Kaynes Technology IPO – Review

Kaynes Technology Limited – a leading end-to-end and IoT solutions-enabled integrated “electronics manufacturer in India” is planning to raise INR 858 crore via IPO [Fresh Issue 530 Cr + OFS 328 Cr]

kaynes technology share price fixed at INR 587

Kaynes Technology: History

Incorporated in the year 2008, Kaynes Technology is a leading player in the field of the Electronics System & Design Manufacturing (ESDM).

Also Read: Five Star Business Finance IPO

Kaynes Technology: Business

Kaynes Technology Limited was among the first companies in India to offer design-led electronics manufacturing to original equipment manufacturers (OEMs) using its mature embedded design capabilities.

The Company’s business is classified into following verticals –

- OEM (Turnkey Solutions – Box Build) (OEM–Box Build): The Company undertake Build to Print or Build to Specifications of complex box builds, sub-systems and products across various industry verticals.

- OEM (Turnkey Solutions – Printed Circuit Board Assemblies (OEM – Turnkey Solutions): The Company undertake turnkey electronics manufacturing services of PCBAs, cable harness, magnetics and plastics ranging from prototyping to product realization including mass manufacturing.

- ODM: The Company offer ODM services in smart metering technology, smart street lighting, brush less DC (BLDC) technology, inverter technology, gallium nitride based charging technology and providing IoT solutions for making smart consumer appliances or devices IoT connected.

- Product Engineering and IoT Solutions: The Company offer conceptual design and product engineering services in industrial and consumer segments. The Company services include PCB cladding or electrical schematics to embedded design and submitting proof of concept to prototyping. The Company also offer connected product engineering and solutions.

The Company has over three decades of experience in providing conceptual design, process engineering, integrated manufacturing and life-cycle support for major players in the field of –

- Automotive,

- Aerospace and defence,

- Industrial,

- Outer-space,

- Nuclear,

- Medical,

- Railways,

- Internet of Things (IoT),

- Information Technology (IT)

Manufacturing Facilities

The Company operates through eight strategically located manufacturing facilities across India in the states of Haryana, Himachal Pradesh, Karnataka, Tamil Nadu, and Uttarakhand.

Also Read: Archean Chemical IPO

Strategies Ahead

- Focus on full product / box build capabilities

- Leverage R&D capabilities to continue to diversify product portfolio and provide value-added services

- Focus on expansion across each vertical to capitalize on industry opportunity

- Continue to expand our customer base to focus on large customers

- Expand manufacturing capacity at our existing facilities and set-up additional strategically located facilities

- Pursue inorganic growth through selective partnerships and acquisitions

- Further improve operational efficiency through backward integration of manufacturing facilities

Promoters

Ramesh Kunhikannan “kaynes technology founder”

Savitha Ramesh, and

RK Family Trust

IPO DETAILS

Dates = 10 Nov 2022 to 14 Nov 2022

Face Value (FV) = INR 10

Issue Price = INR 559 to INR 587

Minimum Investment Amount = INR 14675

Minimum Bid = 25 Shares

Listing On = BSE, NSE

BOOK RUNNING LEAD MANAGERS

DAM Capital Advisors Limited, IIFL Securities Limited

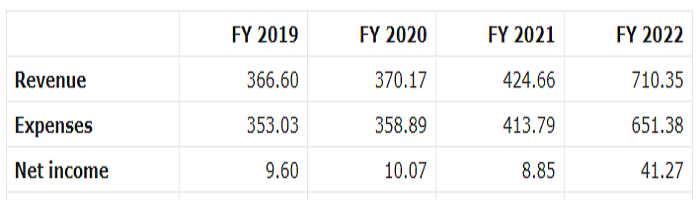

FINANCIALS (Rs in Cr)

Conclusion

Considering the company’s financial parameters, FinBlab recommends NEUTRAL ratings on kaynes technology ipo

Disclaimer: The contents and data presented here are just for your information & personal use only. While much effort is made to provide the information, I ( Vishal Dalwadi ) or “FinBlab” do not guarantee the accuracy, correctness, completeness or reliability of any information or data displayed herein and shall not be held responsible.