with a poll of INR 3,670 Cr while INR revenue grew by 1.6% QoQ to INR 18,083 Cr.

- The BSE Sensex was up 92 points at close 34,193 while the Nifty failed to hold 10,500 levels and ended 22 points higher at 10,481.

Indian Stock Market Weekly Review – A Week Gone By

Future Outlook –

As stated in the previous Indian Stock Market Weekly Review report, The RBI’s monetary policy has helped the Sensex gain more than 500 points and Nifty 150 plus points on a weekly basis. This week also CPI inflation numbers declared by the CSO (Central Statistics Office) are somewhat encouraging. But going forward it is sure that all market participants will be eying Q4 results which will be starting from 13th April.

On technical parameters, the Nifty 50 reclaimed 10,500 on Friday’s trading session but failed to hold the momentum and formed a Doji type of pattern on the daily charts and a bullish candle on the weekly charts. As stated in the last weekly report 10125 is likely to be the strong support for Nifty.

Also Read –

1) Finblab’s Valuepick for of the month of April – RUCHIRA PAPERS LIMITED

2) Finblab’s March ’18 Valuepick BALKRISHNA INDUSTRIES LIMITED (27.50% returns in just 40 days)

Disclaimer: The contents and data presented here are just for your information & personal use only. While much effort is made to provide the information, I ( Vishal Dalwadi ) or “Fin Blab” do not guarantee the accuracy, correctness, completeness or reliability of any information or data displayed herein and shall not be held responsible.